Child And Dependent Care Credit Phase Out 2022. There are two major benefits of the credit: A tax deduction simply reduces the amount of income.

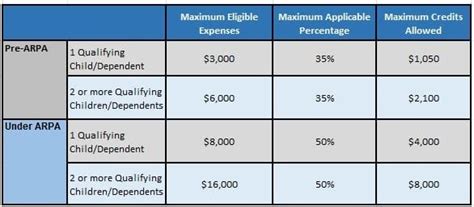

However, the basic starting point is that you get up to $3000 for one dependent and up to $6000 for having multiple dependents in dependent care. The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents. The child and dependent care credit begins to phase out when a taxpayer’s agi exceeds $125,000 and is fully phased out for agi over $438,000.

The Caregiver Can’t Be Your Spouse, The Parent Of A Qualifying Child Below The Age Of 13, Or Any Person You Already Claim As A Dependent.

The child and dependent care credit has been nearly quadrupled allowing taxpayers to write off a portion of up to $8,000 for one child or dependent and $16,000 for two or more of those expenses. Those with an agi that exceeds $438,000. Above that income threshold, the credit begins to phase out, until reaching 20% for income of $183,000 to $400,000 and completely disappearing at income above $438,000.

This Is A Tax Credit, Rather Than A Tax Deduction.

A child who provides care must be 19 or older by the end of the tax year. The credit would begin to phase out for taxpayers earning over $125,000 and fully phased out once income exceeds $400,000. It can reduce or, in some cases, eliminate a tax bill but, the irs cannot refund the taxpayer any portion of the credit that may be left over.

The Child And Dependent Care Tax Credit Was Also Expanded Under The Rescue Act.

Claiming the child and dependent care tax credit. A $2,000 credit per dependent under age 17; The point where the child care credit begins to phase out has been increased due to the recent overhaul in tax laws.

The Contribution Limit Was Previously 5,000 And Was Now Increased To $10,500 For Single Taxpayers And Married Couples Filing Jointly.

The child and dependent care credit begins to phase out when a taxpayer’s agi exceeds $125,000 and is fully phased out for agi over $438,000. You do not get that full amount back as a credit, however. Benefits of the tax credit.

Families Can Now Claim Up To 50 Percent Of Qualifying Expenses, Up From 35 Percent Previously.

But without intervention from congress, the program will instead revert back to its original form in 2022, which is less generous: If you don’t file jointly, you may still be able to claim the child care credit. Special rules for married filing separately