What Is The Phase Out For Dependent Care Credit. A $2,000 credit per dependent under age 17; There are two major benefits of the credit:

For more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and dependent care. A note to our clients regarding i mprovements made by the american rescue plan act (arpa) to the child and dependent care tax credit for the 2021 tax year, i.e., the credit available for expenses a taxpayer pays for the care of qualifying individual(s) under the age of 13 so that the taxpayer can be gainfully employed. The 2021 child tax credit is phased out in two steps based on the taxpayer's modified adjusted gross income in 2021.

What Is The Child And Dependent Care Credit?

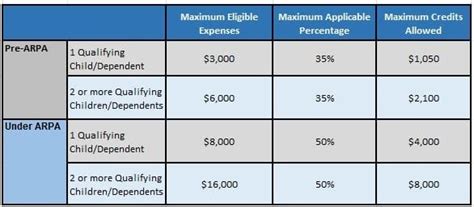

In brief, for the 2021 tax year, you could get up to $4,000 back for one child and $8,000 back for care of two or more. There are two major benefits of the credit: Arpa) provided a temporary expansion of the cdctc for 2021.

The Child And Dependent Care Credit Is A Tax Break Specifically For Working People To Help Offset The Costs Associated With Caring For A Child Or Dependent With Disabilities.

The child and dependent care tax credit (cdctc) can help to partially offset working families’ child care expenses. A $2,000 credit per dependent under age 17; A tax deduction simply reduces the amount of income.

From 2018, The Point Where The Child Care Credit Will Be Phased Out Will Be $200,000.

The credit would begin to phase out for taxpayers earning over $125,000 and fully phased out once income exceeds $400,000. The american rescue plan act (p.l. In prior years, the maximum return for.

The Child Tax Credit Begins To Be Reduced To $2,000 Per Child When The Taxpayer's Modified Adjusted Gross Income In 2021 Exceeds:

For more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and dependent care. This credit is refundable meaning you can receive the full amount of this credit even if you don’t owe any taxes. Upon reaching an agi of $185,000, their applicable percentage is phased out to the 20% floor.

For The 2021 Tax Year, The Credit Amount Begins To Phase Out When The Taxpayer's Income Or Household Agi, Or Adjusted Gross Income, Reaches $125,000.

If you earn between $125,000 and $185,000, the credit. How much is the dependent care credit? Under the arp, the adjusted gross income level at which the credit percentage starts to phase out is raised to $125,000 for 2021.