At What Agi Does The Child And Dependent Care Credit Phase Out. The child tax credit won’t begin to be reduced below $2,000 per child until the taxpayer's modified agi in 2021 exceeds: You must have paid someone, such as a nanny or daycare provider, to care for one or more of the following people to.

Taxpayer b’s agi is $10,000 higher than $125,000, so taxpayer b gets a 45% credit for any eligible dependent care costs. There are also maximum amounts you must consider. $400,000 if married and filing a joint return;

Taxpayer B’s Agi Is $10,000 Higher Than $125,000, So Taxpayer B Gets A 45% Credit For Any Eligible Dependent Care Costs.

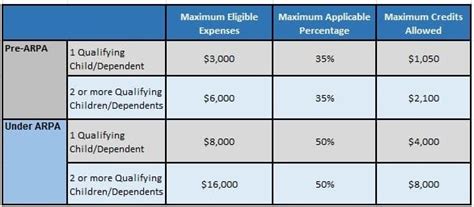

The new bill also increased the agi phaseout to begin at $125,000. There are also maximum amounts you must consider. Child and dependent care expenses allowed as a credit is 50%.

This 20% Lasts Until The Income Reaches $400,000.

Taxpayer a’s agi is less than $125,000, so taxpayer a gets a full 50% credit for any eligible dependent care costs. Those percentages appear on line 8 of form 2441, the form used to calculate and claim the child care credit. If you have children under age 17 at the end of the tax year, you may qualify for a.

The Percentage You Use Depends On Your Income.

The credit does start to phase out once your income is over $125,00 by a certain percentage. Families can claim up to $3,000 in dependent care expenses for one child/dependent and $6,000 for two children/dependents per year. The child and dependent care credit can be worth from 20% to 35% of some or all of the dependent care expenses you paid.

You Must Have Paid Someone, Such As A Nanny Or Daycare Provider, To Care For One Or More Of The Following People To.

For the first phaseout in 2021, the child tax credit begins to be reduced to $2,000 per child if your modified adjusted gross income (agi) exceeds: $400,000 if married and filing a joint return; From 2018, the point where the child care credit will be phased out will be $200,000.

That Is, The First Phaseout Step Can Reduce Only The $1,600 Increase For Qualifying Children Ages 5 And Under, And The $1,000 Increase For Qualifying Children Ages 6 Through 17, At.

The 2021 child and dependent care credit amount begin to phase out when the taxpayer’s adjusted gross income (agi) reaches over $125,000. Taxpayer b makes $135,000 of agi. Eligible families with an agi of $125,000 or less will.