Child Tax Credit In 2022

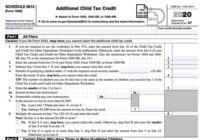

Child Tax Credit In 2022. While the fate of the child tax credit is uncertain for 2022, one thing is certain. 10:37 et, jan 17 2022. What does the new child tax credit mean for your 2022 from technohoop.com The new child tax credit will go into effect for the 2021 taxes. The tax credit isn't completely gone… Read More »