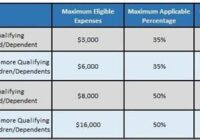

Child And Dependent Care Credit For 2022

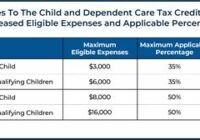

Child And Dependent Care Credit For 2022. The credit also is available to families that must pay for the care of an incapacitated spouse or an adult dependent. Calculate millie’s child and dependent care credit for 2019 using form 2441. Child care tax credit is bigger this year How to claim up from theasianmoniker.com Taxpayers can now claim… Read More »