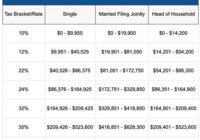

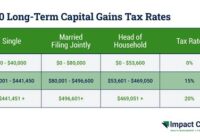

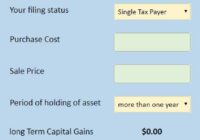

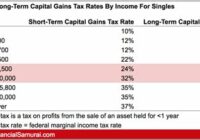

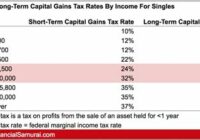

Short Capital Gains Tax Rate 2022

Short Capital Gains Tax Rate 2022. The plan proposed by house democrats would also apply a surtax of 3 percent for people with adjusted gross incomes of more than $5 million beginning in 2022 along with raising the capital gain tax rate to 15%. Capital gains tax will be raised to 28.8 per cent by house democrats. 2021… Read More »