Federal Income Tax Due Date 2022

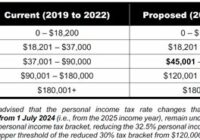

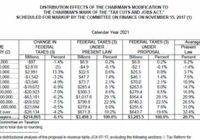

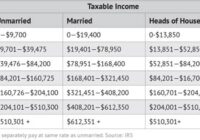

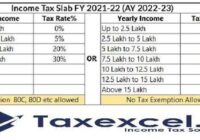

Federal Income Tax Due Date 2022. Government as the day taxes are due every year. Last year, the filing of 2020 tax returns was delayed until february 12, 2021 because the agency needed more time to test its systems and add extra programming in. 202021 Federal Budget Details What's In It For You? from www.datatax.com.au We’ve put together… Read More »