Income Tax 2022 Malaysia Rate. The malaysia income tax calculator uses income tax rates from the following tax years (2022 is simply the default year for this tax calculator), please note these income tax tables only include taxable elements, allowances and thresholds used in the malaysia monthly income tax calculator, if you identify an error in the tax tables, or a tax credit. What is the minimum salary to not pay taxes?

Berdasar rekod kutipan bagi tahun 2021, kerajaan malaysia melalui lhdn adalah lebih rendah daripada. No other taxes are imposed on income from petroleum operations. Monthly tax deduction 2022 for malaysia tax residents {{option.name}}.

Additionally, The Tax Relief For Parents With Children In Kindergartens And Childcare Centres Has Been Increased From Rm1,000 To Rm2,000.

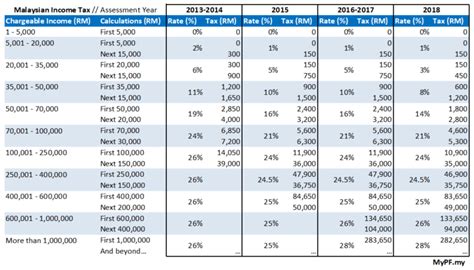

However, if you claimed rm13,500 in tax deductions and tax reliefs, your chargeable income would reduce to. The personal income tax rate in malaysia is progressive and ranges from 0% to 30% depending on your income. The malaysia income tax calculator uses income tax rates from the following tax years (2022 is simply the default year for this tax calculator), please note these income tax tables only include taxable elements, allowances and thresholds used in the malaysia monthly income tax calculator, if you identify an error in the tax tables, or a tax credit.

A Qualified Person (Defined) Who Is A Knowledge Worker Residing In Iskandar Malaysia Is Taxed At The Rate Of 15% On Income From An Employment With A Designated Company Engaged In A Qualified Activity.

Malaysia corporate tax rate was 24 % in 2022. 24% for resident companies, 17% on the first Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn, malaysia.

Income Tax Malaysia Budget 2022 :

Malaysia income tax rates in 2022. 1, 2022 to june 30, 2022 and thereafter at prevailing income tax rates. No other taxes are imposed on income from petroleum operations.

United Arab Emirates 16:05 Gdp (Yoy) Forecast:

What is the income tax rate in malaysia? On the first 5,000 next 5,000. Berdasar rekod kutipan bagi tahun 2021, kerajaan malaysia melalui lhdn adalah lebih rendah daripada.

This Income Tax Calculator Can Help Estimate Your Average Income Tax Rate And Your Salary After Tax.

In addition, there is a new relief for individuals, and, as anticipated, the. 10,00,000 20% 20% above rs. Malaysia budget 2022 businesses a higher income tax rate of 33% is proposed on chargeable income in excess of rm100 million, for the year of assessment (ya) 2022 only.