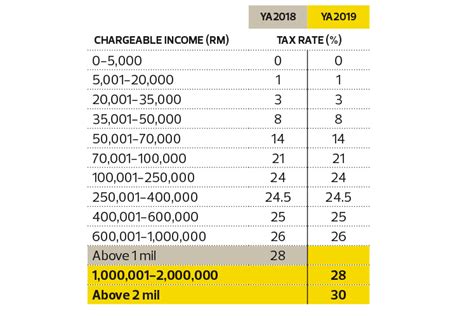

Income Tax 2022 Malaysia. The personal income tax rate in malaysia is progressive and ranges from 0% to 30% depending on your income. 1, 2022 to june 30, 2022 and thereafter at prevailing income tax rates.

This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. On the first 20,000 next 15,000. These proposals will not become law until their enactment and may be.

Calculation Method Of Monthly Tax Deduction (Mtd) 2022 Are As Follows:

It’s time to do your income tax again, everyone! This is also great tool for comparing salaries in malaysia, particularly if you are a. Comparehero.my last updated feb 09, 2022.

This Booklet Also Incorporates In Coloured Italics The 2022 Malaysian Budget Proposals Based On The Budget 2022 Announcement On 29 October 2021 And The Finance Bill 2021.

24% for resident companies, 17% on the first Income remitted to malaysia will be taxed at the rate of 3% on gross income. Any individual earning more than rm34,000 per annum (or roughly rm2,833.33 per month) after epf deductions has to register a tax file.

Deadline For Malaysia Income Tax Submission In 2022 (For 2021 Calendar Year) Posted February 19, 2021 January 19, 2022 Admin.

Income tax rates and thresholds (annual) tax rate. Other tax initiatives proposed in budget 2022 income tax imposed on income from foreign sources. These proposals will not become law until their enactment and may be.

Under The Budget 2022 Proposal, The Malaysian Government Proposed To Remove The Exemption Of Foreign Sourced Income (Fsi) Received By Any Person (Other Than A Resident Company Carrying On Business In Banking, Insurance Or Sea/Air Transport), Which Has Been Provided Under Paragraph 28, Schedule 6 Of The Malaysian Income Tax Act.

This is expected to take place starting from 1 january 2022. This income tax calculator can help estimate your average income tax rate and your salary after tax. The government has proposed to begin taxing malaysian residents who are earning income from foreign sources and receiving them in malaysia.

The Personal Income Tax Rate In Malaysia Is Progressive And Ranges From 0% To 30% Depending On Your Income.

This tool allows you to quickly create a salary example for malaysia with income tax deductions for the 2022 tax year. Those who have received their income tax return (ea) form can do this on the ezhasil portal by logging in or. You can almost hear the groans about filing of taxes from everyone.