Income Tax 2022 Deadline Malaysia. Taxable income (myr) tax rate. Income remitted to malaysia will be taxed at the rate of 3% on gross income.

21 july 2021*] *new submission deadline for form p & b extended from 15 july to 31 aug 2021. How to file your personal income tax online in malaysia. This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for.

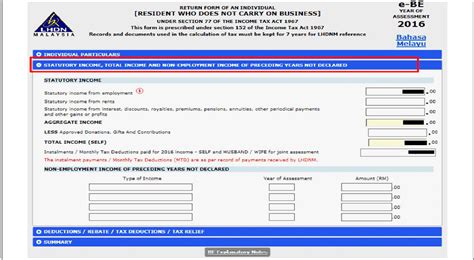

Form Be, Bt, M, Mt, Tp, Tf Or Tj:

For the be form (resident individuals who do not carry on business), the deadline for filing income tax in malaysia is 30 april 2021. How to file your personal income tax online in malaysia. Those who have received their income tax return (ea) form can do this on the ezhasil portal by logging in or registering for the first time.

Malaysia Has Signed Numerous Double Taxation Avoidance Agreements.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. 24% for resident companies, 17% on the first This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for.

Income Tax Return For Partnerships

Malaysia has extended the expiry of existing income tax exemption on interest or profit earned from deposits for corporate investors in retail money market funds to jan. Our calculation assumes your salary is the same for and. In a media release (available only in bahasa malaysia) dated 12 january 2022, the inland revenue board of malaysia (irbm) announced that the remittance of 2% withholding tax under the new section 107d of the income tax act, 1967 (ita) (inserted via the finance act 2021 which has come into operation on 1 january 2022) is deferred until 31 march.

You Can Now Pay Your Taxes And Get Your Tax Returns Online (Or Through Other Methods).

2) a deadline extension to july 15, 2022, from. Tax relief or tax exemption in malaysia is a system established by the inland revenue board of malaysia (ldhn) whereby taxpayers are allowed to deduct a certain amount of money from their income tax. Malaysia residents income tax tables in 2022:

Income Tax Rates And Thresholds (Annual) Tax Rate Taxable Income Threshold;

In 2022, april 16 falls on a saturday, so irs and other offices will be closed on friday, april 15. Filling in a form to provide information about how much you earned in the year of assessment. Taxes for year of assessment should.