Tax Brackets 2022 Utah. 2022 tax brackets and rates. 1828, enacted in 2021, reduces rates and the number of brackets for tax year 2022.

They'll be taxed at 10%. Federal income tax brackets and rates for 2022. While a state standard deduction does not exist, a standard tax credit does exist and varies based on your filing status and income.

This Standard Tax Credit Phases Out For High Income Earners.

Overall, taxpayers in utah face a relatively low state and local tax burden. The state income tax rate in utah is a flat rate of 4.95%. Sales taxes in utah range from 6.10% to 9.05%, depending on local rates.

436, Which Further Consolidates Montana’s Five Tax Brackets To Four.

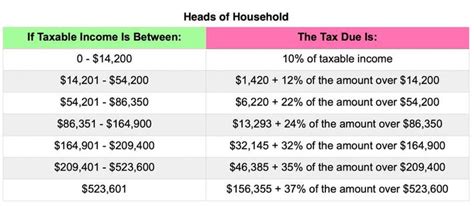

There are still seven brackets broken up by income. Federal income tax brackets and rates for 2022. This is the lowest tax bracket 2021 in canada and is applied to the taxable income of an individual or a business.

May 15, 2021October 4, 2021·Tax Bracket Ratesby Admin.

2021 federal income tax brackets (for taxes due in april 2022 or in october 2022. Then taxable rate within that threshold is: Legislative leaders from both the house and senate have said the earned income tax credit and social security bills are the tax cut proposals that gop caucus members most prefer.

Under The New Law, Which Is Retroactive To January 1, 2022, The 5.5 Percent Bracket Was Eliminated, And The Second.

This means that these brackets applied to all income earned in 2021, and the tax return that uses these tax rates was due in april 2022. Tax brackets and rates for the 2022 tax year, as well as for 2020 and previous years, are elsewhere on this page. The irs also tweaked the marginal tax rates, often referred to as tax brackets, for the year ahead.

The Utah Income Tax Has One Tax Bracket, With A Maximum Marginal Income Tax Of 4.95% As Of 2022.

The money the taxpayer pays to the government every year is then transferred to their regional social development canada office for processing. Federal tax brackets 2022 for income taxes filed by april 15, 2023 tax ratesinglemarried filing jointly or qualifying widow(er)married filing separatelyhead of household10%$0 to $10,275$0 to. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.utah's maximum marginal corporate income tax rate is the 3rd lowest in the united states, ranking directly below north dakota's.