Tax Calculator 2022 Az. The provided information does not constitute financial, tax, or legal advice. Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates.

Arizona has a 5.6% statewide sales tax rate, but also has 82 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.427% on top of the state tax. So the tax year 2021 will start from july 01 2020 to june 30 2021. Calculate your tax year 2022 take home pay after federal/state/local taxes, deductions and exemptions.

This Means That, Depending On Your Location Within Arizona, The Total Tax You Pay Can Be Significantly Higher Than The 5.6% State Sales Tax.

Your average tax rate is 22.2% and your marginal tax rate is 36.1%.this marginal tax rate means that your immediate additional income will be taxed at this rate. For sales tax, please visit our arizona sales tax rates and calculator page. A state standard deduction exists and varies depending on your filing status.

And 4.50% On Income Beyond $159,000.

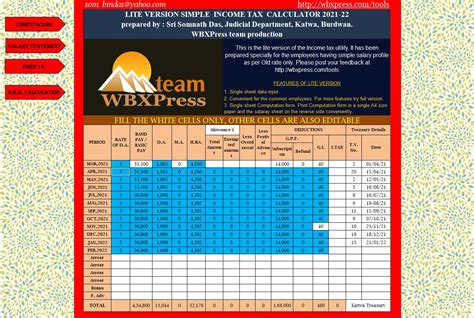

The provided information does not constitute financial, tax, or legal advice. Arizona tax year starts from july 01 the year before to june 30 the current year. Any wages above $147.000 are exempt from the social security tax.

Keep In Mind That Sales Tax Jurisdiction Rules Can Sometimes Be Too Complicated To.

As the employer, you must match this tax. How 2022 sales taxes are calculated in yuma. The amounts are similar to the federal standard deduction amounts.

Calculating Your Arizona State Income Tax Is Similar To The Steps We Listed On Our Federal Paycheck Calculator :

Calculate your tax year 2022 take home pay after federal/state/local taxes, deductions and exemptions. The withholding calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. You can use your results from the calculator to help you complete the form and.

The Salestaxhandbook Sales Tax Calculator Is A Free Tool That Will Let You Look Up Sales Tax Rates, And Calculate The Sales Tax Owed On A Taxable Purchase, For Anywhere In The United States.

You can find more tax rates and allowances for. 18 cents per gallon of regular gasoline, 26 cents per gallon of diesel. The arizona state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 arizona state tax calculator.we also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state.