Tax Calculator 2022 Federal And State. 2022 tax brackets and rates. Icalculator aims to make calculating your federal and state taxes and medicare as simple as possible.

The personal income tax system in the united states is a progressive tax system. 2022 federal tax withholding calculator. 10 percent, 12 percent, 22 percent, 24.

Your Average Tax Rate Is 22.0% And Your Marginal Tax Rate Is 39.7%.This Marginal Tax Rate Means That Your Immediate Additional Income Will Be Taxed At This Rate.

Calculate your combined federal and provincial tax bill in each province and territory. Federal taxes are progressive (higher rates on higher levels of income), while states have either a progressive tax system or a flat tax rate on all income. Calculate your refund fast and easy with our tax refund estimator.

Your Employer Withholds Tax From Your Income Every Pay Period But Keeping Up With The Total Amount Can Be Quite Challenging.

Tax withholding calculator—figure out the taxes withheld from your salary to see if you’re going to receive a tax refund or owe the irs. Similar to the tax year, federal income tax rates are different from each state. Your household income, location, filing status and number of personal exemptions.

Includes State And One (1) Federal Tax Filing.

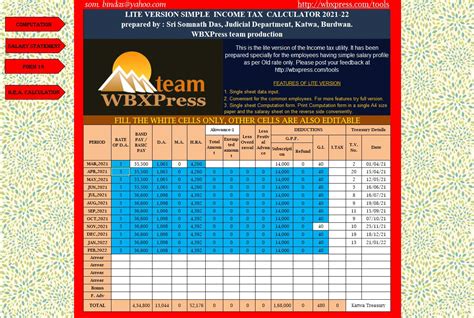

For more details, check out our detail sections. More information about the calculations performed is available on the about page. The 2022 tax calculator uses the 2022 federal tax tables and 2022 federal tax tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Especially If Your Paycheck Is Different At Times.

2022 tax brackets and rates. 10 percent, 12 percent, 22 percent, 24. Fica contributions are shared between the employee and the employer.

See How To File Diy Taxes On Efile.com With The Efile Tax Preparation And Electronic Filing App.

Must file by march 31, 2022 to be eligible for the offer. How income taxes are calculated. Federal tax, state tax, medicare, as well as social security tax allowances, are all taken into account and are kept up to date with 2021/22 rates