Tax Calculator 2022 Income. Use the simple 2022 tax calculator or switch to the advanced 2022 tax calculator to review nis payments and income tax deductions for 2022. $61,200 plus 45c for each $1 over $180,000.

Use our interactive calculator to help you estimate your tax position for the year ahead. Marriage allowance (transferable tax allowance) available to a qualifying spouses/civil partners born after 5th april 1935 equivalent to 10% of the personal allowance spouses or civil partners not liable to taxes in the higher rate or above can transfer up to the amount available to their spouse or civil partner. Details on the 2022 calculator:

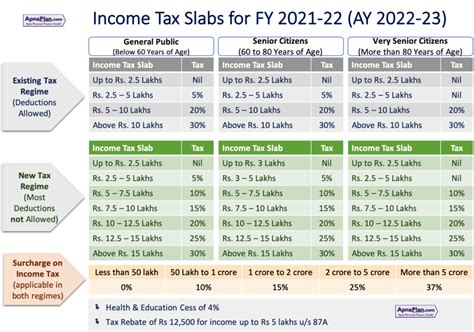

This Tax Calculator Will Show Comparison Of Both Tax Regime.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The calculator reflects known rates as of january 15, 2022. Details on the 2022 calculator:

Use This Tool To Calculate Your Monthly Income Tax And The Tax Deductions Available And Compare It To Last Year's Monthly Income Tax And Tax Deductions.

Additionally, health and education cess at 4% are levied on the total tax rate, above the total amount payable. A tax calculator for the 2022 tax year including salary, bonus, travel allowance, pension and annuity for different periods and age groups. 2022 personal tax calculator calculate your combined federal and provincial tax bill in each province and territory.

The 2022 Tax Calculator Uses The 2022 Federal Tax Tables And 2022 Federal Tax Tables, You Can View The Latest Tax Tables And Historical Tax Tables Used In Our Tax And Salary Calculators Here.

The results will be displayed below it. Sars income tax calculator for 2022 work out salary tax (paye), uif, taxable income and what tax rates you will pay To know more about income tax saving guidelines, click here:

If You Make $52,000 A Year Living In The Region Of Ontario, Canada, You Will Be Taxed $11,432.

Tax slab rates for the tax year 2020 are unchanged in the tax year 2021 by the current government of pakistan, to avoid further burden on salaried persons. The recipient receives a tax bill deduction of 20 percent of the amount transferred This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for.

After 11/30/2022 Turbotax Live Full Service Customers Will Be Able To Amend Their 2021 Tax Return Themselves Using The Easy Online Amend Process Described Above.

You can calculate your annual take home pay based of your annual gross income and the tax allowances, tax credits and tax brackets as defined in the 2022 tax tables. This tool helps you to compute tax on income at first, so you are. It has also embedded tax slab rates for the previous year.