Tax Calculator 2022 South Africa. R16 425 r15 714 r14 958 r14 220: Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year.

Calculating your income tax in south africa is simple, simply select a specific online income tax calculator from the list below to calculate your annual gross salary and net take home pay after tax deductions in south africa. How old will you be on 28 february 2021? You can contribute an additional * per month to increase your tax.

Speak To Your Tax Consultant For Actual Numbers.

R16 425 r15 714 r14 958 r14 220: Ok, thank you please remind me. You can contribute an additional * per month to increase your tax.

Our Online Salary Tax Calculator Is In Line With Changes Announced In The 2021/2022 Budget Speech.

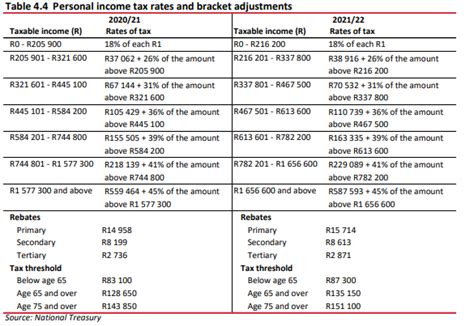

The south africa monthly income tax calculator for 2022 uses the tax tables from the south african revenue service (sars), south africa's nation's tax collecting authority for the 2022 tax year. R23 800) per annum, and persons 65 and older, up to r34 500 (2022: You will pay less than 10% of your other south african income is less than r490 000.

Calculating Your Income Tax In South Africa Is Simple, Simply Select A Specific Online Income Tax Calculator From The List Below To Calculate Your Annual Gross Salary And Net Take Home Pay After Tax Deductions In South Africa.

Enter amount this amount includes your retirement contributions as well as your employer’s contributions. Our salary tax calculator will be updated following the budget speech in february 2022. Calculate your monthly and annual income tax for the 2021/2022 financial year.

We Have Included The Impact Of Uif And Sdl On The Individual And The Company.

How much will you be paying in income tax, petrol and sin taxes? , in order for the recipient to receive a package, an additional amount of. Please use your monthly income, retirement contributions.

When You Receive The Spreadsheet Download, You Need To Choose Your Age (For The Relevant Rebate) And Enter Your Estimated Salary For The Current Year As Shown Below.

Change the yellow cells to your numbers. Interest from a south african source earned by any natural person under 65 years of age, up to r23 800 (2022: Use this tool to calculate your monthly income tax and the tax deductions available and compare it to last year's monthly income tax and tax deductions.