Tax Calculator 2022 With Unemployment. Click add a new rate. If your notice says you have a rate of.055555, enter 5.5555%.

The federal unemployment tax act (futa) requires the employers to pay the futa taxes quarterly and report the same on form 940 annually. Click add a new rate. This means that if you are aware of a 2022 tax exemption or 2022 tax allowance in germany that you are entitled too but it isn't listed here, that we don't allow for it in this version of the germany salary calculator.

The Fica Portion Funds Social Security, Which Provides Benefits For Retirees, The Disabled, And Children Of Deceased Workers.

The unemployment tax rates for new employers vary by industry and range from 1.0% to 1.31% in 2022 (1.0% to 1.23% in 2021). The american rescue plan act, a relief law democrats passed in march last year, authorized a waiver of federal tax on up to $10,200 of benefits per person for 2020. Use any of these 10 easy to use tax preparation calculator tools.

To Qualify For The H&R Block Maximum Refund Guarantee, The Refund Claim Must Be Made During The Calendar Year In Which The Return Was Prepared And The Larger Refund Or Smaller Tax Liability Must Not Be Due To Incomplete, Inaccurate, Or Inconsistent Information Supplied By You, Positions Taken By You, Your Choice Not To Claim A Deduction Or Credit, Conflicting Tax Laws, Or Changes In.

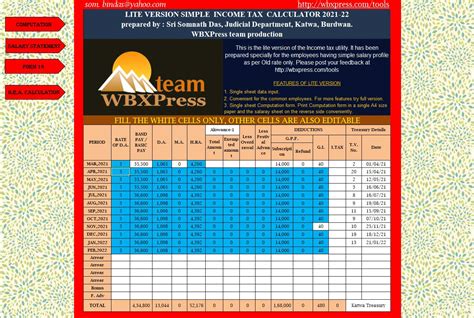

This calculator is for the 2021 tax year due april 15, 2022. We also offer ones covering. Even though unemployment figures have surged in 2021, congress is unlikely to sanction another.

The Full Amount Of Your Benefits Should Appear In Box 1 Of The Form.

This 2021 tax return and refund estimator provides you with detailed tax results during 2022. The provided information does not constitute financial, tax, or legal advice. Click manage taxes under the applicable state tax section.

24 And Runs Through April 18.

For budgeting purposes, you should assume a 0.6% futa rate on the first $7,000 in wages for all states with an additional percentage to be charged to cover the futa credit reduction (fcr). A tax break isn’t available on 2021 unemployment benefits, unlike aid collected the prior year. If your notice says you have a rate of.055555, enter 5.5555%.

As A Result, Many States Currently Have Outstanding Loans To The Government That Will Result In Higher Futa Taxes Being Paid By Employers In Those States In 2022.

Scroll to “state tax settings” and click edit next to sui rate. In the section, we publish all 2022 tax rates and thresholds used within the 2022 germany salary calculator. Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate.