Tax Deadline 2022 Missouri. On this page we have compiled a calendar of all sales tax due dates for missouri,. Pay the tax you owe:

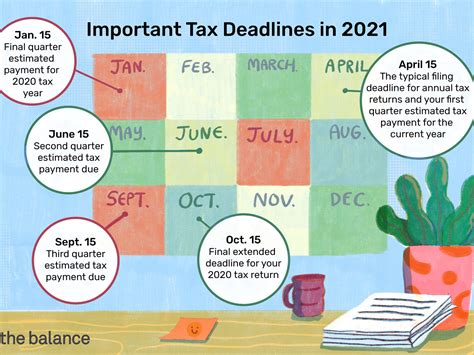

Before the official 2022 missouri income tax rates are released, provisional 2022 tax rates are based on missouri's 2021 income tax brackets. January 18, 2022 (final estimated tax payment for the 2021 tax year) april 18, 2022 (first estimated tax payment for the 2022 tax year) june 15, 2022 (second estimated. On this page we have compiled a calendar of all sales tax due dates for missouri,.

Contact Us For Further Listings Or Verification.

1,405 1,420 41 28 15 1,420 1,435 42 29 16 1,435 1,450 43 30 17 1,450 1,465 44 31 17 1,465 1,480 45 31 18 1,480 1,495 45 32 19 1,495 1,510 46 33 20 1,510 1,525 47 34 21 1,525 1,540 48 35 21 1,540 1,555 49 35 22 However, it is not guaranteed and some dates and/or jurisdictions are not listed. Forms are going out for residents to list their personal.

The Deadline For Filing Your 2021 Taxes Is April 18, 2022.

And the filing status is: Missourians are required to file state income taxes using form mo 1040 each year by april 15. January 2022 sales tax due dates.

Jan 7, 2022 / 09:24 Pm Cst.

No, the irs is not pushing the tax deadline again this year watch on what we found the irs confirmed this year’s april 18 deadline in a jan. January 18, 2022 (final estimated tax payment for the 2021 tax year) april 18, 2022 (first estimated tax payment for the 2022 tax year) june 15, 2022 (second estimated. On this page we have compiled a calendar of all sales tax due dates for missouri,.

2022 Tax Deadline Moves To April 18 January 09, 2022 The Internal Revenue Service Is Giving Filers A Few More Days To File Their Income This Year.

Deadline for employees who earned more than $20 in tip income in september to report this income to their. The 2022 state personal income tax brackets are updated from the missouri and tax foundation data. This information is deemed to be a reliable calendar of specific property tax event dates that are updated quarterly and throughout the year as changes are known.

If You Do Not Owe Missouri Income Taxes By The Tax Deadline Of April 18, 2022, You Do Not Have To Prepare And File A Mo Tax Extension.

Before the official 2022 missouri income tax rates are released, provisional 2022 tax rates are based on missouri's 2021 income tax brackets. All quarterly estimated tax payments for individuals, s corporations, and c corporations, should be made on the following schedule: If the election is made after this date, s corporation treatment will not begin until the calendar year 2022.