Tax Filing 2022 Singapore. How to file tax returns in singapore. The annual tax return/declaration must be filed within three months after the tax period.

In singapore, with a progressive tax system in place, here’s all you’d need to know when filing this year of assessment (ya) 2022 for the year that will end on 31 december 2021. However, you may still need to file a tax return if you have been informed by singapore tax authority to submit your tax return. Subscribe to receive sms notifications when your tax bill is ready for viewing on mytax portal,.

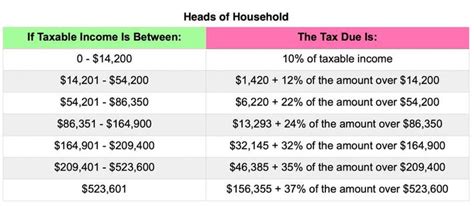

Here’s How Much You’ll Have To Pay Based On Your Chargeable Income:

Longer filing period the filing due date for paper tax form is on 15 apr each year. February 9, 2022, 1:00 pm pst. However, you may still need to file a tax return if you have been informed by singapore tax authority to submit your tax return.

As Americans, The Irs Requires You To File Annual Taxes If Your Global Income Is High Enough.

Advance cit is payable in three instalments. 31 jan 2022 goods and services tax (gst) file gst return (period ending in dec) 31 jan 2022 property tax 2022 property tax bill. Can apply for extension of filing date before 31 march to iras;

You Can Do The Filing By Yourself Or Entrust This Task To Any Person Or Tax Agent Who Has Your Company’s Corppass Accounts.

This doesn’t change when you move abroad;  a singapore government agency website Saint lucia (last reviewed 01 february 2022)

In Singapore, Both Individuals And Businesses Practise Annual (Instead Of Monthly) Tax Filing.

For businesses, employers have to report to the inland revenue authority of singapore (iras) how much their employees earned last year, from 1. Filing of personal tax return for tax resident is mandatory if your annual income is s$20,000 or more. What to expect from singapore's budget, from tax hikes to business relief.

From May 2021, Most Iras Notices Will Be Digitised, With Paper Notices Minimised.access Your Tax Notices Instantly, Anytime And Anywhere, On Mytax Portal, A Safe And Secured Platform.

The annual tax return/declaration must be filed within three months after the tax period. The company, as well as the officers of the company, can be fined up to s$1,000 and s$10,000, respectively. Finance minister wong to present 2022 budget on friday.