Tax Return 2022 Payment Schedule. For most years, the deadline to submit your tax return and pay your tax bill is april 15. Fill out schedule 3 and attach it to your tax return to reduce taxes owed.

You may pay the shortfall with your return even if the amount is $2,500 or more. Irs income tax forms, schedules and publications for tax year 2022: In most cases, you must pay estimated tax for 2022 if both of the following apply.

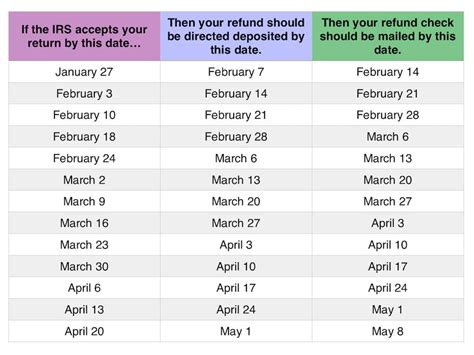

When Can You Expect Your Tax Refund?

The irs tax refund schedule dates could be held up until feb 15. • 31 march 2022 2021 income tax return due for clients of tax agents (with a valid extension of time 9 quarterly fbt return and payment due 10 annual fbt return and payment due 11 income year fbt return and payment • 7 april 2021 2020 income year return and payment due for clients of tax agents (with a valid extension of time) • 7 february 2022 For most years, the deadline to submit your tax return and pay your tax bill is april 15.

The Table Below Shows A Tax Refund Calendar With The Projected Dates Taxpayers Should Receive Their Tax Refund By Either Direct Deposit Or Check.

You may pay the shortfall with your return even if the amount is $2,500 or more. Delays are expected once again Emancipation day is widely celebrated in washington dc, causing many businesses and government offices to close.

Below Is The Estimated 2022 Irs Tax Refund Schedule, Showing The Projected Date You Will Likely Receive Your Refund Based On When You Filed Your Tax Return.

Q2 2022 estimated tax payments due; For 9 out of 10 taxpayers, the irs issued refunds in less than 21 days from the date the return was received last year. Washington — the internal revenue service announced that the nation's tax season will start on monday, january 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

You Expect To Owe At Least $1,000 In Tax For 2022, After Subtracting Your Withholding And Refundable Credits.

Taxpayers in maine and massachusetts have until april 19, 2022 due to the patriot’s day holiday observed in those two states. That's about 3 weeks earlier than last year. If you were granted a filing extension back on.

The First Wednesday Or Friday That Falls On Or After The 15Th Of The Month Following The Month In Which The Shortfall Occurred.

However, we're estimated that the irs will begin accepting tax returns on january 25, 2022. Q3 2022 estimated tax payments due; When can i file my tax return?