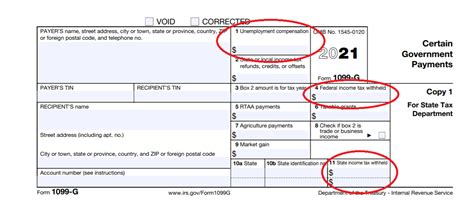

Tax Return 2022 Unemployment. If you received unemployment benefits in 2021, you will owe income taxes on that amount. The american rescue plan act of 2021 allowed an.

Unfortunately, another tax break for unemployed people is unlikely to come to fruition in 2022. The irs says 6.2million tax returns from 2020 remain unprocessed. These 10 tax changes could impact the size of your tax return here's what to know if you received child tax credit payments, collected unemployment.

If You Received Unemployment Compensation In 2021, You Will Pay Taxes On That Income Regardless Of The Amount Received And The Unemployment Duration.

In its latest update, the tax agency said it had released more than $10 billion in jobless tax refunds to nearly 9. Since these states had an outstanding balance on january 1, 2021, employers with employment in these states may be subject to an increase in federal unemployment tax for 2022 if the loan amount remains outstanding as of january 1, 2022 and. If you collected unemployment in 2021, you could end up owing the irs this year.

If Eligible, You Should Exclude Only The Lesser Of Your Unemployment Compensation Amount Reported On Schedule 1, Line 7, Or $10,200 From Your Gross Income.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds, the irs said in a press release. The irs has been sending out unemployment tax refunds since may. If you were one of the thousands who collected unemployment last year, filing your income tax return could be a little more.

The Irs Says It Plans To Issue Another Batch Of Special Unemployment Benefit Exclusion Tax Refunds Before The End Of The Year—But Some Taxpayers Will Have To Wait Until 2022.

Unemployment income rules for tax year 2021 when it went into effect on march 11, 2021, the american rescue plan act (arpa) gave a tax break on up to $10,200 in unemployment benefits collected in tax year 2020. Prior to 2020, all unemployment benefits were considered taxable income. The irs is now concentrating on more complex returns, continuing this process into 2022.

These 10 Tax Changes Could Impact The Size Of Your Tax Return Here's What To Know If You Received Child Tax Credit Payments, Collected Unemployment.

The agency issued tax refunds worth $14.5 billion to over 11.8 million households as of dec. Overall, the irs says unprocessed individual tax year 2020 returns included those with errors. Consumers with incomes above 150% fpl ($39,750 for a family of four) may be eligible for lower aptc and csr amounts on their py 2022 plan, meaning their premium and cost sharing owed would be higher.

For Those Waiting On Their 2020 Tax Return To Be Processed, Make Sure You Enter $0 (Zero Dollars) For Last Year’s Agi On The 2021 Tax Return.

For the 2022 tax season, in which you’ll file a federal income tax return for the income earned in 2021, there isn’t an unemployment tax break. The irs will continue the process in 2022, focusing on more complex tax returns. If you received unemployment benefits in 2021, you will owe income taxes on that amount.