Impromptu statement according to Art. 53 LR

Initial FY-22 leads to line with changed assistance, predictability of bargain closures recovered in the quarter

GENEVA, Switzerland, January 16, 2023– Temenos AG (6: TEMN), the financial software program business, today pre-announces its initial 4th quarter and also complete year 2022 outcomes.

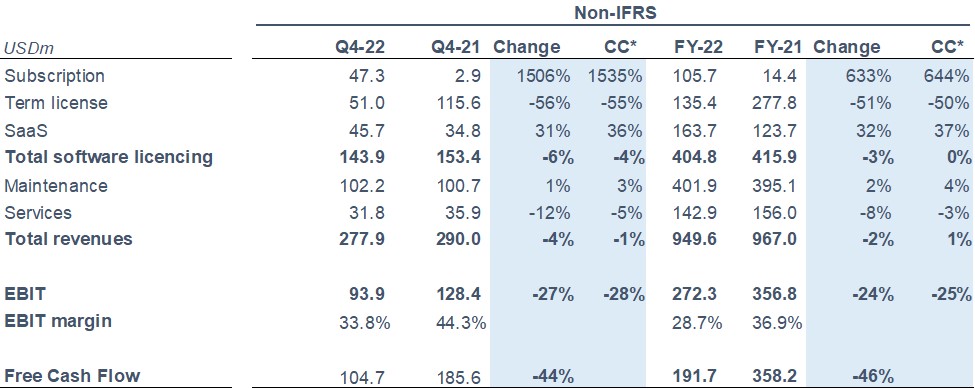

Earnings declaration and also Cost-free Capital

* Continuous money (c.c.) changes previous year for motions in money

Q4 and also FY-22 organization upgrade

- Initial FY-22 leads to line with changed FY-22 assistance with Free Capital substantially surpassing assistance

- Efficient activity taken early in Q4-22 to reinforce sales implementation and also sales management, predictability of organization and also sales efficiency recovered

- No more lengthening of sales cycles saw contrasted to Q3-22

- Financial institutions stay mindful in their choice making offered future macro-economic unpredictability; nonetheless, great variety of big handle rate 1 organizations checked in Q4-22

- Transfer to registration proceeds at speed, with 48% of permit income in Q4-22 authorized as registration, constant with considerable conclusion of the transfer to registration by the end of 2023

- Greater term certificate sales in Q4-22 driven by better mix of sales to existing customers and also rate 1 bargains

- News in December that a leading United States banks prolonged its connection with Temenos to include its worldwide personal financial organization, with Temenos sustaining the financial institution’s critical shift to a cloud-based core financial system to aid drive development in Europe and also the Asia-Pacific

- SaaS remains to do well, with SaaS income up 36% c.c. in Q4-22 driven by a mix of brand-new organization and also added intake from existing customers

- Solutions income decreased this quarter because of the recurring change to a companion version

- Excellent progression was made on recurring executions; solutions prices anticipated to pattern highly downwards in 2023 as corresponding tasks come close to conclusion

- FY-23 assistance will certainly be offered with the launch of complete Q4 and also FY-22 outcomes on 20 th February

- Resources Markets Day to be hung on 21 st February in London and also using webcast

Q4 and also FY-22 monetary recap (non-IFRS)

- USD 47.3 m of non-IFRS registration licenses checked in Q4-22 and also USD 105.7 m checked in FY-22

- Non-IFRS SaaS income of USD 45.7 m in Q4-22 and also USD 163.7 m in FY-22

- Non-IFRS overall software program licensing earnings down 4% in Q4-22 and also 0% in FY-22 c.c.

- Non-IFRS overall income down 1% in Q4-22 and also up 1% in FY-22 c.c.

- Non-IFRS EBIT decrease of 28% in Q4-22 and also 25% in FY-22 c.c.

- Q4-22 non-IFRS EBIT margin of 33.8% and also FY-22 non-IFRS EBIT margin of 28.7%

Talking about the outcomes, Temenos Chief Executive Officer Max Chuard stated:

” I am pleased with the commitment and also dedication every person at Temenos has actually revealed to carry out and also provide on our 4th quarter, the biggest and also essential of the year. We took crucial activity early in Q4 to reinforce our sales management and also sales implementation and also this led to stabilized implementation of bargain closures in the quarter. Whilst general it has actually been a tough year with macro unpredictability affecting sales cycles in the 2nd fifty percent of the year, in Q4 we had solid finalizings throughout registration and also term licenses with need throughout customer rates. I was specifically pleased with the recurring toughness in our SaaS organization in the quarter and also our ongoing change to an extra reoccuring income version along with our far better than anticipated money generation in the quarter. Whilst our income wound up being partially in advance of 2021, the considerable inflationary effect on prices fed via the P&L. The shift to registration licensing is proceeding at speed and also our SaaS organization is getting to emergency and also is progressively underpinning both the income and also productivity exposure.”

Added details

This news release and also all details here is initial and also unaudited.

4th quarter and also Complete Year 2022 results statement

Temenos’ 4th quarter and also complete year 2022 outcomes will certainly be introduced on Monday 20 th February after market close, and also a webcast will certainly be held at 18.30 CET/ 17.30 GMT/ 12.00 EST on the very same day. Enrollment information for the webcast will certainly be provided quickly.

Resources Markets Day

Temenos will certainly organize an in-person Resources Markets Day on Tuesday 21 st February in London. The occasion will certainly additionally be webcast. Enrollment information for the Resources Markets Day will certainly additionally be readily available quickly.

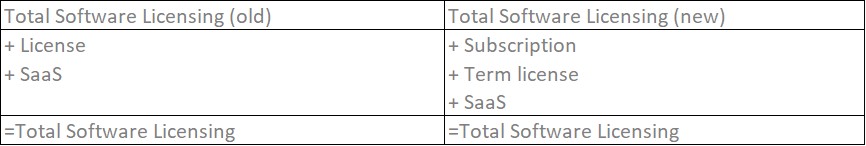

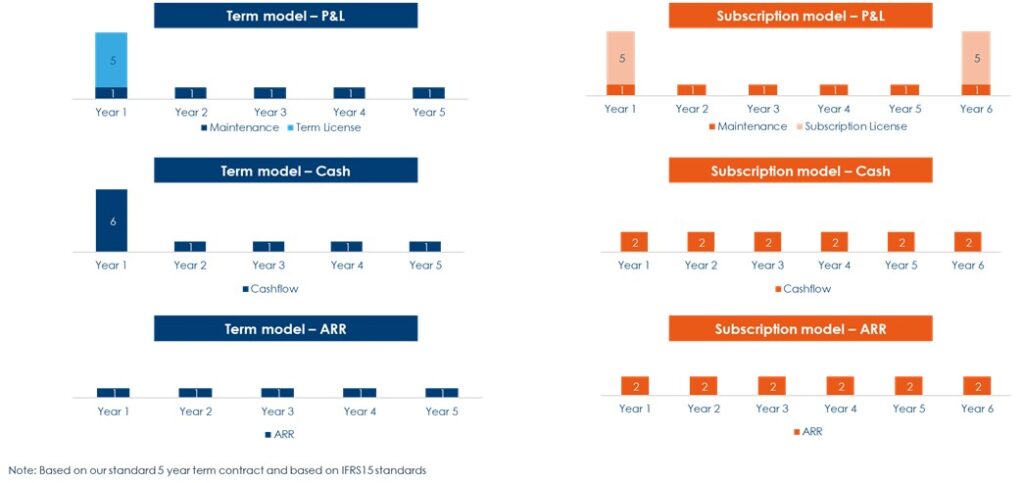

Transfer to registration income and also effect on future coverage

Temenos relocated to marketing five-year registration agreements for on-premise certificate and also upkeep as typical from 2022, consisting of for revivals. This will certainly speed up development by recording better agreement worth and also speed up the change to even more monetary efficiency driven by a much greater percentage of reoccuring earnings. To mirror this modification, on the P&L the Permit income is divided right into either Membership certificate or Term certificate, depending upon the nature of agreement.

The influence of the transfer to a registration version on P&L, money and also ARR is revealed listed below for illustratory objectives:

Non-IFRS monetary Info

Visitors are warned that the additional non-IFRS details provided in this news release goes through fundamental constraints. It is not based upon any kind of thorough collection of audit regulations or concepts and also need to not be thought about as an alternative for IFRS dimensions. Likewise, the Business’s additional non-IFRS monetary details might not approach in a similar way entitled non-IFRS procedures utilized by various other firms. The Business’s non-IFRS numbers omit share-based repayments and also associated social fees prices, any kind of deferred income write-down arising from procurements, ceased tasks that do not certify because of this under IFRS, purchase associated fees such as funding prices, consultatory charges and also assimilation prices, fees as an outcome of the amortisation of gotten intangibles, prices sustained about a restructuring program or various other business change tasks intended and also managed by administration, and also modifications made to mirror the connected tax obligation cost connecting to the above things.

Various other interpretations

SaaS ACV is Yearly Agreement Worth which is the yearly worth of step-by-step organization taken in-year. This consists of brand-new clients, up-sell and also cross-sell. It just consists of the reoccuring component of the agreement and also leaves out variable components. Complete Reservations consists of reasonable worth of certificate agreement worth, dedicated upkeep agreement worth on certificate, and also SaaS dedicated agreement worth. All need to be dedicated and also shown by properly authorized arrangements.