bluebay2014

The quick rise in rates of interest all over the world evaluated on financial investment financial task this year as reserve banks in numerous innovative economic situations took the strike dish away. The greater price of loaning in 2022 placed the kibosh on 2021’s boom times.

Equity funding markets issuance of $582B (since Dec. 19) really did not also exceed the $733B provided in H2 2021, according to Dealogic information. Financial obligation funding market supply of $6.3 T year-to-date moved 30% from a year earlier. Worldwide mergings & & purchase offer worths of $3.6 T went down practically 39% from 2021.

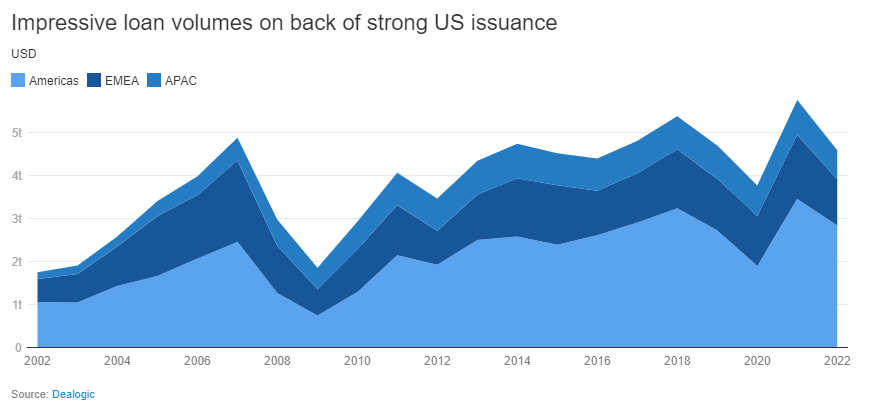

Leveraged financing issuance amounted to $444B YTD vs. the document high $1.58 T increased in 2021. Funding funding markets, however, stood up for the year, increasing $4.6 T YTD, according to the standard over the previous one decade.

Throughout the year, JPMorgan Chase ( NYSE: JPM) drew in one of the most investment financial income for the year at $5.86 B, maintaining its leading placement. It likewise remained atop the organization tables for financial obligation funding markets, equity funding markets, and also syndicated funding income. Wall surface Road competing Goldman Sachs ( NYSE: GS) took the prime placement in worldwide M&A profits, with simply under $4B.

Throughout the year, JPMorgan Chase ( NYSE: JPM) drew in one of the most investment financial income for the year at $5.86 B, maintaining its leading placement. It likewise remained atop the organization tables for financial obligation funding markets, equity funding markets, and also syndicated funding income. Wall surface Road competing Goldman Sachs ( NYSE: GS) took the prime placement in worldwide M&A profits, with simply under $4B.

In the previous year, the leading 5 financial institutions in the financial investment financial organization table saw their supplies decrease: JPMorgan (JPM), -17%, Goldman Sachs (GS) -9.9%, Morgan Stanley ( NYSE: MS) -13%, Financial Institution of America ( NYSE: BAC) -27%, and also Citigroup ( NYSE: C) -26%. Yet Goldman and also Morgan Stanley handled to drop much less than the S&P 500’s 18% decrease.

When it comes to the overview for 2023, right here are some Dealogic monitorings:

For M&A, lenders report sufficient personal equity completely dry powder and also cash money on company annual report can produce a rebound in sell 2023. On top of that, the relentless appraisal space that had actually been suppressing task in 2022 has actually been shutting, Dealogic stated. Because of the damaged appraisals, “numerous firms are deciding to market a risk as opposed to the entire point,” the business’s Insights group stated.

The unfavorable headings in the cryptocurrency industry might cause M&A task as firms deal with clinically depressed appraisals and also a hard capital-raising setting, created Mergermarket’s Rachel Rock. “Firms need to negotiate today,” Adam Sullivan, taking care of supervisor at XMS Funding Allies informed Mergermarket. “Firms are lacking cash money.”

There is some wish for a rebound in equity issuances following year. “There are hopes that a duration of capitalist interaction in ECM adhering to on from a better-than-expected rising cost of living print in the united state will certainly proceed right into 2023 which a worldwide price increasing cycle will certainly come to a head mid-way following year,” Dealogic stated.

James Manson-Bhar, head of EMEA ECM distribute at Morgan Stanley informed

In leveraged financing, a flurry of sell December might start the year on favorable note. Still, “unpredictabilities bordering rising cost of living, rates of interest and also the economic climate are still anticipated to posture difficulties for leveraged financing markets following year,” Dealogic’s Jelena Cvejic created.

With an economic crisis anticipated following year, worldwide funding quantities will, in big component, rely on exactly how well reserve banks “browse these unclear waters and also their capacity to assist their economic situations to as soft a touchdown as feasible,” Dealogic’s Ben Watson created.

With most of the variables that harm markets in 2022 (Russia-Ukraine battle, Chinese building dilemma, Covid) still a consider 2023, markets are most likely to remain unpredictable and also defaults are anticipated to increase. Moody’s anticipates worldwide default prices to increase to 4.9% from 2.6%. S&P, on the other hand, approximates united state default prices will certainly reach. 3.75% from 1.6% in 2022 and also European default prices to raise to 3.25% from 1.4%.

When it comes to equities, planners anticipate little from the S&P in ’23, yet SA visitors still like supplies