Babies born in 2021 were eligible to qualify for the third stimulus payment, which was issued in march 2021. All these were advance payments of the credit;

3Rd Stimulus Check 2022 Based On What Tax Year E Jurnal

On march 11, 2021, president biden signed the american rescue plan act, which includes a third round of stimulus checks.

Third stimulus check based on 2022 income. However, this payment will be available next year, and very few people will qualify for it. Even so, some people could still get a $1400 coronavirus stimulus check because of the american rescue plan act, which approved the third round of stimulus checks. To be eligible for the full amount on the third round of checks, individuals need to have an adjusted gross income (agi) of $75,000 or less and married couples filing jointly need to have an agi of $150,000 or less.

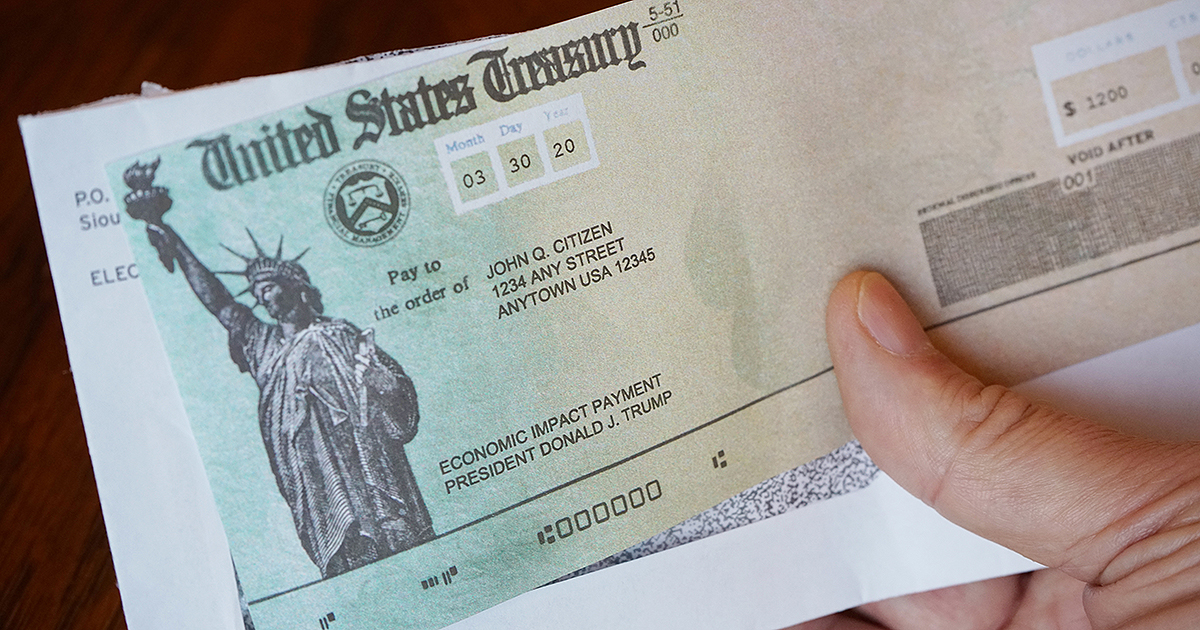

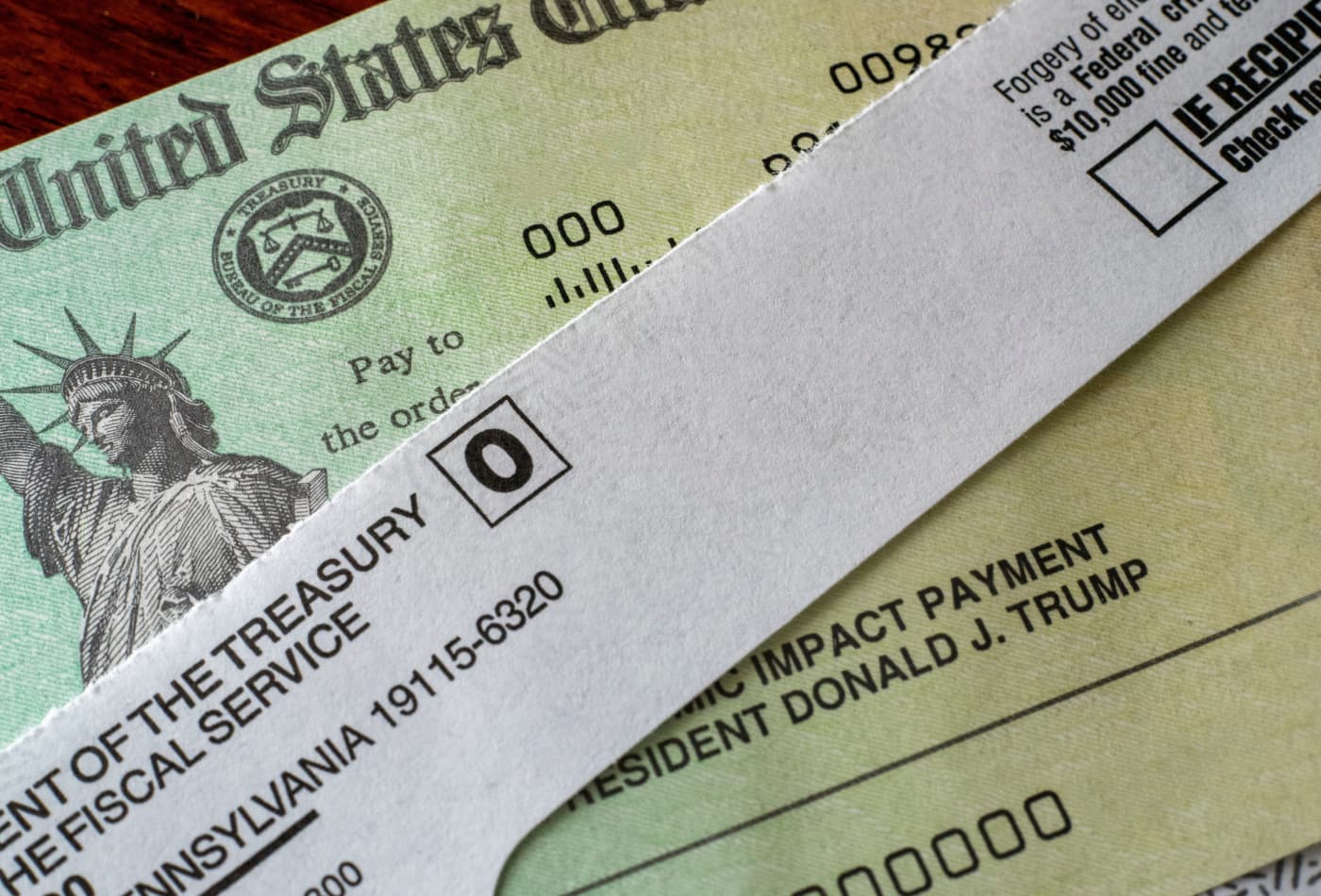

The third economic impact payment is worth up to $1,400 per individual and dependent. How the third stimulus check became law. The american rescue plan was signed into law on march 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of americans.

If you did not receive your third stimulus check, this is to be claimed on your 2021 tax return as the recovery rebate credit or rrc.this refundable tax credit was introduced in 2020 and was composed of stimulus one and two; Eligible parents who welcomed a newborn into their family during 2021 could receive another $1,400 stimulus payment in 2022. If you had a baby in 2021 or adopted one, you may qualify for another stimulus payment worth up to $1,400 in 2022 as well as $3,600 in child tax credits.

It will not reduce your refund or increase the amount you owe when you file your 2021 federal income tax return in 2022. According to the irs, because the third round of stimulus payments was based on information. The payments are an advance of a temporary credit for 2021 (which you file taxes for in 2022).

The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021. Therefore, you will not include the third payment in your taxable income on your 2021 federal income tax return or pay income tax on the third payment. Individuals eligible for payments could receive up to $1,400, and married couples filing a.

The third round of stimulus checks are based on your most recent tax filing with the irs but are an advanced payment on a refundable tax credit for 2021. No, the third economic impact payment is not includible in your gross income. The plus up payments are additional stimulus checks that are sent to people who have been sent stimulus control based on their 2019 tax return or information that was in the social security administration system.

Eligibility for third stimulus check. Single filers earning an adjusted gross income (agi) up to $75,000 and heads of household earning up to. Will people who welcomed a baby in 2021 receive a stimulus check?

Bill oxford / getty images/istockphoto. January 23, 2022, 3:00 p.m. According to biden’s stimulus legislation, those who earned as much as $75,000 in adjusted gross income (agi), or couples $150,000—in addition to their children or adult dependents—qualified for the full $1,400 per individual.

The year opened with a debate over the american rescue plan, which would go on to boost household income by $1,400 — $5,600 for a family of four — through a third round of direct economic impact payments. A single tax filer must make under $75,000, $112,500 as a head. A third stimulus check is on its way with the american rescue plan signed into law, and checks could start hitting bank accounts soon.

The 2021 credit is only stimulus three. While the $1,400 payments will be based on the most recent tax return the internal revenue service (irs) has on file for each taxpayer, if you lose income in 2021 and become eligible for the third. Luckily, this money can be claimed on your 2021 taxes if you qualify based on the income restrictions for the third stimulus payment, which were a maximum of $150,000 for married people who file.

Claim your 2021 recovery rebate credit when you prepare. This time, the full check will be $1,400. The full amount of the third stimulus payment is $1,400 per person ($2,800 for married couples filing a joint tax return) and an additional $1,400 for each qualifying dependent.

Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000. The income requirements are the same as those for the three stimulus checks passed by congress. The payment is worth up to $1,400 for each eligible adult and each qualifying dependent in a household.

Third Stimulus Check Update July 2022 E Jurnal

Stimulus Check Breakup Got The Right Amount In 2021?

How a Third Stimulus Check Could Differ From the First and

Third stimulus check update House plan unveiled. When

The US Third Stimulus Check Who Gets the Full 1,400

3rd stimulus checks Social Security recipients could see

Stimulus Checks Third stimulus check approved by Senate

Stimulus Check Max 2022 E Jurnal

Social security stimulus check status April 7 IRS deposit

Third Stimulus Check Biden Supports Current

Third stimulus check update Use our calculator to see if

Stimulus check details limit, delivery, payment

Where’s My Third Stimulus Check? The TurboTax Blog

Third Stimulus Check For Senior Citizens Takeaway For

Limit For Stimulus Check 2022 E Jurnal

Where’s My Third Stimulus Check? IRS Confirms New Batch Of

1400 Stimulus Check Eligibility Stimulus Checks