Eligibility for the third round of stimulus checks, issued earlier this year as part of president joe biden's american rescue plan, was based on a family's last tax return filed. 31, you will need to request any missing third stimulus payments on your 2021 tax return by claiming the recovery rebate tax credit.

3Rd Stimulus Check 2022 Based On What Tax Year E Jurnal

Which tax return is used for my third stimulus check?

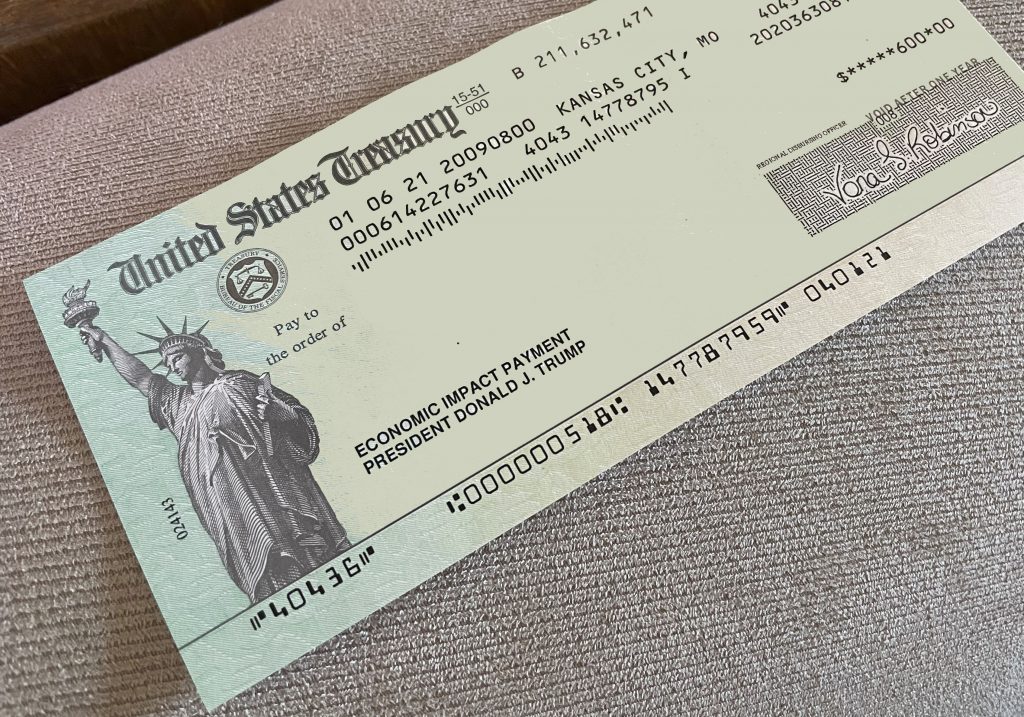

Third stimulus check based on what tax year. The third round of stimulus checks are based on your most recent tax filing with the irs but are an advanced payment on a refundable tax credit for 2021. While the $1,400 payments will be based on the most recent tax return the internal revenue service (irs) has on file for each taxpayer, if you lose income in 2021 and become eligible for the third stimulus check for the first time — or for a larger portion of it — you will be able to claim it on your 2021 tax returns, which you will file in 2022, Under the current plan, if the third stimulus payment amount you receive winds up being based off your 2019 taxes but you should have gotten more based off your 2020 taxes, you can claim the.

If she doesn't file her 2020 tax returns by the time congress passes the next relief bill, the irs would likely base her third stimulus check on her 2019 earnings. “it is our understanding that the current checks would. Couples filing jointly would get a total of $2,800 if they made up to $150,000.

That’s because, while eligibility for the third stimulus check was initially based on americans’ 2019 or 2020 tax returns, the information in. Under the current proposal, the amount for the third stimulus check would be phased out, reaching zero at $100,000. The irs uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check.

The checks are part of a $1.9 trillion economic. Under the current plan, if the third stimulus payment amount you receive winds up being based off your 2019 taxes but you should have gotten more based off your 2020 taxes, you can claim the. The most recent democratic proposal states that the irs will determine the total third payment based on the adjusted gross income from either your 2020 or 2019 tax returns—whichever the irs has most recently on file at the time of payment.

Since babies born in 2021 were not factored in, the $1,400 checks will be applied to their parent or guardian's 2021 tax return. He said the worst case scenario is that you will have to wait until it processes your 2020 tax return to see your third stimulus payment. What tax year will the third stimulus payment be based on?

Yes, adult dependents qualify for the third stimulus check which tax year is used to determine eligibility? This newest round of stimulus payments (eip3) will be reconciled on the 2021 tax return. A third round of stimulus checks is on its way to americans.

For the people still waiting on a stimulus check, keep in mind that eligibility and the amount of any recovery rebate credit will be based. The check is the largest yet: However, the payment will be based on the taxpayer's most recent processed tax return, 2020 or 2019.

Couples filing jointly would get a total of $2,800 if they made up to $150,000. My 2020 income was below the threshold, filed the taxes on 3/16/21, received tax refund on 3/24/21. Americans will likely have to file their 2020 tax return in the next few weeks to take advantage of the opportunity to use their latest income for the third stimulus check.

If you're one of 22 million americans who lost a job during the pandemic, you could benefit from having the third stimulus payment based on your 2020 tax filing. Under the current proposal, the amount for the third stimulus check would be phased out, reaching zero at $100,000. What tax year are the payments based on?

The payments will be based on 2020 agi if a taxpayer has already filed tax returns for last. Up to $1,400 per person and $2,800 per married couple. You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check.

Will the irs based your third stimulus check on your 2019 or 2020 taxes ? Many who have received a third stimulus payment have now received in excess of $3,000. This is the case if you received a partial amount.

I should get $2,800 3rd stimulus check based on 2020 income. My 2019 income was higher than the stimulus threshold.

How To Qualify For Stimulus Check 2021 Irs Don T Lose

Stimulus check 2021 What to do if you must file a tax return

3rd Stimulus check Tax filing impact, the child tax

Third stimulus check eligibility Who will get 1,400 (and

Third Stimulus Checks IRS Tax Return, Amount and More

Third stimulus check Will it be based on 2019 or 2020

Your third stimulus check could arrive during tax season

When will I get my third stimulus check? The Tax

Third stimulus check update Tax season is here. Should I

Third Stimulus Check Update Should I File My 2020 Tax

Third Stimulus Check Why Some People Should File Their

Your Third Stimulus Check Could Be Much Bigger If You File

Third stimulus check update Get more stimulus money by

Third Stimulus Checks Delayed? 1400 Payments Still Coming

Stimulus check 2021 Millions face tax refund delay as

3Rd Stimulus Check 2022 Based On What Tax Year E Jurnal

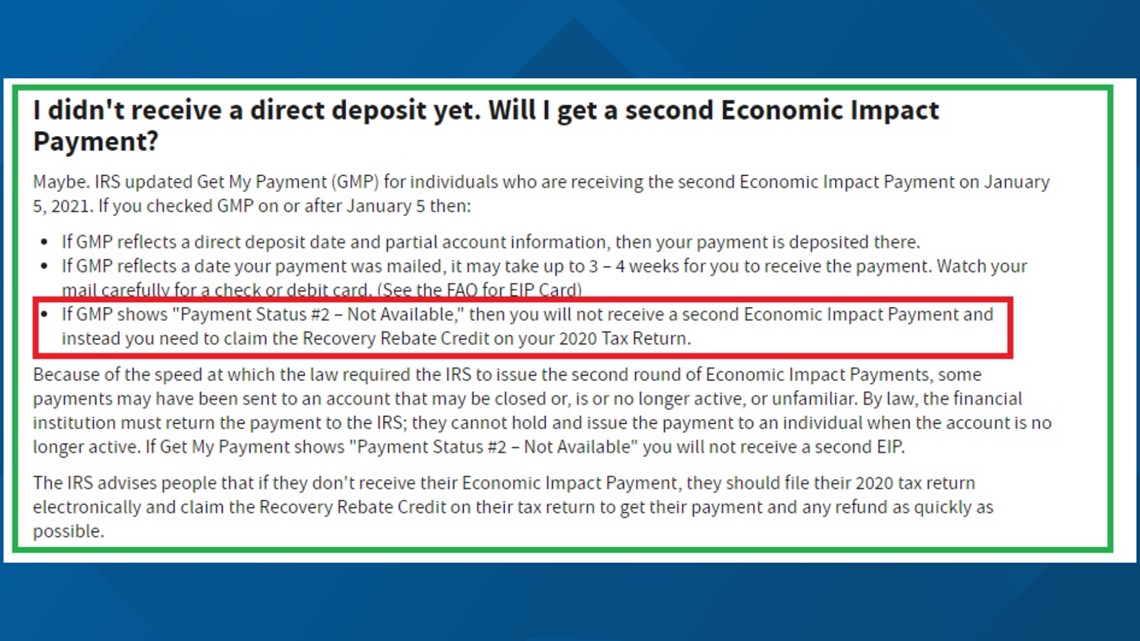

Payment status 'not available' on IRS tracker? Sorry, your