The lack of garnishment protection isn’t the only thing that’s different about this latest round of stimulus—also known as an economic impact payment or eip. If you have unpaid private debts that are subject to a court order, your $1,400 stimulus check could be garnished.

Third Round of Stimulus Checks Not Protected from Garnishment

More changes to the third round of economic impact payments.

Third stimulus check garnishment. The internal revenue service has. Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks or private creditors. The previous stimulus checks were passed via 2/3rd majority vote.

What to know about a possible third stimulus payment posted on february 20, 2021. People should be getting their third round of stimulus, $1,400 per person, any day now. Can the third round of stimulus checks be garnished by either the government or private debtors?

Yes, rules under the third stimulus check allow garnishment for private debts, such as consumer debt and other private debt. Because of that, this 3rd check can be garnished when the others could not. These checks are part of the recent $1.9 trillion stimulus bill.

It depends on the type of debt that you have and who would be attempting to collect it. The rule changed for the second stimulus payment and remains in effect for the third. Your third check cannot be garnished to pay overdue child support.

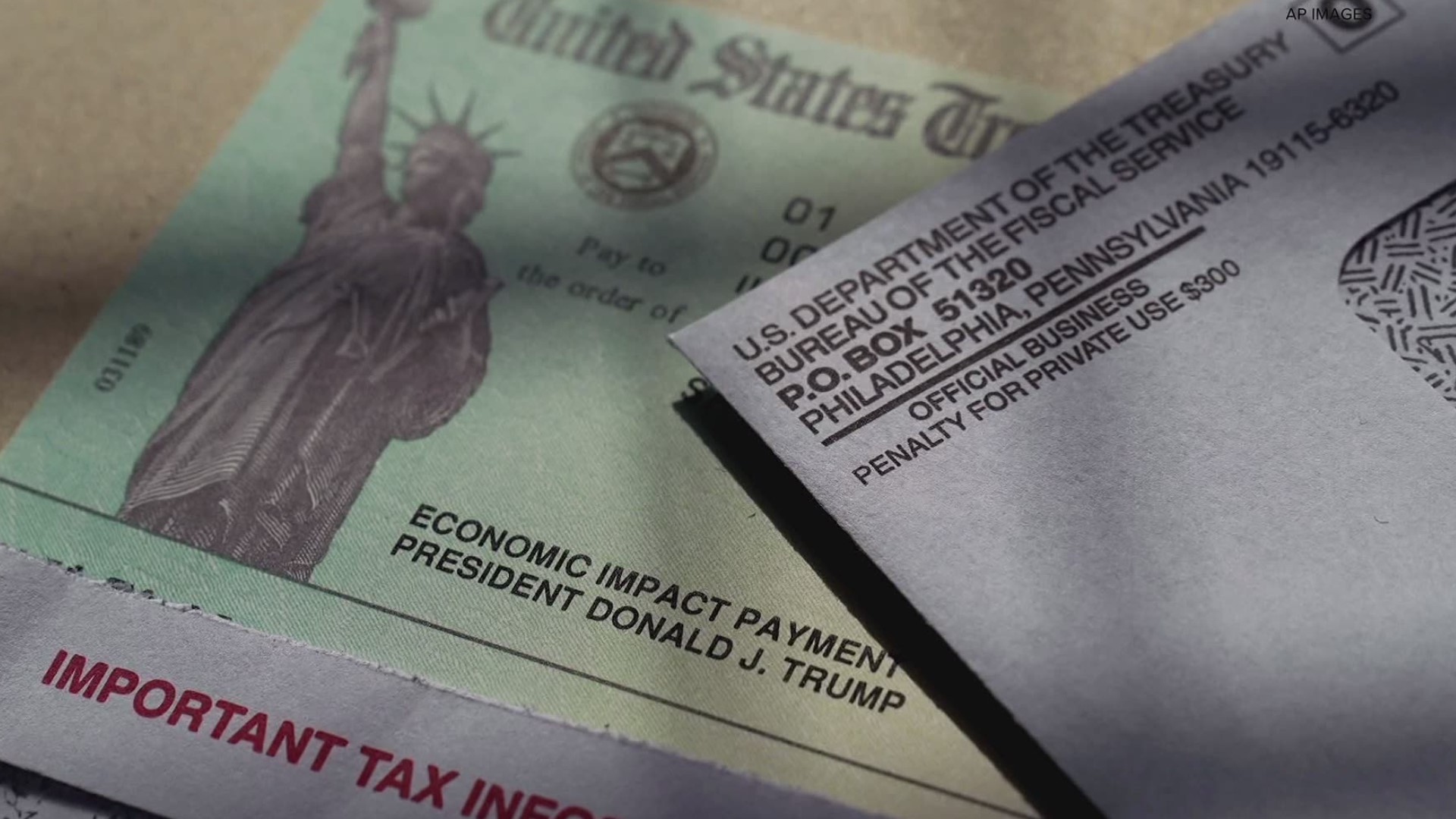

While millions of americans are eagerly awaiting the third round of stimulus checks from the government, the people who need the money the most might never get their hands on the $1,400 relief. Congress is poised to authorize new $1,400 stimulus checks, but some people with unpaid debts could have that money garnished this time. This third stimulus payment cannot be seized or garnished for back child support, but it can be taken to satisfy private debts.

The third check is also supposed to be protected from bank garnishment, though not from private creditors and debt collectors. Like the previous rounds of stimulus checks, this aid can not be garnished by the federal government or the irs. Irs sent about 90 million $1,400 payments, totaling $242 billion the third stimulus package was passed through a process called reconciliation in the senate.

Generally, where a caa payment is deposited in an individual’s account, either by check or electronically, financial institutions must exempt that amount from attachment, garnishment, levy, execution, or other legal process for two months from the date of deposit. In many cases, the money will come by direct deposit. Yes, your third check could be garnished to pay certain debts.

Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks. Can your stimulus payment be garnished to pay other debts? Most people will receive the third stimulus check even if they haven't filed a 2020 tax return.

Yes, your third check might be seized to pay certain debts. 10 financial institutions are not required to inspect more than the two month “lookback period”. There’s a new protective shield over the round 3 stimulus checks, but if you’re heavily in debt, you still might not see the $1,400, depending on who you owe.

Dependents will receive a full payment this time and payments are not limited to dependents under age 17.you. Stimulus checks, child support, & divorce: “i am actually kind of disappointed that they carved it out that we can’t garnish from the second and possibly the third check,” he added.

There has been a lot of speculation about the final version of the third stimulus package currently making its way through congress. With the second stimulus check, your payment was protected from bank garnishment and from private creditors and debt collectors, according to the text of the law. The house is due to pass the $1.9 coronavirus relief bill.

You have no protections against garnishment. The funds from the third stimulus check can't be garnished to pay government debts like back taxes and child support, however, private debt collectors can ga. Most people will receive the third stimulus check even if they haven't filed a 2020 tax return.

Third round of stimulus checks not protected from garnishment march 11, 2021 today, i read an interesting article regarding the third round of stimulus checks that are on the verge of being approved by congress. This 3rd one had no republican vote and had to be passed with a 51% majority via a process called budget reconciliation. While the first stimulus payment allowed garnishment only for back child support, the second payment had protections from garnishment completely.

Many residents of maryland are asking themselves, “can my stimulus check be garnished?”. When can the government garnish my stimulus check?

Stimulus Checks (Round 3) and Garnishment What to Know

Stimulus checks Debt collectors can garnish your 1,400

WOW!! 1400 Third Stimulus Check Update + GARNISHMENTS

Irs Stimulus Checks / Why Didn T You Receive Full Irs

1400 stimulus checks can be seized by private collectors

How To Know If My Stimulus Check Was Garnished IRSYAQU

How To Get 1400 Stimulus Check For Newborn Who Gets 1

NEW ARRIVAL DATES! 1400 Third Stimulus Check Update

Can 3rd Stimulus Check Be Taken For Back Child Support SWHOI

How To Track My Third Stimulus Check Direct Deposit Get

How Do I File For My Stimulus Check oneofthreedesigns

New 1,400 Stimulus Checks could be Garnished for Unpaid

Some 1,400 stimulus payments could be garnished for

Your third stimulus check can be garnished. Here's what to

Can the Government Take My Third Stimulus Check for Back

Third Stimulus Check Garnishment What You Need to Know

Consumers Could Face Garnishment on Stimulus