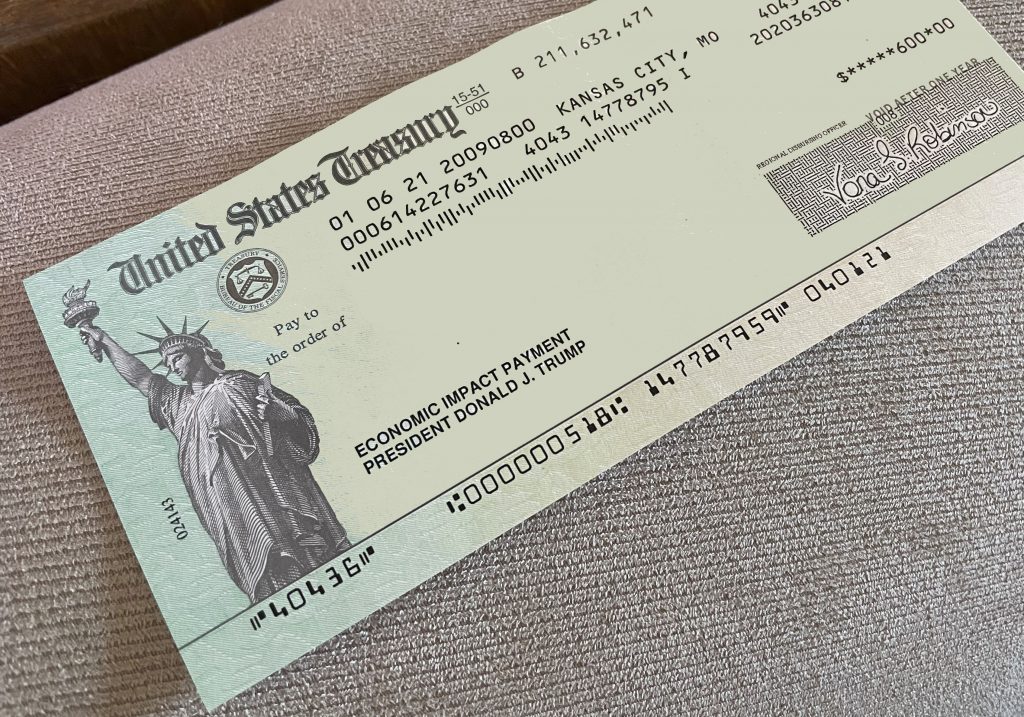

Individuals eligible for payments could receive up to $1,400, and married couples filing a. Generally, someone is eligible for the full amount of the third economic impact payment if they:

Stimulus check 2021 What to do if you must file a tax return

The income cutoff to receive a third stimulus check is $80,000 for an individual taxpayer, $120,000 for a head of household and $160,000 for a married couple that files jointly.

Third stimulus check on tax return. There is talk of a third stimulus payment, it's so important to get your taxes done sooner than. Individuals who didn't qualify for the third economic impact payment, better known as the third stimulus check, or did not receive the full amount may be eligible for the recovery rebate credit. If you have not received your third stimulus check and are eligible, you can claim the recovery rebate credit when you file your 2021 tax return.

Your stimulus check will not impact your tax refund because that’s money that is owed to you by the irs. You may still be able to get a third stimulus check if you haven’t filed one. The stimulus checks are not an advanced payment on your tax refund like the child tax credit payments.

Therefore, you will not include the third payment in your taxable income on your 2021 federal income tax return or pay income tax on the third payment. Third stimulus check 2020 tax return. Since babies born in 2021 were not factored in, the $1,400 checks will be applied to their parent or guardian's 2021 tax return.

Again, we’re talking about the third stimulus check here, generally for $1,400. Americans who were eligible for the third stimulus check or the monthly advance child tax credit in 2021 need to be on the lookout for two letters from the. If you haven't received stimulus money from 2020, make sure you file for a refund recovery credit.

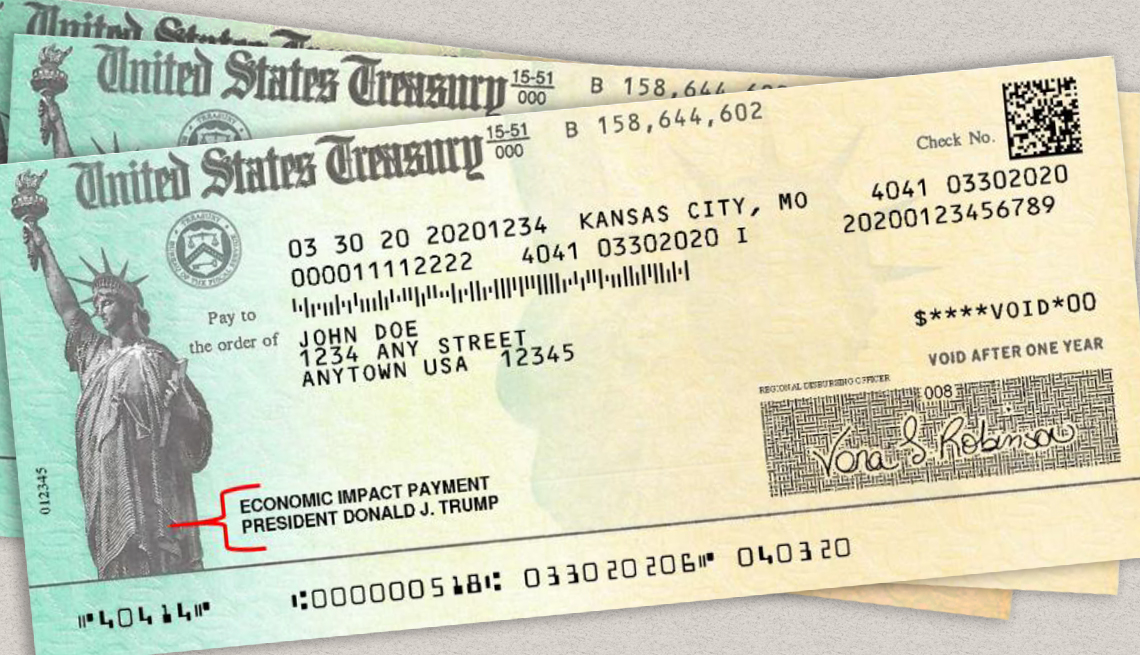

If you didn’t automatically receive your third stimulus payment, you can claim it when filing taxes as a recovery rebate credit. Because you're getting what amounts to a refundable tax credit now in the form of a third stimulus payment, rather than waiting to get the money from the credit in 2022 when you actually file your 2021 tax return, you're in effect. If the irs bases their stimulus check on their 2020 return, george and suzanne will get a $2,240 third stimulus check.

Which tax return is used for my third stimulus check? Just like the previous rounds of stimulus checks, the third direct stimulus payment will be a refundable tax credit called the recovery rebate credit. The stimulus check was a separate payment.

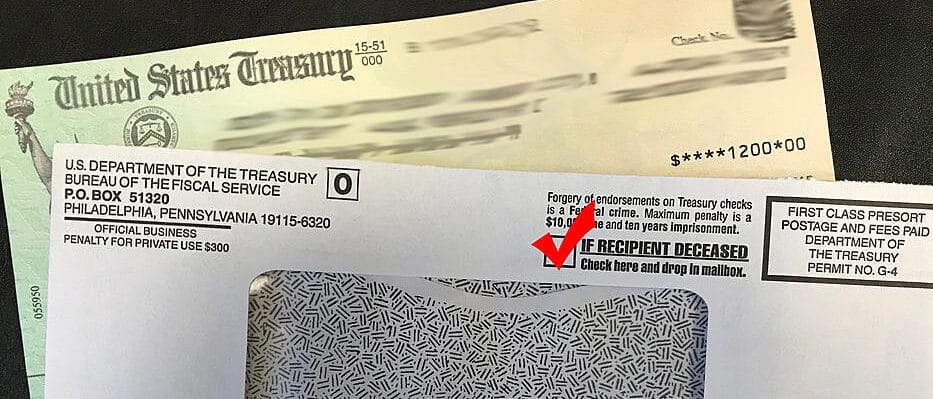

The irs uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check. A further group who can use a 2021 tax return to get their third stimulus check is eligible americans who did not file a return for the 2019 or 2020 tax years and also did not claim a. You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check.

Not last year’s six child tax credit checks. In addition to the third stimulus payment, parents of children born in 2021 can likely claim the enhanced child tax credit on their return. There were three stimulus payments.

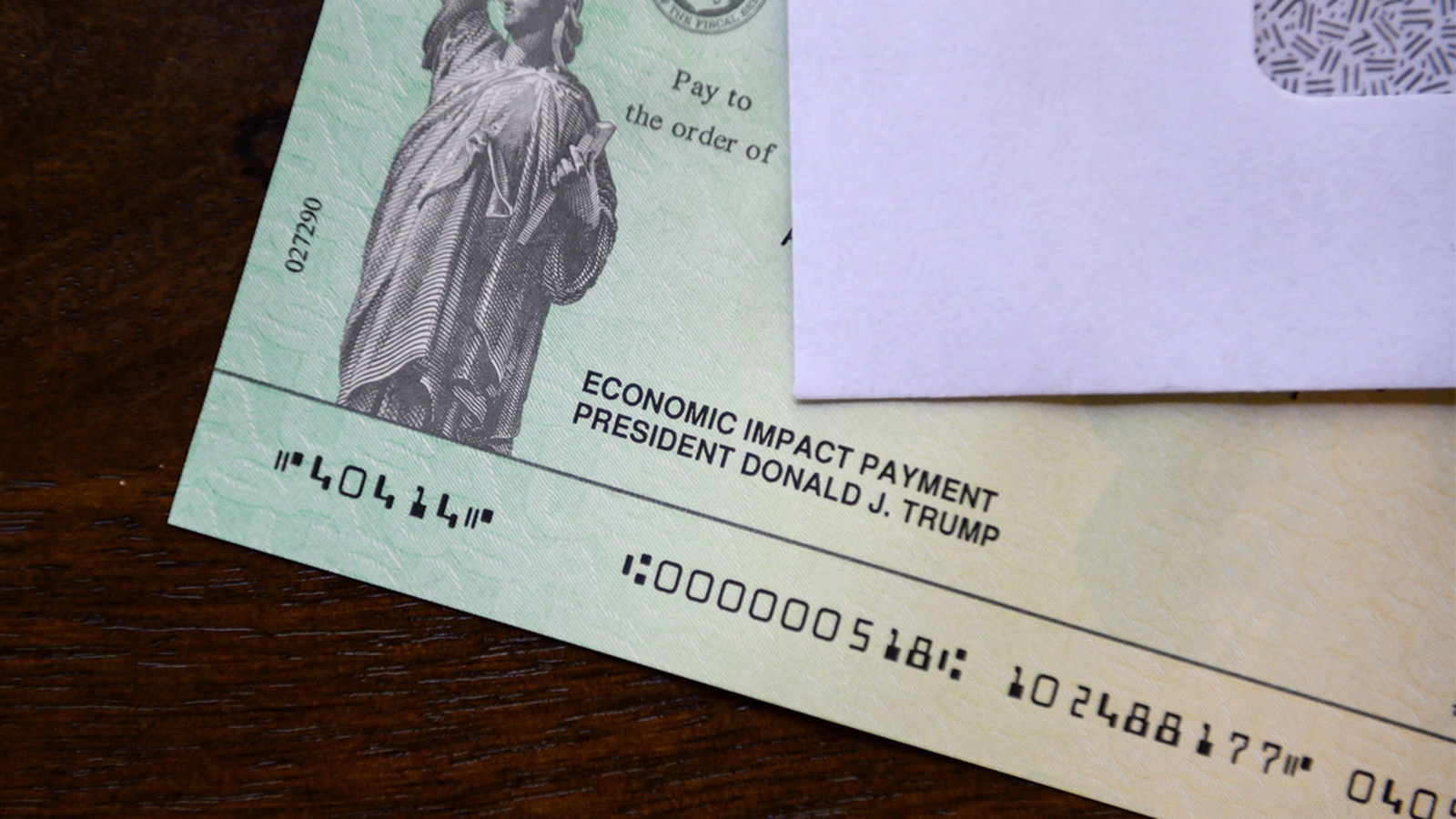

For both 2019 and 2020, george and suzanne had an agi of $160,000. No, the third economic impact payment is not includible in your gross income. The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021.

Here’s everything you need to know about the third stimulus check and your 2021 tax return. For example, if you owed $1,000 in taxes but had a refundable tax credit of $1,200, you'd get a $200 tax refund check from uncle sam. The first two should have been reported on your 2020 tax return.

It will not reduce your refund or increase the amount you owe when you file your 2021 federal income tax return in 2022. Eligibility for the third round of stimulus checks, issued earlier this year as part of president joe biden's american rescue plan, was based on a family's last tax return filed. The full amount of the third stimulus payment is $1,400 per person ($2,800 for married couples filing a joint tax return) and an additional $1,400 for each qualifying dependent.

The deadline for filing has been pushed back from april 15 to may 17. Mar 19, 2021 · americans have been given a little bit longer to file their 2020 tax return. Check out the third stimulus payment eligibility below.

The third payment will be reported on your 2021 tax return.

How to Increase your Tax Refund and Receive the Maximum

Irs Stimulus Checks / Coronavirus IRS deposits first

Third stimulus check Will the IRS tax returns affect my

Where’s My Third Stimulus Check? The TurboTax Blog

Any News On Our Second Stimulus Check NEWCROD

Third Stimulus Check Track Your COVID19 Relief Fund With

Third Stimulus Check Why Some People Should File Their

Second stimulus check update If you received notice that

Third stimulus check update Tax season is here. Should I

Increase Your Third Stimulus Check By Filing Your Tax

3rd stimulus checks Social Security recipients could see

Third Stimulus Check For Senior Citizens Takeaway For

Irs Stimulus Checks / Why Didn T You Receive Full Irs

A bonus stimulus check may be on the way, thanks to your

Third Stimulus Checks IRS Tax Return, Amount and More

How the timing of your tax return could affect your third

How To Get Stimulus Check As A Dependent 2021 Stimulus