The third stimulus payout of $1,400 for every qualified. I am aware that the 3rd was to be included with my parents lump some but when i asked them for my share they said “they didn’t get it” and only got $2800.

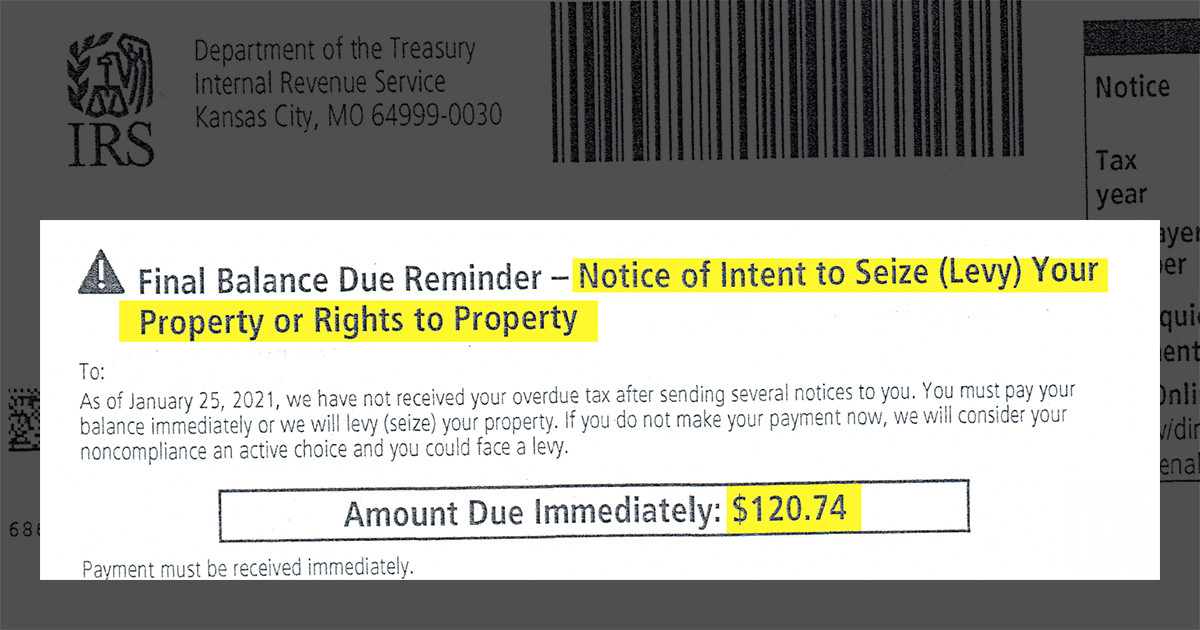

Do you have to return your stimulus money to the IRS

The advance refund (the check) and the tax credit (in the case of the third stimulus payment, it's a tax credit for the 2021 tax year).

Third stimulus check overpayment. My daughter received the first two stimulus payments a couple of weeks ago as part of her tax refund/filing process, and yesterday received the third payment for $1,400.00. He, son, filed 2020 taxes and received the 3rd stimulus, $1400. Alternatively, there was no stimulus payment but he will be able to claim a recovery credit on his 2021 tax return.

Then son filed his 2020 tax return and son received $1400 as he filed independent of his father. For the advance refund, you received the correct amount; Additionally, the irs only has the discretion to not offset overpayments to satisfy federal tax debts, she wrote.

The $1,400 economic stimulus payment is not a loan. There already have been reports of u.s. You both need to decide which.

Technically, we received $1400 too much. The income cutoff to receive a third stimulus check is $80,000 for an individual taxpayer, $120,000 for a head of household and $160,000 for a married couple that files jointly. No, the third economic impact payment is not includible in your gross income.

I don't think these type of overpayments need to be paid back. Our, the parents, 2020 returns have not been filed yet. 2019 my parents claimed me as a dependent (2019) which means i did not receive the first two stimulus checks.

Congress is slated to approve the third round of direct stimulus payments in less than a year, meaning that most americans can expect another cash i. Taxpayers receiving stimulus check amounts that seemed to be too much, which could potentially occur if divorced parents both receive payments for the same Irs used out 2019 returns.

Therefore, you will not include the third payment in your taxable income on your 2021 federal income tax return or pay income tax on the third payment. We have not filed yet for this year, but my daughter did (her first year filing and no longer our dependent). I don't see anything right now.

There are two parts to the stimulus payment: You both need to decide which. Section 9601 adds 26 usc 6428b which provides the third stimulus tax credit and advance refund.

Do you qualify for $1,400? We, the parents, today just received $4200 (3×1400) in stimulus money. This third stimulus check is an advanced tax credit on your 2021 taxes, and calculated based on your 2020 taxes.

Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks. Now, for the 2020 tax year, our son is not a dependent. And for the tax credit, the lowest it can be is 0 (it cannot be negative).

It will not reduce your refund or increase the amount you owe when you file your 2021 federal income tax return in 2022. Hope for more stimulus as biden to push another coronavirus recovery bill on top of $1.9t package Yes, your third check might be seized to pay certain debts.

Under the american rescure plan act signed in 3/11/2021, a family with household income of $150,000 or less will receive a stimulus payment of $1,400 per taxpayer and qualified. It's weird but as far as i can tell they don't keep track of whether more than one taxpayer gets a stimulus for the same dependent. The $1,400 economic stimulus payment is not a loan.

Here are answers to some common questions about this set of stimulus payments, which differ in some ways from the first two. This third stimulus check is an advanced tax credit on your 2021 taxes, and calculated based on your 2020 taxes. A second stimulus check for $600 was approved and sent out in december 2020.

The irs send dad $2800 as the third stimulus payment because it used 2019 as the basis of the stimulus. Within a week the irs should post a faq page about the third stimulus / eip3 addressing these questions.

The IRS Is Sending Out Unemployment Tax Refund Checks

Third stimulus check updates summary 14 February 2021

Child tax credit for 3,600 Everything to know about

What Happens If You Get Two Stimulus Checks?

Unemployment Stimulus Ohio Update UNEMPLM

Stimulus Check Irs Letter 2021 90 Million In Wisconsin

Stimulus Check calculator Is your payment total correct

Stimulus Check 2022 Limits E Jurnal

Third stimulus summary Wednesday 5th March 2021

Stimulus Check 2022 Limits E Jurnal

Third stimulus check summary and news on 09 February 2021

Monthly Child Stimulus Check 2022 Start Date E Jurnal

Stimulus Check Reduce Tax Return ISTIMULUS

Mail Stimulus Check Envelope 2021 Why Your Second

Third stimulus check prepaid debit cards coming; IRS has

Do You Get A Stimulus Check If You Owe Back Child Support

Experts Share Advice on Confusing Tax Situations Created