$0 loan fees and 0% apr. There are $0 loan fees and 0% apr on the credit karma visa® debit card.

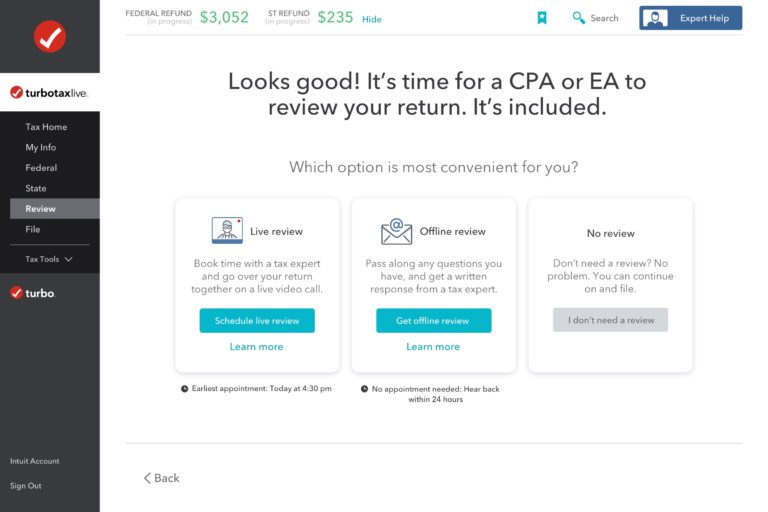

TurboTax Offers Refund Advance to Taxpayers for 2020 The

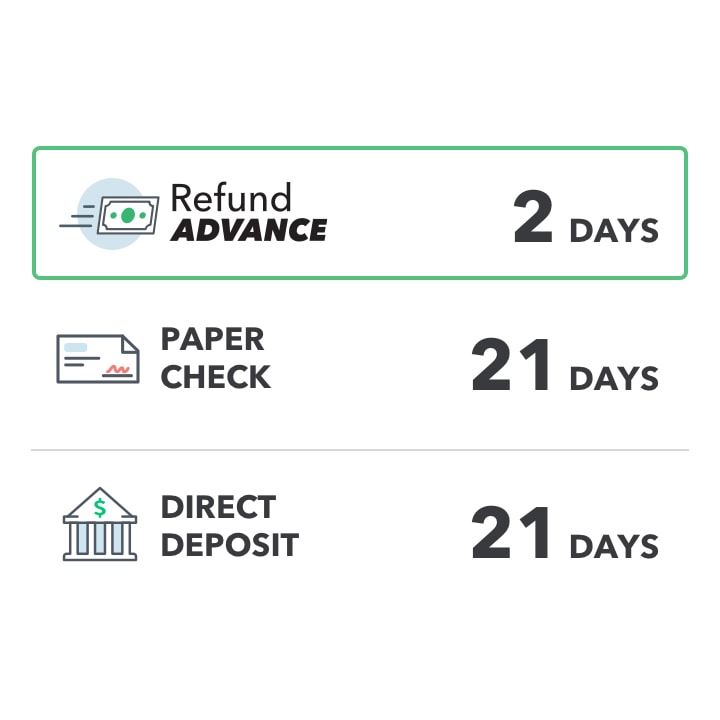

This means you don’t have to wait for your refund when you file with turbotax.

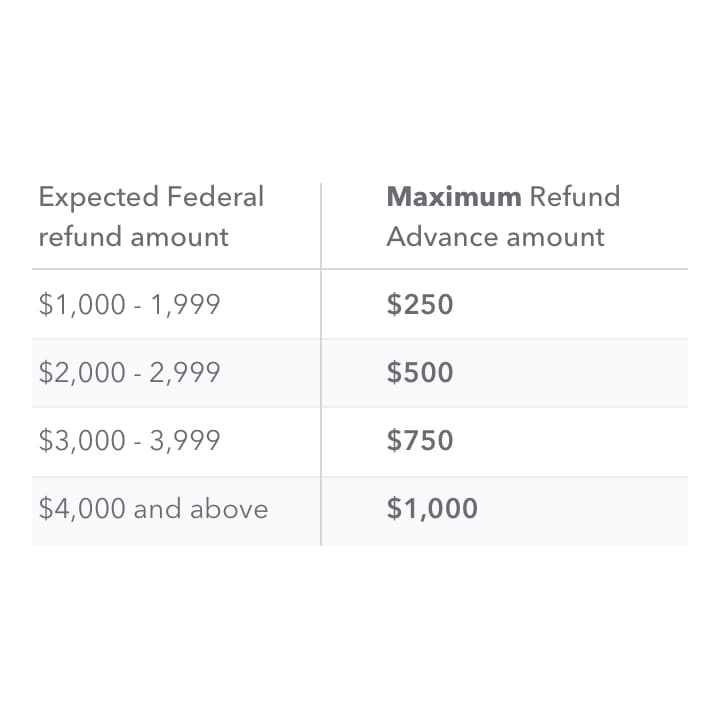

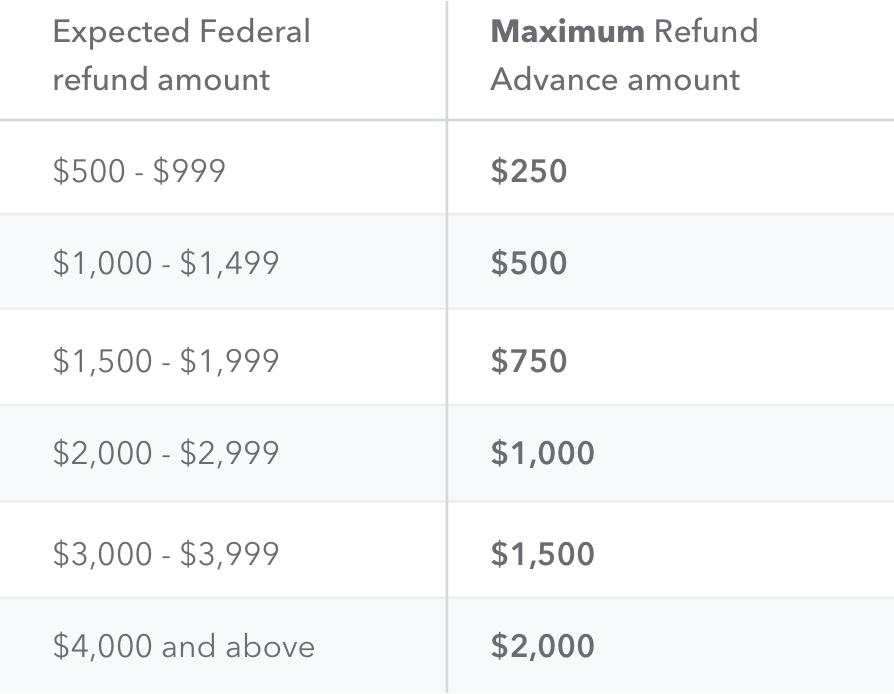

Turbotax refund advance status. You’ll receive your refund advance on a credit karma visa® debit card that you can spend anywhere visa is accepted. Prices are subject to change without notice. Tax refund loans can provide fast cash up to $4,000.

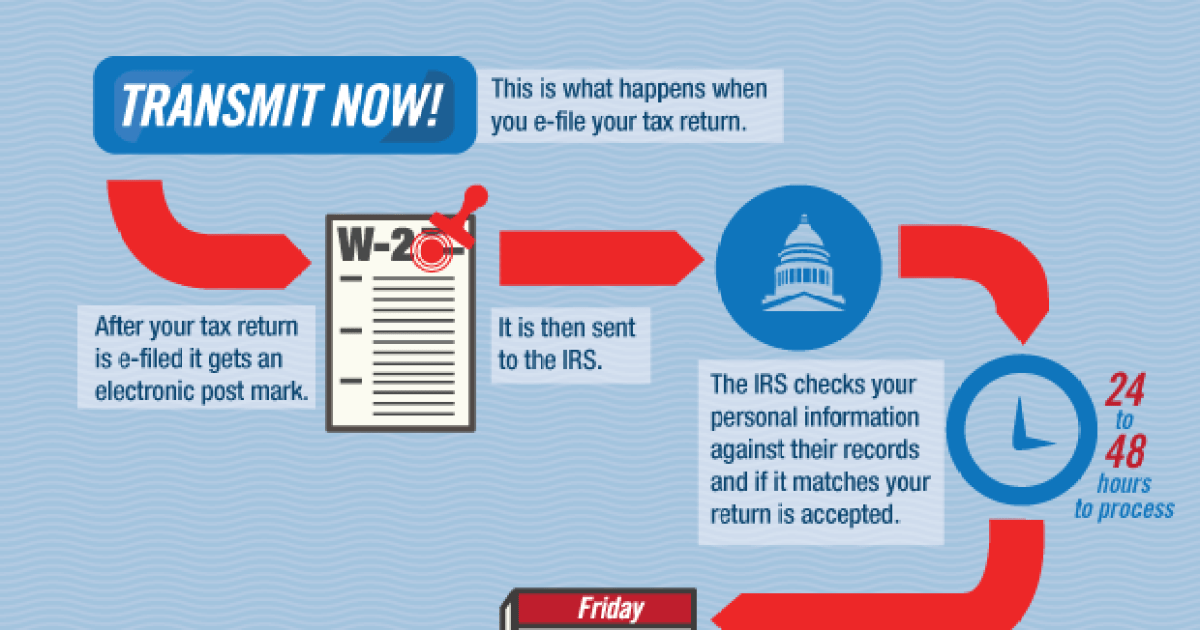

I filed on 22nd around 330pm, status still shows as pending and no advance yet. See refund delivery timelines and find out when to. Use turbotax, irs, and state resources to track your tax refund, check return status, and learn about common delays.

Turbotax, h&r block and others offer tax refund loans. The turbotax system has been used by millions of people and helps take the stress away from doing your taxes without costing an arm and a leg. Checking your tax refund status online.

If you opened a new credit karma account or linked an existing one when filing your taxes with turbotax, you can track your federal refund using your credit karma account. Loans range from $250 to $2,000 and are based on your expected federal tax refund. Also, a physical turbo® visa® debit card will be mailed to you within 5 to 10 business days.

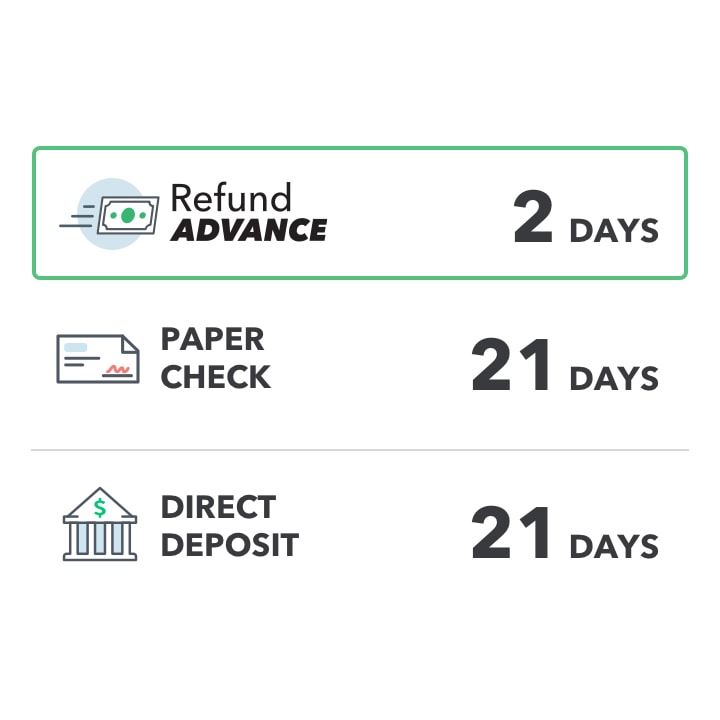

Learn about refund advances and other options. Your refund tracker should appear shortly after you file your federal tax return, log into your credit karma account to check it out! The remainder of your refund (minus the refund advance amount and any turbotax fees) will be loaded onto the card when the irs or state tax authorities distributes your refund (typically within 21 days from.

How to track my refund advance. Turbotax is also releasing a tax refund advance program beginning in early december 2021. If you have, you should have an email from our partners at credit karma letting you know if your credit karma money spend account was approved.

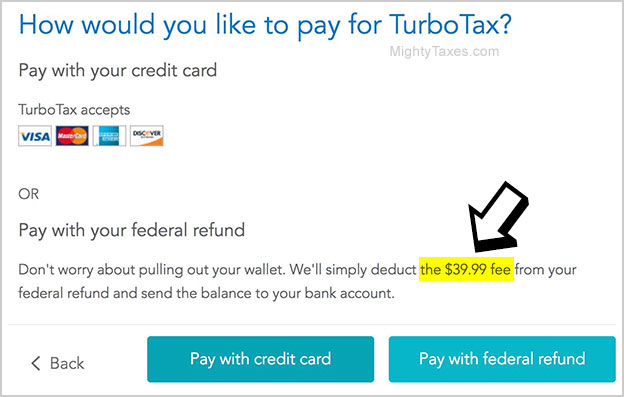

If you choose to pay your tax preparation fee with turbotax using your federal tax refund or if you choose to take the refund advance loan, you will not be eligible to receive your refund up to 5 days early. Single married filing joint married filing separate head of household qualifying widow/widower. I filed my taxes on jan 27th and filed the recovery rebait claim.

A $39 refund processing service fee applies to this payment method. My return was accepted on feb 11th. I never got the first and second stimulus so i'm supposed to get over $1800.

My status bar disappeared and it's been saying your return is still processing. what feels like forever now! March 5th 2021 still no tax refund. Check the where's my refund tool or use the irs2go app.

Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund guaranteed. I received my advance at 5:30pm yesterday, it does still show as received by irs but i got the ck email and notification of deposit first, then about 10mins later the email from tt. Refund advance means you can get cash in as little as 1 hour of the irs accepting your tax return (est.

Tax refund time frames will vary. If your filing isn't showing as received or accepted, that's why. With turbotax you could get up to $4,000 on a refund advance in as little as 1 hour of irs acceptance (est.

Turbotax cd/download or turbotax live with state (retail purchase) you can request a refund for turbotax cd/download or turbotax live with state using the form below. The irs issues more than 9 out of 10 refunds in less than 21 days. You should receive an email telling you that it was accepted by the irs if it's gotten to that stage yet.

Pay for turbotax out of your federal refund: Start for free today and join the millions who file with turbotax. I will comment or update post when my status changes update:

Tax Refund Advance Limited Time Offer TurboTax® Official

4 Steps from Efile to your Tax Refund! The TurboTax Blog

How Do I Get A New Turbotax Card Up to a 2.50 fee per

Irs Accepting Returns Turbotax IRSAUS

Tax Refund Advance With Turbotax TAXIRIN

TurboTax Deluxe 2014 Fed + State + Fed Efile

TurboTax Refund Advance aka Cash Advance 0 Loan Review

Tax Refund Advance Limited Time Offer TurboTax® Official

What Are The Reviews For TurboTax Refund Advance? Tax

Bamboozled TurboTax error may be a problem if you filed

Tax Refund Advance Limited Time Offer TurboTax® Official

How Much Does TurboTax Cost? New Prices (+ State Fee!)

How Does Turbotax Refund Advance Work TAXIRIN

10 Tax Refund Bonus! & TurboTax Figuring

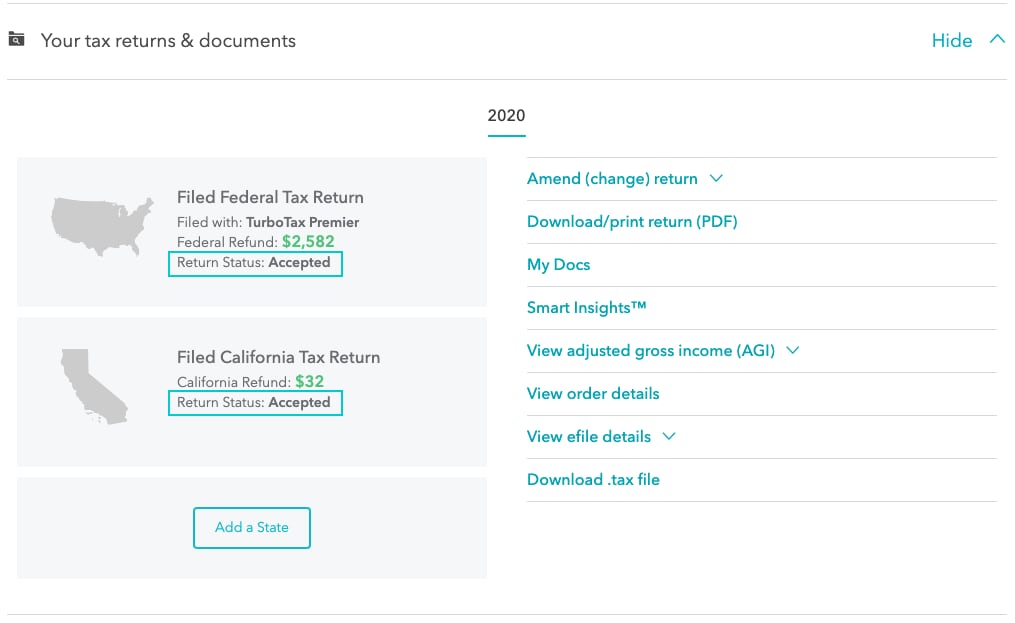

How do I track my state refund?

Download Intuit Turbotax Home And Business 2016 Download