What Happens If You Get An Extra Stimulus Check. If your recently filed 2020 tax return makes you eligible for a bigger stimulus check than you got last month, the irs says you’re covered. Even my accountant hasn't figured out yet what to do with the extra $1400 i got.

However, if the internal revenue service (irs) doesn't have your banking information, you could receive the money as a check. Child tax credit payments begin july 15 My son had already filed his 2020 taxes, so they based his stimulus check off that and sent him $1400.

Failing To Correct Your Return Could Lead To The Irs Auditing Your Taxes, Which Can Get Very Expensive And Wipe Out The Value Of Extra Stimulus Money.

If you received more than one stimulus check in this last round of stimulus payments, or you got more money than what you are actually eligible for, you unfortunately do not get to keep the extra. Even my accountant hasn't figured out yet what to do with the extra $1400 i got. Stimulus checks are not taxable, but they still need to be reported on 2021 tax returns, which need to be filed this spring.

Amid The Rush To Get The Stimulus Money Quickly Out To Those Most Affected By The Ongoing Pandemic, There Reportedly Have Been.

All the extra stimulus check money parents and the elderly could get in their third payment. If you haven't received all of the money you are eligible for, you will need to claim the recovery rebate credit on your 2021 tax return. If you don't get the payment, you can always claim the tax credit next year.

What Happens If Your Get The Wrong Amount?

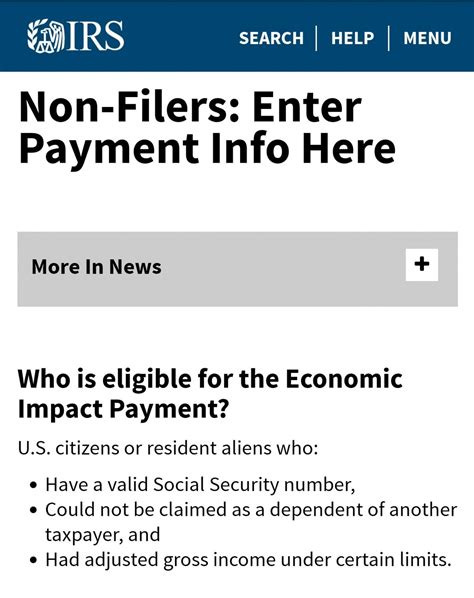

Americans may receive an additional stimulus check as part of the third round of direct payments if their 2020 tax return makes them eligible for more money. If you were eligible to receive the first or second stimulus check and it never arrived, you'll need to claim it as a recovery credit rebate on. $1,400 stimulus checks began to roll out last month credit:

Parents Who Welcomed Newborn Children In 2021 Might Be Eligible For Another Stimulus Payment For #1,400 In 2022.

You and your dependents could be eligible for way more than a $1,400 stimulus check. As for taxpayers eligible for stimulus payments who have recently died but were still sent checks, the irs has given notice that spouses or. The third stimulus payment is an advance on a tax credit for the 2021 tax year.

You May Actually Receive A Letter From The Irs Telling You To Do So If They Notice That A Dependent Was Claimed Twice.

The stimulus payment is an advance tax credit meant to offset your 2020 taxes. The third wave of stimulus checks appears to have done nothing to spare people from financial misery as inflation and omicron instances rise. Failing to correct your return could lead to the irs auditing your taxes, which can get very expensive and wipe out the value of extra stimulus money.