What Is A W9 Form 2022. It is possible to request confirmation by a person who is defined as a u.s. Herein article, we'll present you with the what is w 9 form 2022 and explain how to print it

The w9 form is a form that is from the internal revenue service and the function of it is so individuals and organizations can send their tin to customers financial. This entry was posted in fillable w9 on october 14, 2021 by tamar. It lets you send your tax identification number (tin) 14which is your employer identification number (ein) or your social security number (ssn) 14to another person, bank, or other financial institution.

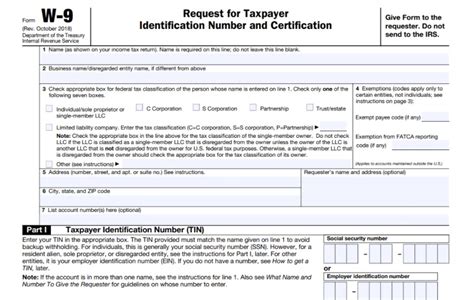

The Form Includes The Name, Address, And Taxpayer Identification Number Of The Individual Or Business.

The irs utilizes this details to help determine taxpayers and identify whether they have properly reported all. They will then be able to send you form. The irs uses this details to help determine taxpayers and identify whether they have actually properly reported all earnings.

Herein Article, We'll Present You With The W9 Form 2022 What Is It And Reveal How To Print It

Fillable blank w 9 2022.form. This will enable the company to correctly prepare. This entry was posted in fillable w9 on october 14, 2021 by tamar.

W9 Form 2022 Request For Taxpayer Identification Number Is The Renowned Tax Form Used For Providing The Correct Social Security Or Employer Identification Number Of Taxpayers To Payers.

Citizen, or an foreign resident. What is a w9 form and where do i get one. The w9 form is a form that is from the internal revenue service and the function of it is so individuals and organizations can send their tin to customers financial.

The Irs Utilizes This Info To Assist Identify Taxpayers And Identify Whether They Have Correctly Reported All.

The irs utilizes this info to help determine taxpayers and determine whether they have actually correctly reported all earnings. It lets you send your tax identification number (tin) 14which is your employer identification number (ein) or your social security number (ssn) 14to another person, bank, or other financial institution. You can send the form to a person in the case that you are freelance.

Citizen Or A One Who Is Considered To Be A Resident Or An Alien.

It also includes the name and address of the other person or company using the taxpayer. Learn the list of the required information and documents. A confirmation form can be requested for either an u.s.