Who Qualifies For The First Stimulus Check 2022. Throughout the first two years of the child tax credit program, the federal government divvied up the first half of the. Newborn infants, college students, disabled adult children, and senior adult relatives identified as dependents are all eligible for $1,400.

So, for example, if you added twin babies to your family this year, you would. Anybody who received unemployment benefits in 2020 won’t be eligible for the payment, but a second round of checks is expected to be announced by the state government in the near future. If you didn’t receive the first or second stimulus payment for your baby, you can claim the recovery rebate credit when you claim the child on.

If You Missed Out On A Payment For Any New Dependents You Added In 2021, You Can Claim $1,400 Per Dependent In 2022.

If you had a baby in 2020, you are eligible for the $1,400 credit in 2021. If you had a significant drop in income from 2020 to 2021 or had other significant changes to your finances or household status you may also qualify for. Mothers will get the stimulus money in the form of cash, and there is no restriction on what the mothers can spend the money on.

To Qualify For The Full Payment, You Must Make Less Than $75,000 Per Year ($150,000 For A Married Couple Filing Jointly) Or Less Than $112,500 If You’re The Head Of Household (Typically Single Parents).

If you had a new baby or added a qualified child to your family in 2021, you're eligible for an additional $1,400 for each new child. This is because the dependent born in 2021 had not yet been reported to the irs. So, if you had a baby or added a new dependent in 2021, then you need to claim the stimulus money for them in 2022.

This Will Be Paid In An Advance Third Stimulus Payment If You Filed Your 2020 Return By The Time The Payments Were Issued.

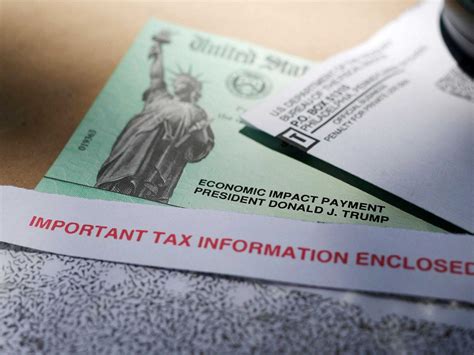

The same $2.2 trillion package that sent millions of americans the $1,400 stimulus check, also upped the child tax credit for one year. The economic impact payment (eip), cares act, or stimulus check payment one was launched in april of 2020. The dependent must claimed on this year’s tax returns.

Those Eligible For The Full $1,400 Include Single Parents Making Up To $75,000 Per Year And Couples Earning Up To $150,000 Per Year.

The most common group that will see another stimulus check in 2022 are new parents, parents with new foster children, and parents who recently adopted a child in 2021. In 2022, certain people in the united states will receive a financial boost in the form of a stimulus check of up to $1,400 on top of their tax return, but they must meet specific conditions to qualify. Throughout the first two years of the child tax credit program, the federal government divvied up the first half of the.

According To The Internal Revenue Service, This Is A “Tax Credit That May Help You Pay For The Care Of Eligible Children And Other Dependents (Qualifying Persons).

If you didn’t receive the first or second stimulus payment for your baby, you can claim the recovery rebate credit when you claim the child on. How to get it massachusetts residents who qualify for the payment will receive checks after they are automatically mailed out at the end of march. Citizens in the united states of america may be eligible to receive a $1,400 payment on top of their tax refund in 2022, as long as they are either a parent of a.