2022 Tax Withholding Table. There are seven tax rates in 2022: Withholding kentucky income tax 2022 withholding tax tables computer formula revised december 2021 effective for tax year beginning january 1, 2022 commonwealth of kentucky department of revenue frankfort 42a003(t)

The federal income tax withholding tables c hanged effective january 1, 2021. 2022 income tax withholding instructions, tables, and charts state of vermont department of taxes taxpayer services division p.o. We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees.

For Single Taxpayers And Married Individuals Filing Separately, The Standard Deduction Rises To $12,950 For 2022, Up $400, And For Heads Of Households, The Standard Deduction Will Be $19,400 For Tax Year 2022, Up $600.

The following are aspects of federal income tax withholding that are unchanged in 2022: 2022 income tax withholding instructions, tables, and charts state of vermont department of taxes taxpayer services division p.o. Between 2021 and 2022, many of the changes brought about by the tax cuts and jobs act of 2017 remain the same.

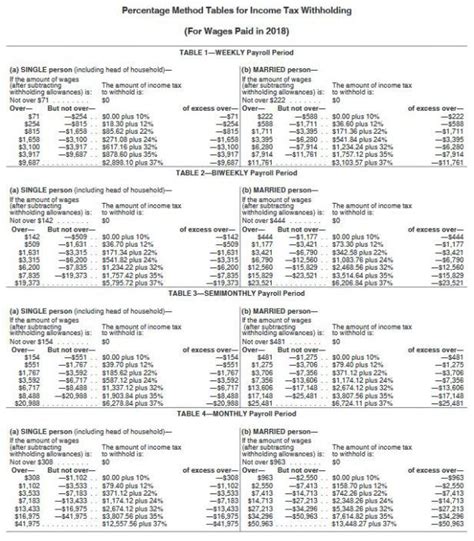

Worksheet 1B Is Used With The Standard Withholding Rate Schedules In The 2022 Percentage Method Tables For Automated Payroll Systems And Withholding On Periodic Payments Of Pensions And Annuities That Are Included In Section 1.

Between 2021 and 2022, many of the changes brought about by the tax cuts and jobs act of 2017 remain the same. The iowa department of revenue is issuing updated income tax withholding formulas and tables for 2022. 2022 federal withholding tax table update your payroll tax rates with these useful tables from irs publication 15, (circular e), employer's tax guide.

And The Filing Status Is:

2022 income tax withholding tables. Listed below are the actual 2022 local income tax rates. 2022 federal tax tables are available the irs has released the ‘2022 circular e’ which provides employers guidance on withholding federal taxes for earnings earned in calendar year 2022.

We Provide Separate Tables For The Convenience Of Employers Who Do Not Withhold Using An Automated Or Computerized System, Or Who Prefer To Look Up The Amounts To Be Withheld Manually.

You may also be interested in using our free online 2022 tax calculator which automatically calculates your federal and state tax return for 2022 using the 2022 tax tables (2022 federal income tax rates and 2022 state tax tables). The following are aspects of federal income tax withholding that are unchanged in 2022: A tax withheld calculator that calculates the correct amount of tax to withhold is also available.

• Things You Need To Know.

Here's how they apply by filing status: Withholding tax tables effective january 1, 2022 to: Oregon employers the oregon withholding tax tables include: