Pa Withholding Tax Due Dates 2022

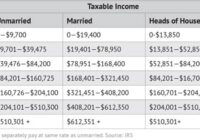

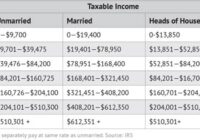

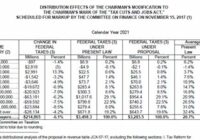

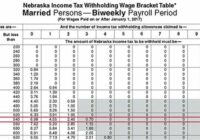

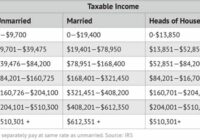

Pa Withholding Tax Due Dates 2022. Important tax due dates 2022 pennsylvania state tax witholding table 2021 pennsylvania state tax witholding table 2020 pennsylvania state tax witholding table 2019 pennsylvania state tax witholding table 2018 pennsylvania state tax witholding table 2017 pennsylvania state tax witholding table 2016 pennsylvania state tax witholding table Withholding of payments that are less… Read More »