Colorado Income Tax Withholding 2022. How to submit withholding statements. How to remit income tax withholding.

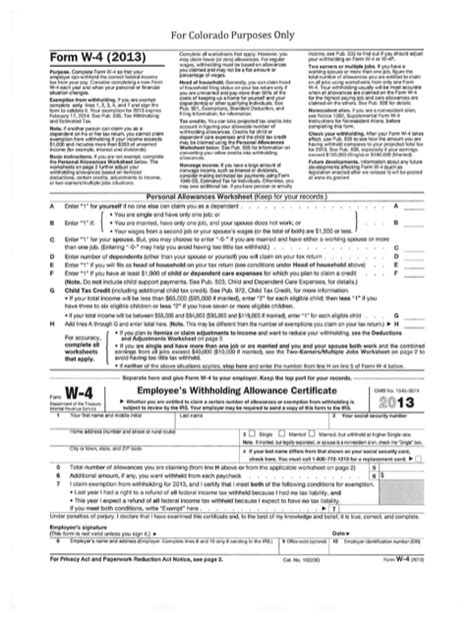

Final tax 5% dividend from company covered under clause 132c part i 2nd schedule dividend if no tax is payable by the co. If employees request that their colorado state income tax withholding be adjusted, their employer must give them form dr. Colorado income tax withholding who must withhold colorado income tax?

The Compensation Is Subject To Federal Withholding For Income Tax Purposes;

Employers who are required to withhold colorado income tax from employees’ wages are liable for the required withholding, regardless of whether they actually withheld the required amounts. You find that this amount of $2,025 falls in the “at least $2,020, but less than $2,045” range. Estimated 2022 colorado alternative minimum tax $ 00 4.

Estimated 2022 Colorado Income Tax — 4.55% Of Line 1 $ 00 3.

Colorado income tax withholding who must withhold colorado income tax? (1) must set, by ordinance or resolution, the income brackets that apply to each income tax rate; Using the chart, you find that the “standard withholding” for a single employee is $176.

The Compensation Is Subject To Federal Withholding For Income Tax Purposes;

Colorado income tax withholding rate is decreased to 4.55% effective january 1, 2021. Final tax 5% dividend from company covered under clause 132c part i 2nd schedule dividend if no tax is payable by the co. Under sb 133 and effective in 2022, each county is authorized to set by ordinance or resolution, a county income tax rate equal to at least 2.25% (previously, 1%) and to apply the county income tax on a bracket basis.

2022 Income Tax Withholding Tables And Instructions For Employers | Ncdor.

Estimated 2022 colorado wage or nonresident real estate withholding. Starting in 2022, an employee may complete colorado form dr 0004, but it is not required. If an employee completes form dr 0004, you must calculate withholding based.

Subtract Line 6 From Line 5 $ 00 8.

Colorado withholding based on the amounts you entered. Among these states, colorado’s rate ranks in about the middle of the pack. Colorado's state income tax rate is a flat 4.55% of your federal taxable income, regardless of your income level.