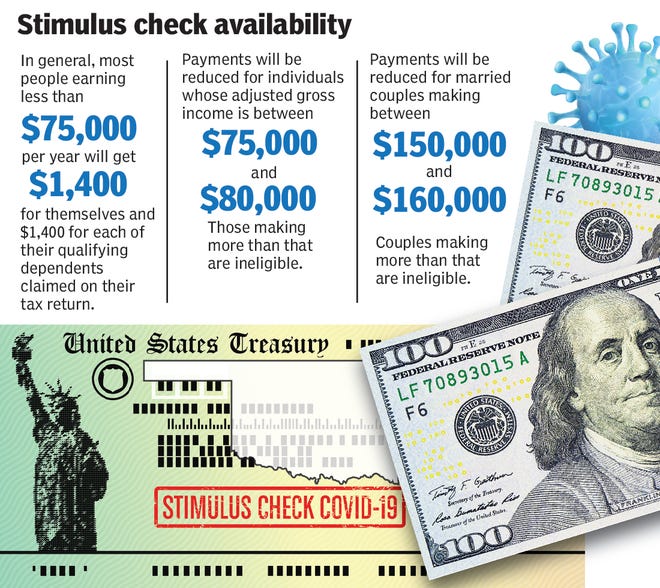

Check 1040 line 30 for the recovery rebate credit. To be eligible for the full amount on the third round of checks, individuals need to have an adjusted gross income (agi) of $75,000 or less and married couples filing jointly need to have an agi of $150,000 or less.

3rd stimulus check update Payments will start in March

In the third stimulus check, dependents of every age count toward $1,400.

3rd stimulus check qualifying dependent. Citizen, national or resident alien with a valid social security number (ssn) or adoption taxpayer identification number. Individuals eligible for payments could receive up to $1,400, and married couples filing a joint return could receive up to $2,800. The agency, though, has breathing space since the tax deadline day has been extended to 17 th may.

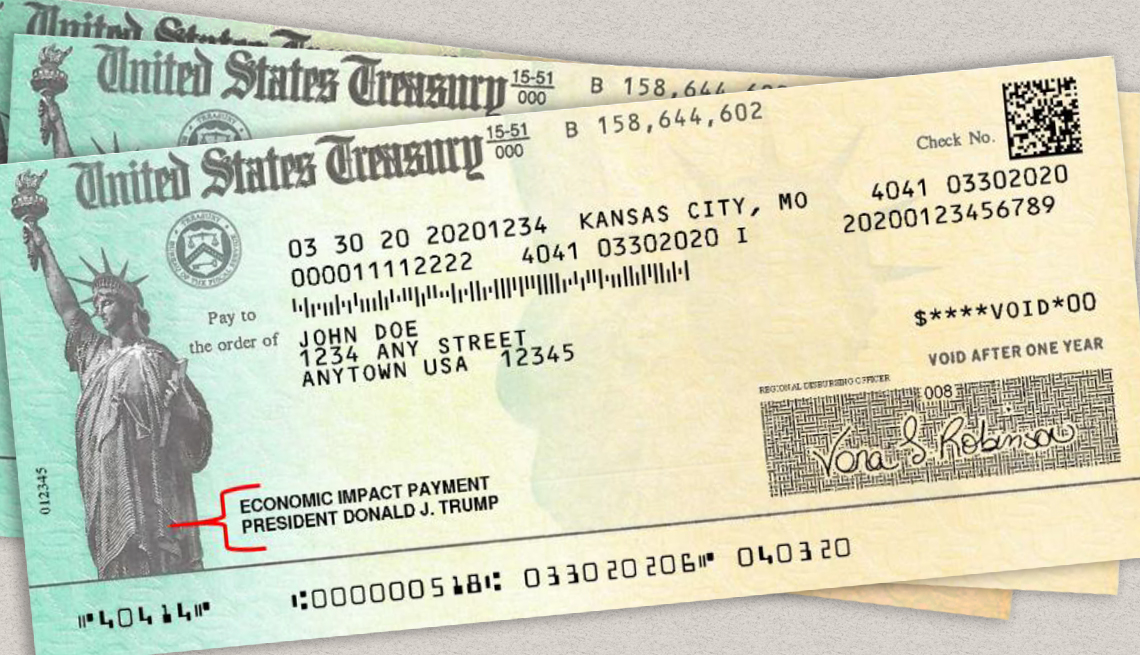

The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021. Up to $1,400 for qualifying individuals. The 3rd stimulus for 1,400 was an advance for your 2021 return and will be reconciled on your 2021 return we are filing now.

The third payment will be based on either 2019 or 2020 income, depending on if a taxpayer has already filed their tax return for last year. $1,400 for each child dependent under the age of. Each eligible dependent — including adult dependents — also will qualify for a payment of $1,400.

It doesn't matter what your 2019 or 2020 income was. The irs has already sent out more than 156 million third stimulus checks, worth approximately $372 billion. We also may see arguments where spouse a would qualify for a stimulus check with dependents, but spouse b would not.

The third stimulus checks are being sent out by the irs at the same as tax refunds. For the third round, a dependent can now be any age to qualify for additional stimulus money. However, the third round has more requirements for dependents to meet before they can qualify for the payment.

Dependents and the first two stimulus checks. Any family member that has a social security number (ssn) or dependent (regardless of age) can qualify for the third stimulus check. The maximum amount for the third round of stimulus checks will be $1,400 for any eligible individual or $2,800 per eligible couple filing taxes jointly.

If you're a parent of a baby born in 2020, you could be entitled to. The third stimulus check will also help people who live by themselves and work but are unable to meet ends. Qualifying dependents need to be claimed during that tax.

That rate was $500 for each dependent as part of the first check, approved in march 2020 as part of the cares act, and $600 each for the second stimulus check that was approved and sent in december. That means a family of four could receive as much as $5,600 in total. A qualifying child dependent must be a u.s.

The first 2 stimulus checks were based on 2020 returns. This is the third round of stimulus checks issued by the irs based on parents or guardians claiming dependent in their tax returns in 2019 and 2020. For example, in a household where both parents have itins, and their children have ssns, the children qualify.

$2,800 for qualifying couples who file a joint tax return. Adults & young adults can get the third stimulus check. Anyone who can be claimed as a dependent on someone else's tax return doesn't qualify for a third stimulus check.

For the first and second rounds of stimulus checks from 2020, a dependent had to be a child under the age of 17 to qualify for additional stimulus money. In the previous rounds of the stimulus checks, reportedly, 15 million dependent adults and older children were not given stimulus checks. People who support adult dependents now qualify for additional stimulus money.

On the contrary, you will have spouse b rushing to file for 2020 (so long as their income qualifies) so that they can receive the dependent stimulus funds during the third round of checks. So if your 2021 income qualifies it will be added to your return. The third check makes dependents of all ages, including young adults and older adults, eligible to add up to $1,400 each to your household's total.

This was under the cares act. To get the third stimulus check, a tax filer must have a social security number and adjusted gross income of $75,000 or less for the 2020 tax year (or 2019. Who gets the dependent stimulus check?

President joe biden’s american rescue plan pays individual taxpayers earning less than $80,000 a maximum of $1,400 and couples making under $160,000 up to $2,800. People could also get $1,400 for each qualifying dependent.

Stimulus Update Dependents / Stimulus Payments May Be

Stimulus Checks Third stimulus check How much for

Who's a dependent for stimulus checks New qualifications

Everything You Need To Know About The Third Stimulus Check

Stimulus Checks For Dependents With Disabilities MULUSTI

How a Third Stimulus Check Could Differ From Your First

Are You Eligible for a Third Stimulus Check and If So

Who Qualifies As A Dependent For The Third Stimulus Check

Will dependents get a stimulus check this time Stimulus

How To Get 3Rd Stimulus Check Without Filing Taxes Third

(3rd stimulus check)who qualifies for a 1,400 stimulus

Third stimulus check eligibility Who will get 1,400 (and

Oklahomans will get COVID stimulus checks this week

Stimulus Check 2021 Head Of Household 1 Dependent ISWOH

Stimulus Checks And Dependents All The New Details Added

How To Get Stimulus Check As A Dependent 2021 Stimulus

Will you get your own third stimulus test? How the rules