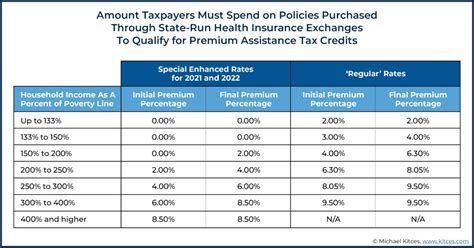

American Rescue Plan Act Of 2022 Head Of Household Requirements. The earned income tax credit Also noticeable in the table above is that the legislation would allow households with income above 400 percent of fpl to receive aca subsidies in 2021 and 2022 that are more generous than what current law would provide to those making less than 400 percent of fpl.

American rescue plan act of 2021 The american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000. Under current law, the provisions will largely revert back to prior year rules for taxable year 2022.

The Provisions Examined Are Head Of Household Filing Status (Hoh);

Also noticeable in the table above is that the legislation would allow households with income above 400 percent of fpl to receive aca subsidies in 2021 and 2022 that are more generous than what current law would provide to those making less than 400 percent of fpl. An eligible individual is anyone except: To apply for arpa economic impact payments to minors:

President Biden Will Sign A Huge New Covid Relief Bill, Officially Named The “American Rescue Plan Act Of 2021” (Full Text), Into Law Very Shortly.

Lifting the cap on subsidy eligibility: This revenue procedure addresses the federal income tax treatment and information reporting requirements for payments made to or on behalf of financially distressed individual homeowners by certain entities with funds allocated from the homeowner assistance fund (haf), established under section 3206 of the american rescue plan act of 2021, pub. Not only does it provide lower caps for those who get subsidies through cost assistance, but it also caps the premium that can be charged the benchmark plan at no more than 8.5% of household income.

The New Bill Increases The Fine Municipalities Must Pay For Altering Monuments From A Total Of $25,000 To $5,000 Daily.

The credit phases out between $75,000 and $80,00 of adjusted gross income ($112,500 and $120,000 for head of household filers and $150,000 and $160,000 for joint filers). American rescue plan act public law no: An applicant must completely fill out, notarize and sign an original arpa

Following Cdc Guidelines, Paying Full Employee Compensation, And Providing Tuition Relief To Families In

The payment will fully phase out when income reaches $80,000 for single filers, $120,000 for heads of household with one child, and $160,000 for joint filers or surviving spouse. The earned income tax credit The measure applied per person, for households with income less than $150,000.

The Head Of Household Parent Or Guardian Shall Receive A Payment Of $500 Per Dependent Minor Only Upon An Approved Application At A Reasonable Date And Time Established By The Treasurer Of The Tribe.

The american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000. For people with lower incomes, the normal percentage of income that has to be paid for. For 2021 and 2022, section 9661 of the american rescue plan simply caps marketplace health insurance premiums (for the benchmark plan) at no more than 8.5% of household income.