American Rescue Plan Act Of 2022 Requirements. The change to the de minimis threshold also highlights the importance of adhering to the taxpayer identification number (“tin”) solicitation requirements and imposing backup withholding at the proper time for tpsos that have not received a tin from a participating payee, received a facially erroneous tin, or are otherwise required to impose backup withholding. These rules are subjec t to change.

This act may be cited as the ‘‘american rescue plan act of 2021’’. Department of treasury has issued interim rules for the american rescue plan act. The change to the de minimis threshold also highlights the importance of adhering to the taxpayer identification number (“tin”) solicitation requirements and imposing backup withholding at the proper time for tpsos that have not received a tin from a participating payee, received a facially erroneous tin, or are otherwise required to impose backup withholding.

The State Funding Portion Is Approximately $195 Billion With $25.5 Billion Distributed Equally Among The 50 States And The District Of Columbia And The Remaining Amount.

American rescue plan act of 2021 the american rescue plan act of 2021 (h.r. The change to the de minimis threshold also highlights the importance of adhering to the taxpayer identification number (“tin”) solicitation requirements and imposing backup withholding at the proper time for tpsos that have not received a tin from a participating payee, received a facially erroneous tin, or are otherwise required to impose backup withholding. Department of treasury has issued interim rules for the american rescue plan act.

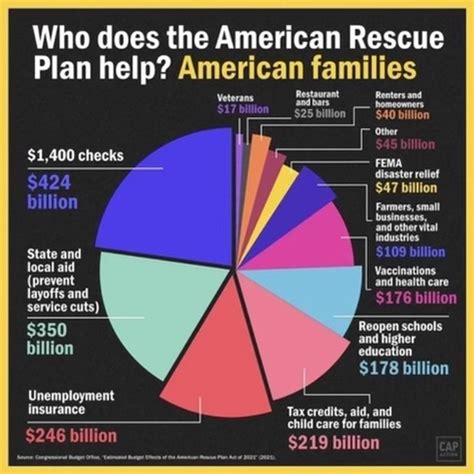

Signed Into Law On March 11, 2021, The American Rescue Plan Act Of 2021 (“Arpa”) Provides $350 Billion In Additional Funding For State And Local Governments.

Cities are permitted to calculate the extent of reduction in revenue as of four points in time: The new and expanded financial help has led to a record 1.6 million people enrolled in covered california, which gives the state one of the healthiest consumer pools in the nation for the seventh consecutive year. This act may be cited as the ‘‘american rescue plan act of 2021’’.

The Emergency Funding Was Designed Specifically To Help Keep Front Line Public Workers On The.

The program ensures that governments have the resources needed to: The information provided during this webinar is solely intended for general reference and is not comprehensive or final. The american rescue plan act will be effective on january 1, 2022.

The Adjusted Percentage For 2022 (I.e., The Percentage Of Household Income That Recipients Of The Tax Credit Must Pay For Exchange Coverage) Is Unchanged From 2021;

Please click here for gfoa’s analysis of arpa. Plans approved for special financial assistance must be paid the amount sufficient for the plan to pay the full benefits due through the plan year ending in 2051. These rules are subjec t to change.

The American Rescue Plan Will Continue To Provide Lower Premiums, At Levels Never Seen Before, Throughout The Entire 2022 Coverage Year.

American rescue plan act of 2021 summary unless otherwise stated under “key provisions,” the sections became effective upon enactment on march 11, 2021. The american rescue plan act passed on march 11, 2021, which included a massive change for business owners and side hustlers. 1319) , § 4001, enacted on march 11, 2021, established a new category of paid leave for selected federal employees.