Tax Calculator 2022 Oregon. The median property tax in oregon is $2,241.00 per year for a home worth the median value of $257,400.00. How to calculate oregon state tax in 2022.

That’s because oregon personal income tax law limits the amount of federal income tax that is subtracted from federal adjusted gross income (agi). To qualify for the h&r block maximum refund guarantee, the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete, inaccurate, or inconsistent information supplied by you, positions taken by you, your choice not to claim a deduction or credit, conflicting tax laws, or changes in. The or tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in ors.

Your Average Tax Rate Is 20.52% And Your Marginal Tax Rate Is 32%.

If you make $202,000 a year living in the region of oregon, usa, you will be taxed $59,525. The or tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in ors. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information.

How To Calculate Oregon State Tax In 2022.

Oregon income tax calculator 2021. That means capital gains can be taxed at a rate as high as 9.9%, depending on your total income. Tax advice, expert review and turbotax live:

Calculate Your Tax Year 2022 Take Home Pay After Federal & Oregon Taxes, Deductions And Exemptions.

For instance, an increase of $100 in your salary will be taxed $36.13, hence, your net pay will only increase by $63.87. Wages of oregon residents (regardless of where the work is performed). Oregon personal income tax withholding and calculator;

Tax Rate Used In Calculating Oregon State Tax For Year 2022.

The median property tax in oregon is $2,241.00 per year for a home worth the median value of $257,400.00. This means that the tax rate can be anywhere from 10% to 37% depending on your household income. Access to tax advice and expert review (the ability to have a tax expert review and/or sign your tax return) is included with turbotax live or as an upgrade from another version, and available through december 31, 2022.

For Payroll Periods Of Less Than A Year, Figure The Annual Withholding Divided By The Number Of Pay Periods (See Page 5 Or 6).

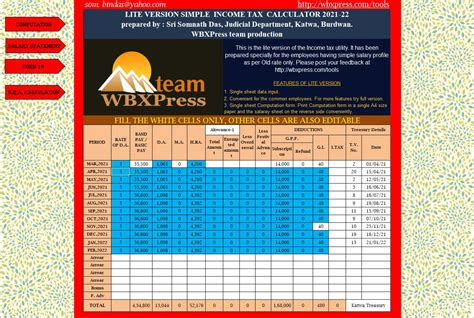

We strive to make the calculator perfectly accurate. 2022 oregon tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. Taxable income × tax rate = tax liability.