American Rescue Plan Act Of 2022 Tax Year. The act is a $1.9 trillion economic stimulus bill designed to facilitate us recovery from the. Please consult with your tax accountant or professional tax expert before adhering to any of these recommendations.

It’s been a long time coming and will be effective on january 1, 2022. The irs has already sent almost all the payments to the eligible recipients. Endowment tax in the previous higher education emergency relief fund will not apply to new.

The Average Monthly Premium Per Enrollee Came Out To $574.95, With Average Monthly Advance Premium Tax Credit Payments Reaching $491.30.

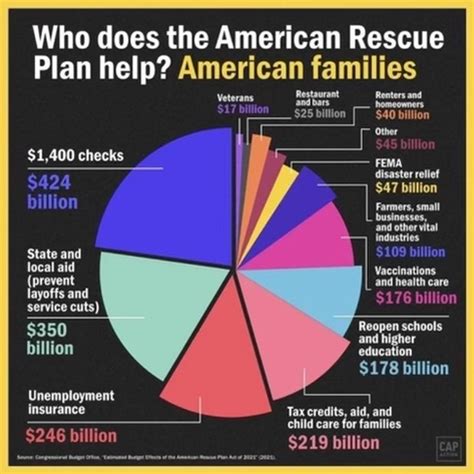

The measure applied per person, for. The american rescue plan act, which was approved in march of this year, authorized a $1400 coronavirus stimulus check per dependent. 6, 2022, governing the use of fiscal recovery funds (frf) as established under the american rescue plan.

The American Rescue Plan Act Had Waived Federal Tax On Up To $10,200 Of Benefits Collected In 2020.

The american rescue plan act, which democrats passed in march, waived federal tax on up to $10,200 of unemployment benefits, per person, collected in 2020. Section 2101 of the american rescue plan act provided $200,000,000 in supplemental funding to the department of labor to carry out worker protection activities, and for the office of the inspector general (oig) for oversight of the secretary's activities to prevent,. The congressional budget office (cbo) projects the premium tax credit program cost $53 billion in 2020.

The American Rescue Plan Act Only Broadens The Reporting Needed To Collect Tax Information Once A Taxpayer Nears Or Reaches $600 In Goods And Services Transactions.

The law included no new taxes on such transactions, although it did change reporting requirements to make it easier to collect them from people using the platforms for business. The american rescue plan, the $1.9 trillion pandemic relief bill signed into law last year by president joe biden, expanded the credit, raised income limits and. The american rescue plan (arp) act was signed into law on march 11, 2021.

New Small Business Tax Rule For 2022 Reports State That The New Tax Rule In Due To A Small Change Within The American Rescue Plan Act Of 2021.

This resulted in just half the credit being paid out. Endowment tax in the previous higher education emergency relief fund will not apply to new. The american rescue plan act passed on march 11, 2021, which included a massive change for business owners and side hustlers.

The American Rescue Plan Act Of 2021 (H.r.

Please consult with your tax accountant or professional tax expert before adhering to any of these recommendations. The american rescue plan act authorized the advanced payment of these tax credits at a rate of $250 or $300 per month from july to december. Department of the treasury released the final rule on jan.