Bas Due Dates For Tax Agents 2022. They cover annual topics as well tax issues for sme owners. Payment (if required) is due 28 may 2021.

In general, where the due date falls on a weekend or public holiday, it is moved to the next business day. 25 august 2022 (to be confirmed) the actual due dates for each of your lodgment periods are as advised to you by the tax office in the business portal, or on the paper form if you still receive it. 25 august 2022 to be confirmed when the.

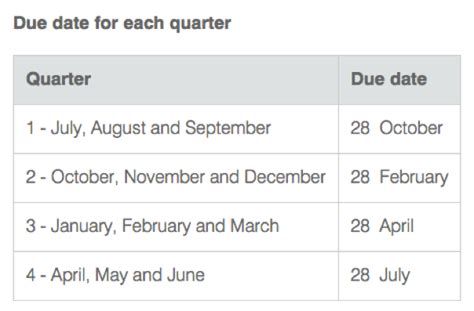

If You Use A Registered Tax Or Bas Agent, Different Dates May Apply.

25 august 2022 (to be confirmed) the actual due dates for each of your lodgment periods are as advised to you by the tax office in the business portal, or on the paper form if you still receive it. Lodge and pay july 2021 monthly business activity statement. If a due date falls on a weekend or public holiday, we can receive your return and payment on the next working day without a penalty being applied.

21‐Jun May 2022 Payg Withholding (Ias) Due 21‐Dec November 2022 Payg Withholding (Ias) Due 14‐Jul 2021‐22 Stp Finalisation Due *Please Note That Bas Due Dates Are Based On Tax & Bas Agent Lodgement Concession Due Dates.

Tax returns for individuals and trusts with a lodgment due date of 15 may 2022. Standard due date 28 july 2022 (+ 2 weeks = 11 aug 2022) agent: Unless otherwise stated, the due dates provided are for 30 june balancers only.

When A Due Date Falls On A Saturday, Sunday Or Public Holiday, You Can Lodge Or Pay On The Next Business Day.

Payment (if required) is due 28 may 2021. If you aren't required to lodge a tax return then the due date is 28 february following the annual tax period. Provisional tax is also due this date for certain balance dates per table 1.

April To June 2020 Quarterly Superannuation Guarantee (Sg) Contribution:

Payers who have no tax agent or bas agent involved in preparing the report. Quarterly fbt return and payment due. 2022 fringe benefits tax annual return for tax agents if lodging electronically.

May 31 Payment For Close Companies Is Due On Relevant Terminal Tax Date).

Tax return for all entities with a lodgment due date of 15 may 2022 if the tax return is not required earlier. Provisional tax instalments due for people and organisations who file gst on a monthly or two. Our expectations for agents to access lodgment program due dates are defined under the lodgment program framework.