Child Care Credit 2022 Form. A $2,000 credit per dependent under age 17; To claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal income tax return.

To claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal tax return. Read more about the child and dependent care expenses credit. Moreover, the maximum amount a taxpayer could claim was up to $3,000 for one child and $6,000 for two or more children.

It Can Be Tricky To Calculate Exactly How Much The Tax Credit Will Be Worth When It Comes Time To File Your Taxes.

For your 2021 tax return, the cap on expenses eligible for the child and dependent care tax credit is $8,000 for one child (up from $3,000) or $16,000 (up from $6,000) for two or. To help taxpayers reconcile and receive 2021 ctc, the irs is sending letter 6419, advance child tax credit reconciliation from late december 2021 through january 2022. 2022 qualifies for the child tax credit, an estimated 65 million people, and about 61 million received the monthly payments.

The Expanded Child And Dependent Care Credit Allows Eligible Taxpayers To Claim A Credit Worth Up To $4,000 In Care Expenses Paid For One Qualifying Dependent Or $8,000 For Two Or More Dependents.

The expanded child tax credit for 2021 gets a lot of attention, but there's another big tax change for families this tax season: In completing the form to claim the credit, you will need to provide a valid taxpayer identification number (tin) for each qualifying person. You do not get that full amount back as a credit, however.

However, The Basic Starting Point Is That You Get Up To $3000 For One Dependent And Up To $6000 For Having Multiple Dependents In Dependent Care.

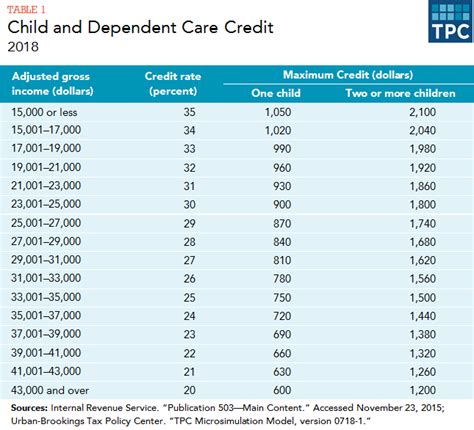

To claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal tax return. In 2020, for instance, the cdctc was 20 percent to 35 percent of qualified childcare expenses. Families who received advance payments must:

Above The $125,000 Threshold The Credit Amount Begins To Phase Out By One Percent Off The Starting 50 Percent For Every $2,000, Or Fraction Thereof, Over The.

But without intervention from congress, the program will instead revert back to its original form in 2022, which is less generous: The child and dependent care credit has also been expanded this year, so parents can get up to $8,000 for one child or up to $16,000 for two or more. When you do so, you'll need to provide a valid taxpayer identification number (tin) for each qualifying person.

How Do I Claim The Child Care Tax Credit On My 2022 Taxes And What Can I Expect To Save?

A $2,000 credit per dependent under age 17; Lawmakers in vermont approved a $50million tax cut package that would send $1,200 per child to families with children aged six or under. However, the maximum amount for the credit is $3,000 per qualifying person.