Child Care Tax Credit For 2022. Eligible parents could receive a tax. Distributing families’ eligible credit through monthly checks for all of 2022.

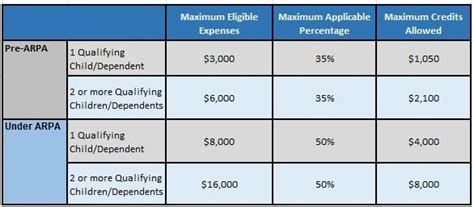

Prior to the american rescue plan, parents could only claim 35% of a maximum of $6,000 in child care expenses for two children, or a maximum tax credit of $2,100. An increase in the maximum credit that households can claim, up to $3,600 per child age five or younger and $3,000 per child ages six to 17. The expanded child tax credit for 2021 gets a lot of attention, but there’s another big tax change for families.

The Child Tax Credit Isn't Going Away.

It can be tricky to calculate exactly how much the tax credit will be worth when it comes time to file your taxes. Therefore, child tax credit payments will not continue in 2022. Changes to the credit could give families almost four times as much money back.

The Expanded Child Tax Credit For 2021 Gets A Lot Of Attention, But There’s Another Big Tax Change For Families.

Parents can expect more money to come from the expanded child tax credit this year. However, the basic starting point is that you get up to $3000 for one dependent and up to $6000 for having multiple dependents in dependent care. Here's what you need to know published thu, jan 13 2022 9:44 am est updated tue, feb 8 2022 4:05 pm est

Taxpayers Can Now Claim Up To $8,000 In Expenses For One Child — Or Up To $16,000 For Two Or More Dependents.

Families of more than 65 million children will begin receiving monthly payments of the new and improved child tax credit stimulus of up to $300 on july 15, the joe biden administration announced. But without intervention from congress, the program will instead revert back to its original form in 2022, which is less generous: Any hope of receiving a child tax credit payment in january 2022 is slowly slipping away as congress holds the key to more money for americans.

As Of Now, The Size Of The Credit Will Be Cut In 2022 Back To $2,000 (Some Families Earned Up To $3,600 In 2021), With Full Payments Only.

The expanded child tax credit for 2021 gets a lot of attention, but there's another big tax change for families this tax season: Up to $2,000 per eligible child under 17, in the form of an annual tax credit. A more modest child tax credit remains in place for the 2022 tax year, and beneficiaries can still claim half of the 2021 expansion that wasn’t sent out in the monthly checks starting jan.

Last Year President Joe Biden Signed The American Rescue Plan Which Increased The Child Tax Credit (Ctc) Amount And Offered Half Of The Credit Through A Series Of Monthly Payments.

The effective increase in the value of the child and dependent care tax credit is about 381%. The expanded child tax credit for 2021 gets a lot of attention, but there’s another big tax change for families this tax season: An increase in the maximum credit that households can claim, up to $3,600 per child age five or younger and $3,000 per child ages six to 17.