Child Care Credit In 2022. Up to $2,000 per eligible child under 17, in the form of an annual tax credit. Increasing the maximum credit that households can claim to $3,600 per child age 5 or younger and $3,000 per child ages 6 to 17;

Claiming the child and dependent care tax credit. The child and dependent care credit has also been expanded this year, so parents can get up to $8,000 for one child or up to $16,000 for two or more. The child tax credit’s extra benefits are ending just as more parents are scrambling for child care.

It Can Be Tricky To Calculate Exactly How Much The Tax Credit Will Be Worth When It Comes Time To File Your Taxes.

Up to $2,000 per eligible child under 17, in the form of an annual tax credit. Increasing the maximum credit that households can claim to $3,600 per child age 5 or younger and $3,000 per child ages 6 to 17; Since july, more than 36 million households around the country have received a payment from the federal government on the 15th of the month, up to $300 per kid, from the child tax credit.

Child Tax Credits May Be Extended Into 2022 As Payments Worth Up To $900 Could Be Sent Out.

An increase in the maximum credit that households can claim, up to $3,600 per child age five or younger and $3,000 per child ages six to 17. Once that threshold exceeds that number, the credit percentage rate starts to phase out from 50 percent. The child and dependent care tax credit can save families up to $1,200 in 2022 when they hire a nanny or other child care provider.

Therefore, Child Tax Credit Payments Will Not Continue In 2022.

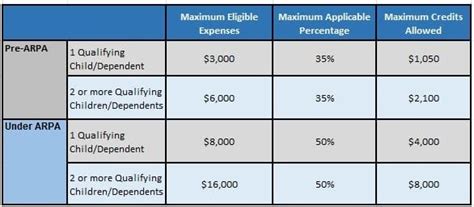

Prior to the american rescue plan, parents could only claim 35% of a maximum of $6,000 in child care expenses for two children, or a maximum tax credit of $2,100. For six months last year, most households with kids received a monthly cash deposit from the increased advanced child tax credit — up to $300 per child. Claiming the child and dependent care tax credit.

The Child And Dependent Care Tax Credit Was Also Expanded Under The Rescue Act.

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). The size of the credit will be cut in 2022, with full payments only going to families that earned enough income to owe taxes, a policy choice that. As of now, the size of the credit will be cut in 2022 back to $2,000 (some families earned up to $3,600 in 2021), with full payments only.

This Expansion Is Part Of The American Rescue.

Families can now claim up to 50 percent of qualifying expenses, up from 35 percent previously. While the monthly advance payments ended in december, the 2022 tax season will deliver the rest of the child tax credit money to eligible parents with their 2021 tax refunds. Distributing families’ eligible credit through monthly checks for all of 2022.