Estimated Tax Payments 2022 Schedule. January 15 th of the next year (1/16/23 for 2022 4q) key points to remember with estimated taxes: Thursday, april 15, 2021 ;

Appearing in the firsttwo columns of the 2022 tax rate schedules) based on the ratio of their wisconsin income to their. September 15 for the period june 1 through august 31, 2022 *normally, first quarter estimated tax payments are due on april 15, but in 2022 this date gets pushed to april 18 due to the emancipation day holiday in washington, d.c. June 15 for the period april 1 through may 31, 2022.

The Due Dates For The First Three Payment Periods Don't Apply To You.

On or before april 18, 2022. If your return is filed on a fiscal year basis, your due dates are the 15th day of the 4th, 6th, and 9th months of your current fiscal year,. January 15 th of the next year (1/16/23 for 2022 4q) key points to remember with estimated taxes:

April 18* For The Period January 1 Through March 31, 2022.

Thursday, april 15, 2021 ; Voucher #1 due april 18, 2022 voucher #2 due june 15, 2022 voucher #3 due september 15, 2022 voucher #4 due january 15, 2023. For 2022 returns, taxpayers whose income is subject to estimated withholding will want to begin making their estimated 2022 payments by these dates:

If You Are A Farmer Or Fisherman (As Defined In Internal Revenue Code § 6654(I)(2)) Who Is Required To Make Estimated Income Tax Payments, You Will Be Required To

17 is martin luther king jr. Your check or money order payable to the “franchise tax board.” † your first estimated tax payment is due on september 15, 2022 if you meet your estimated tax filing requirement after june

Generally, The Internal Revenue Service (Irs) Requires You To Make Quarterly Estimated Tax Payments For Calendar Year 2022 If Both Of The Following Apply:

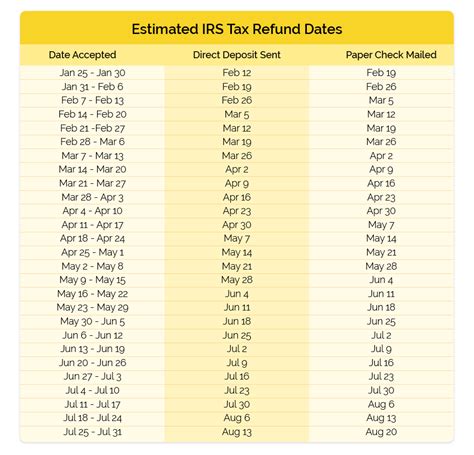

† your first estimated tax payment is due on june 15, 2022 if you meet your estimated tax filing requirement after april 1 and before june 1. Appearing in the firsttwo columns of the 2022 tax rate schedules) based on the ratio of their wisconsin income to their. Our tax refund calendar relies on guidance issued by the irs and.

2022 Estimated Tax Payment Deadlines.

September 15 for the period june 1 through august 31, 2022 *normally, first quarter estimated tax payments are due on april 15, but in 2022 this date gets pushed to april 18 due to the emancipation day holiday in washington, d.c. This is the deadline for estimated tax payments for the fourth quarter of 2021. Using black or blue ink, make.