Irs Estimated Payments 2022

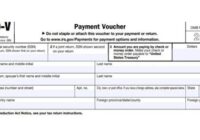

Irs Estimated Payments 2022. Do not use this voucher for any other purpose. Their lifeline comes in the form of a quarterly estimated tax payment, as long as it’s made for the fourth quarter of 2021 and gets to the irs by tuesday, january 18. 2210 Form 2021 IRS Forms Zrivo from www.zrivo.com This simplifies the process, but… Read More »