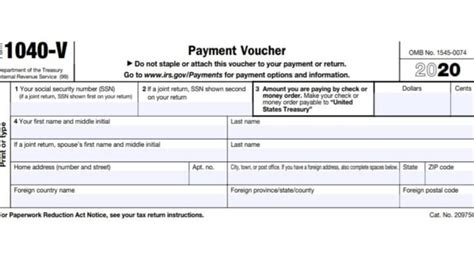

Irs Estimated Tax Payments 2022 Form. Do not mark in this area. • file form 1041 for 2022 by march 1, 2023, and pay the total tax due.

Their lifeline comes in the form of a quarterly estimated tax payment, as long as it’s made for the fourth quarter of 2021 and gets to the irs by tuesday,. Generally, the internal revenue service (irs) requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply: 2021 federal quarterly estimated tax payments.

You Can Take A Credit On This Line For The Amount Withheld In Excess Of $8,853.60.

The due date for filing form 940 for 2021 is january 31, 2022.the irs provides a rundown of when payroll tax returns are due on the irs.gov website.october 2022 tax due dates2022 tax due dates and deadlines.you may be able to skip filing and paying the estimated tax payment due on january 16, 2023, if you have filed… read more » That may make taxpayers nervous about delays in 2022, but most americans should get their refunds within 21 days of. Irs is in crisis, taxpayer advocate warns.

Calculate Income Tax Using The 2022 Income Tax Bracket.

Voluntary state withholding on those payments. You expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and. M m d d y y y y ador 10575 (21) az form 140es (2022) page 1 of 2 to ensure proper application of this payment, be sure that you:

Crediting An Overpayment On Your 2021 Return To Your 2022 Estimated Tax;

For fiscal year estates, pay. • file form 1041 for 2022 by march 1, 2023, and pay the total tax due. For more information on all the payment options available, visit irs.gov/payments on the irs website.

• Recipients Of Unemployment Compensation Who Do Not Choose.

If your return is filed on a fiscal year basis, your due dates are the 15th day of the 4th, 6th, and 9th months of your current fiscal year,. Any income you earn that is not subject to federal withholding tax might. 7, 2022 after two years of tax seasons delayed due to the covid pandemic, americans will also be getting a few extra days to file their income taxes in 2022.

Than $400 In Taxes On Income Not Subject To Withholding.

You generally have to make estimated tax payments if you expect to owe tax of 1000 or more when you file your return. 88 81 pm 80 rcvd do not staple any items to the form. • individual residents and nonresidents who expect to owe more.