Etp Tax Calculator 2022. That ratio when applied to the etp dollar amount is the tax free invalidity amount. It cannot be used to identify reporting obligations.

Or, if you’re ready to get your 2021 refund now, click here to finish your tax return in just minutes! It cannot be used to identify reporting obligations. Above the preservation age, you pay tax at 15% (+medicare levy) on any excess amount above the tax free component, up to $210,000 then, at any age, you pay tax at the rate of 45% (+medicare levy) for any remaining amount above $210,000.

This Is Known As A 'Life Benefit Etp' When It’s Paid To An Employee.

The steps below help you work out:. Subtract the invalidity part (if any) from the etp; Any amount that exceeds $180,000 is taxed at the top marginal rate of 46.5%.

Above The Preservation Age, You Pay Tax At 15% (+Medicare Levy) On Any Excess Amount Above The Tax Free Component, Up To $210,000 Then, At Any Age, You Pay Tax At The Rate Of 45% (+Medicare Levy) For Any Remaining Amount Above $210,000.

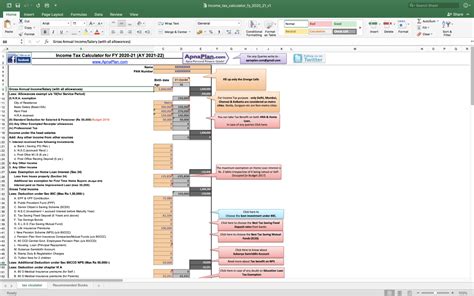

$61,200 plus 45c for each $1 over $180,000. This calculator is developed for australians to estimate their possible redundancy payment entitlements, tax on redundancy payout, and net after tax redundancy pay. The more details you add, the more accurate your refund estimate.

The Amount In Excess Of This Is Treated As An.

If the employee has died, a 'death benefit etp' is paid to their estate. To calculate the tax free invalidity component of an etp, the period from actual termination to the last retirement date is compared to the total period (including the period to last retirement date). That ratio when applied to the etp dollar amount is the tax free invalidity amount.

Any Taxable Component Of The Etp Below $180,000 Is Taxed Either At 16.5% Or 31.5%, Depending On The Type Of Payment.

Number of days of employment before 1 july 1983 ÷ total number of days of employment to which the etp relates. Compensation for personal injury, unfair dismissal, harassment or discrimination. Use canstar's 2022 tax & pay calculator to work out how much you will be paid and how much tax you will pay to the ato for the 2022 financial year.

This Calculator Is Based On The Publicly Available Guidelines And Publications About Redundancy Payment That Can Be Found In The Notice Of Termination & Redundancy Pay Guide Based On National Employment.

Base amount = $9,514 (indexed annually), and service amount = $4,758 per year. Please enter your salary into the annual salary field and click calculate. Up to the etp cap amount.