Fafsa 2022-21 Tax Year. The free application for federal student aid (aka fafsa) opens oct. States and territories not included in the main listing below:

When the fafsa says “you,” it is referring to the student (not the parent). Parents may find that different strategies are needed during different years. Kheaa is an eeo employer.?

1, 2020, And 11:59 P.m.

And in a year where change feels near constant, the fafsa application has undergone a few. To confirm rollover amounts, review your 201 9 federal tax return and complete the section below. Tax return line items listed in the fafsa instructions, which should be reviewed for potential conflicting information.

Pay Attention To Any Symbols Listed After Your State Deadline.

Al , as *, az , co , fm *, ga , gu *, hi *, ky. The individual fafsa items that an applicant must verify are based upon the verification tracking group to which the applicant is. Kantrowitz said, when the fafsa would be based on income from the tax year 2022.

M Your Fafsa Will Reset After 45 Days If It Isn’t Submitted.

Parents may find that different strategies are needed during different years. M make sure that you select the correct form. So if the fafsa is to be filed on oct.

Users Will Be Able To Select Their Specific Role—Student, Parent, Or Preparer—Before They Enter The Fafsa Form.

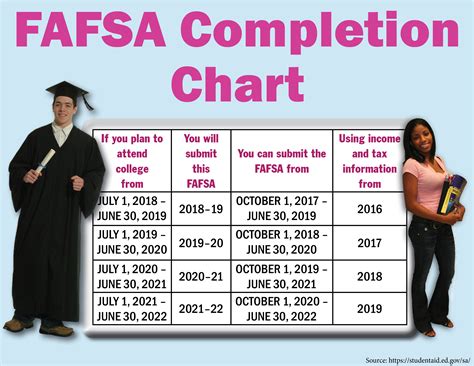

Students can apply for federal student aid starting from october 1st, 2020. This year there are a few fafsa changes that. When the fafsa says “you,” it is referring to the student (not the parent).

A Student Can Submit The Application Any Time Until The End Of The Award Year To Apply For Federal Aid.

If you are applying for. Central time (ct) on june 30, 2022. The online fafsa form will have a visual update and a similar look and feel to the rest of studentaid.gov.