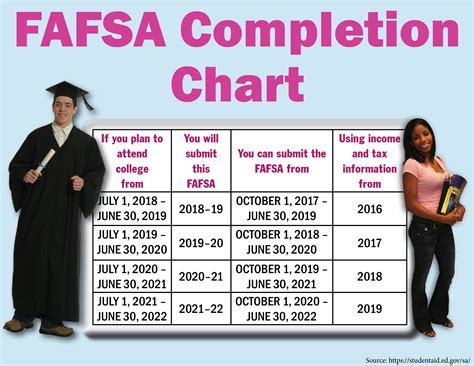

What Tax Year Do I Use For Fafsa 2022. A student can submit the application any time until the end of the award year to apply for federal aid. When quantifying your income, the fafsa uses information in your tax return from two years prior.

The prior year (py) is the tax year before the academic year. If you are applying for. Now go to page 3.

Contact Your Financial Aid Office.

If you are applying for. When counting assets, the fafsa uses the current value of your and your child’s assets. You need to complete fafsa.

When Counting Assets, The Fafsa Uses The Current Value Of Your And Your Child’s Assets.

You should be able to retrieve this information to automatically populate the corresponding questions on the fafsa. Use the irs data retrieval tool when possible to automatically import your tax information into your fafsa. When counting income, the fafsa uses information in your tax return from two years earlier.

Some Assets Are Not Counted And Do Not Need To Be Listed On The Fafsa.

When counting income, the fafsa uses information in your tax return from two years earlier. Students must complete the form for each year they wish to receive aid. The form uses tax information from the prior prior year to determine eligibility.

This Means No Waiting On Your Next W2 To Complete Or Update The Fafsa!

What year’s tax information do i use? Now go to page 3. When counting income, the fafsa uses information in your tax return from two years earlier.

The Form Can Still Be Filled Out And Submitted Even While You're Still.

Or apply free online at. Most students who file a fafsa during the overlap period are filing the fafsa for the upcoming academic year. What year of income do i need to report on my fafsa?