EvilWata

Pricey Companions and Mates,

The markets continued to sell-off within the second quarter, particularly for internet-based companies. This 12 months continues to be the hardest stretch for us, because the Hayden’s inception. Inflation considerations and the ensuing climbing of rates of interest resulted in risky markets in April and early Could, however then this market angst began to subside in second half of the quarter.

The sort of “choppiness” is regular for this part of main bear markets, because it takes time for markets to seek out their footing. In truth, as famous in final quarter’s letter, 10 – 40% weekly strikes is regular for inventory costs in our sector, within the months surrounding a bear-market lows.

Time Interval |

Hayden (NET)1 |

S&P 500 (SPXTR) |

MSCI World (ACWI) |

20142 |

(4.9%) |

1.3% |

(0.9%) |

2015 |

17.2% |

1.4% |

(2.2%) |

2016 |

3.9% |

12.0% |

8.4% |

2017 |

28.2% |

21.8% |

24.4% |

2018 |

(15.4%) |

(4.4%) |

(9.2%) |

2019 |

41.0% |

31.5% |

26.6% |

2020 |

222.4% |

18.4% |

16.3% |

2021 |

(15.8%) |

28.7% |

18.7% |

1st Quarter |

(39.2%) |

(4.6%) |

(5.7%) |

2nd Quarter |

(40.3%) |

(16.1%) |

(15.1%) |

2022 |

(63.7%) |

(20.0%) |

(19.9%) |

Annualized |

7.6% |

10.5% |

6.9% |

Complete Return |

74.6% |

114.8% |

66.0% |

|

Whereas the latest stability of our portfolio these final three months could present hope that we could have already seen the worst, it’s probably that volatility will proceed to be excessive for the remainder of the 12 months. The macro backdrop stays risky, so it’s laborious for traders to deploy capital on this surroundings – with latest statistics exhibiting investor’s willingness to deploy capital remaining at file lows. Afterall, inventory costs fluctuate with investor flows / demand within the brief time period.

Nevertheless because the financial clouds finally dissipate, I’m sure we’ll see demand as soon as once more for our firms’ shares.

Throughout this time interval, it’s been encouraging watching our firms persevering with to execute and develop. Some are gobbling up market-share as opponents go bankrupt (or a minimum of financially constrained), whereas additionally accelerating their timeline to profitability. When this financial downturn finally ends, we count on them to emerge in an excellent stronger place on the opposite aspect. That is what actually issues for valuations, over the long-run.

Whereas our firms proceed to go on the offensive throughout this time interval of weak share costs and opponents, we ought to be too. After reaching a excessive of ~30% money as we repositioned the portfolio intra-quarter, we have been in a position to opportunistically deploy this and ended with ~4% money as of quarter finish.

We’re seeing loads of alternatives available in the market at present, inside a 3 – 5 12 months funding horizon. In truth, I’ve been telling companions that our minimal bar at present ought to be investments with the potential to “3x in 3 years”. Fortunately, the fishing pool to seek out these sorts of alternatives is getting extra fertile by the day. Over time, I anticipate discussing a few of these new alternatives which have already joined our portfolio, in additional depth. **

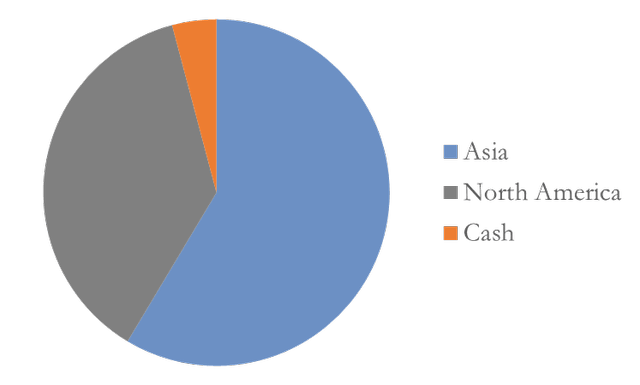

Geographic Allocation % As of June 30, 2022

Our portfolio declined by -40.3% within the second quarter of 2022, versus -16.1% for the S&P 500 and -15.1% for the MSCI World indices. This brings our annualized return since inception, to +7.6%.

Our portfolio ended the quarter with ~59% of our belongings invested in Asia, ~37% in North America, and the rest in money.

Ecommerce’s Covid Hangover

Again through the depths of Covid, in our Q1 2020 letter, I talked about how the subsequent few years would speed up the patron habits and ecommerce adoption world-wide:

“To me, the safer (and doubtlessly greater returning) investments in at present’s market, are these firms that may profit from the lasting change Coronavirus may have on shopper & enterprise habits. These tendencies have been already underway earlier than the virus, however adoption has been accelerated by the wide-spread, immediately “compelled” must function on this new method.

Many of those new habits / enterprise fashions, are at an early stage of simply low-single digit penetration inside their industries. At such an early stage, shopper habits are simply beginning to get fashioned, so the first hurdle is getting shoppers to only do that new technique.

The concept is that if the brand new enterprise mannequin is actually a superior proposition (i.e. a greater mousetrap), the best ROI is coaxing extra mice into the lure and in the event that they prefer it, to inform all their pals about how nice it’s (thereby creating a referral loop / social proof, which drives additional acceleration of the pattern)…

If historical past is any information, there will likely be firms that adapt, and can emerge stronger throughout this latest disaster too. As soon as once more, it’s the ecommerce trade that’s proving to be a shining instance, given the large progress we’re seeing globally prior to now few months…

So we are able to see that world wide, these ecommerce companies are all accelerating their progress charges, not decelerating. The commonality amongst all these firms, previous and current, is that they supply instruments / methods, that assist different retailers to succeed…

And the largest alternative for traders, is within the earlier-stage companies. This era will assist speed up their person adoption, and for sure firms, give them the “leap begin” wanted to attain their market “tipping level” / a sustainable enterprise mannequin. Logically, this could end in a better valuation, because the odds of reaching sustainability are a lot greater, versus only a couple months in the past…

I don’t know the way lengthy the virus will final, so betting on when Coronavirus-sensitive firms will return to “enterprise as regular” appears silly and largely a timing guess (a race towards time to keep away from chapter).

However in these former firms, we’re already seeing laborious knowledge on how shoppers are behaving and the way it’s impacting their financials. These on-line firms profit the longer the virus lasts, by giving enterprise / shopper habits an extended time to kind.

In truth, a 2009 research discovered it takes ~66 days to kind a brand new behavior – coincidentally the size of the social distancing interval in lots of nations already. And even when we return to regular tomorrow, I feel it’s

protected to guess that a few of the habits fashioned throughout this era will likely be carried on & even speed up into the longer term.”

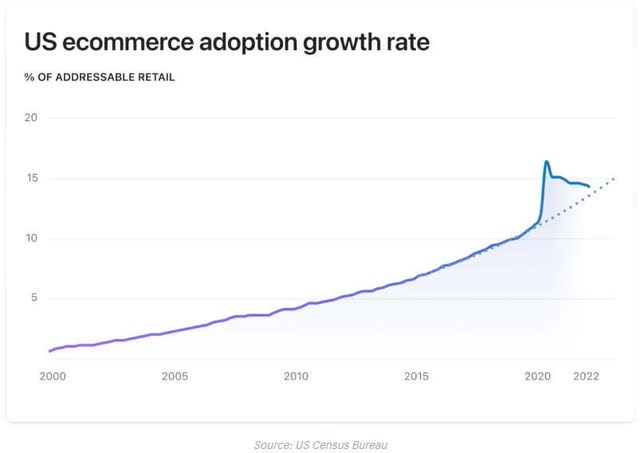

Over the previous two years, it seems to be like this perception was largely appropriate. In developed markets just like the US, the place ecommerce was an already established behavior, ecommerce penetration accelerated even additional, from ~18% previous to Covid to over ~25% throughout this era[1]. Equally, China’s ecommerce penetration accelerated from ~28% to ~35% over this time interval as effectively.

However in markets the place ecommerce penetration was much less established and required shopper schooling (i.e. the hurdle was getting folks to check out procuring on-line for the primary time, in hopes of making a model new behavior), the acceleration was extra dramatic. Attributable to Covid restrictions and lockdowns, shoppers in these markets have been compelled to interrupt previous habits, and embrace this unfamiliar (however superior) technique of procuring.

We noticed ecommerce penetration enhance from ~5% pre-Covid to ~8% in Southeast Asia, and ~4% to ~7% in Latin America in consequence[2]. So whereas already established ecommerce markets like US and China elevated penetration by 25 – 39%, rising markets like Latin America and Southeast Asia grew even faster, by 67 – 75%.

Nevertheless as Covid comes beneath management worldwide and shoppers return to their traditional existence, international ecommerce progress is slowing. The previous two years have skilled extraordinary progress, and it’s laborious for these progress charges to proceed in a world that’s reopening and providing extra avenues for shoppers to spending their cash, outdoors of on-line channels.

For instance, Amazon (AMZN) simply reported considered one of its lowest progress charges in latest historical past, at +10% y/y progress in its North American retail division through the second quarter of 2022. That is in comparison with +44% y/y and +21% y/y throughout the same interval in 2020 and 2021, respectively. Shopify likewise reported slower +16% y/y income progress for 2Q 2022, vs. +97% y/y in the identical quarter in 2020 and +57% y/y in 2021.

On the opposite aspect of the world, Alibaba (BABA) simply reported its first destructive income progress quarter, declining -1% y/y for its Chinese language ecommerce division[3]. This compares to +34% y/y for a similar quarter in 2020, and +35% y/y in 2021.

Nascent ecommerce markets are doing higher, the place progress charges appear to have based mostly greater, regardless of “post-Covid normalization”. In Latin America, MercadoLibre (MELI) ecommerce revenues grew +23% y/y within the second quarter, vs. +149% in Q2 2020 and +101% in Q2 2021. And in Southeast Asia, Shopee reported +51% y/y income progress for Q2 2022, vs. +188% in Q2 2020 and +161% in Q2 2021[4].

Whereas there’s deceleration throughout the board, astute readers will even discover that there’s a divergence between ecommerce progress charges in developed markets vs. these in rising markets, the place ecommerce penetration remains to be low. Not solely did these newer ecommerce markets speed up faster through the Covid years, however they’re additionally exhibiting the flexibility to carry onto extra of those positive aspects, regardless of the excessive base after the final two years.

This distinction in these progress charges make sense, because the rise in penetration was pushed by two parts:

- consumers who historically would favor to buy offline, however have been compelled on-line because of Covid lockdowns, and

- consumers who have been model new to ecommerce, and have been discovering a brand new strategy to store.

The previous cohort is transient, whereas the latter is structural because of these newly fashioned shopper habits.

In developed markets, ecommerce was already acquainted to most shoppers, so sadly the majority of Covid positive aspects in these nations got here from the primary cohort. These positive aspects have been transient due to this, as buyers returned to offline choices quickly because the lockdown measures have been lifted.

A couple of weeks in the past, Shopify described this actual situation in a memo to staff:

“When the Covid pandemic set in, virtually all retail shifted on-line due to shelter-in-place orders. Demand for Shopify skyrocketed. To assist retailers, we threw away our roadmaps and shipped every little thing that might presumably be useful…

Earlier than the pandemic, ecommerce progress had been regular and predictable. Was this surge to be a short lived impact or a brand new regular?And so, given what we noticed, we positioned one other guess: We guess that the channel combine – the share of {dollars} that journey by ecommerce somewhat than bodily retail – would completely leap forward by 5 and even 10 years. We couldn’t know for positive on the time, however we knew that if there was an opportunity that this was true, we must increase the corporate to match.

It’s now clear that guess didn’t repay. What we see now’s the combo reverting to roughly the place pre-Covid knowledge would have prompt it ought to be at this level. Nonetheless rising steadily, but it surely wasn’t a significant 5-year leap forward. Our market share in ecommerce is loads greater than it’s in retail, so this issues. Finally, inserting this guess was my name to make and I obtained this flawed. Now, we have now to regulate.”

US Ecommerce Penetration Reverting Again to Pre-Covid Pattern (Supply: Shopify)

In distinction, we’re seeing these Covid positive aspects show to be “stickier” in rising markets, with ecommerce penetration remaining at these greater ranges. That is probably as a result of most of those Covid positive aspects are as a substitute attributable to the second cohort of customers – shoppers who had by no means used ecommerce earlier than, however have been compelled to offer it attempt because of lockdowns and amid an absence of brick & mortar choices. As soon as they tried this superior approach of procuring although, they caught round inside this “mousetrap”, and proceed to spend extra of their finances inside this channel.

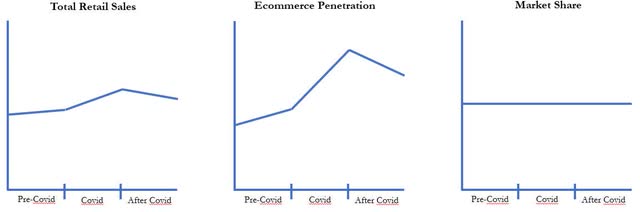

GMV=[TOTAL RETAIL SALES] X [ECOMMERCE PENETRATION RATE] X

[COMPANY’S MARKET SHARE]

Primarily, if I have been to generalize (and this actually is a broad generalization, since particular person nation / firm dynamics are so totally different), that is how I see the parts of GMV differing throughout the most important ecommerce firms in developed and rising markets.

Ecommerce in Developed Markets Ecommerce in Rising Markets

In developed markets, ecommerce is already effectively established, with secure market share among the many main firms, and demand reverting again to pre-Covid tendencies. In the meantime in rising markets, Covid restrictions accelerated the variety of shoppers discovering ecommerce for the primary time, and these scale advantages additional strengthened the place of the main on-line platforms.

One of the simplest ways to see this “stickiness”, is through what number of instances prospects order from a platform every month. In impact, it’s a measure of “dependancy” / buyer loyalty to a platform, and the way ingrained it’s to their buy habits.

For instance, Shopee in Southeast Asia is predicted to have grown their GMV by +370% within the final three years. Earlier than Covid, Shopee bought ~$17BN value of things in 2019, whereas they need to promote near ~$80BN this 12 months.

Most significantly, this progress didn’t simply come from conventional offline buyers, unwillingly compelled on-line throughout Covid (i.e. growing the breadth of the shopper base). Quite, a significant driver was present Shopee prospects ordering extra steadily / deepening their relationship with the corporate even additional throughout this era (i.e. deepening the loyalty of the shopper base).

This second driver is far more lasting and impactful to the long-term worth of the enterprise mannequin, than the primary.

We will see this greatest within the elevated order frequency charges during the last three years. For instance in Q2 2020, the corporate acknowledged on their earnings name:

“…when it comes to buy frequency, earlier than we reported greater than 4x [per month]. And this – we’re seeing greater than 5x a month on common. In some markets, like Indonesia, [it is] getting nearer to 6x a month, and that is sustaining into – even after the lockdown interval.” – Q2 2020 Earnings Name

Previous to Covid, buy frequencies have been 4x a month and elevated to 5x a month through the depths of the pandemic. If these new prospects that have been gained throughout Covid have been transient (i.e. the primary cohort), we should always count on them to buy much less steadily from on-line platforms, after lockdowns subsided. As a substitute, what we noticed was an additional enhance in buy frequency:

“By way of engagement, our consumers shopped on Shopee over 6x a month on common within the fourth quarter, with Indonesia’s month-to-month order frequency exceeding 8x.” – This autumn 2021 Earnings Name

This enhance so as frequency is occurring, regardless of lockdowns considerably loosened up by the top of final 12 months, and the platform persevering with the appeal to new consumers[5]. At 6x purchases monthly, which means that the typical Shopee shopper is receiving a bundle each 5 days (or in Indonesia’s case, each 4 days)[6]. It indicators that the free “buyer acquisition” supplied by Covid has lasting optimistic affect on the platform, these customers at the moment are “addicted”, and are probably now a everlasting a part of the platform’s person base.

It is a big profit for nascent ecommerce market companies, since there are community results at play. Typically, the most important marketplaces have benefits versus subscale opponents, since a bigger, captive buyer base is ready to appeal to a greater variety and bigger variety of sellers, who in flip compete towards one another on value to win orders from this buyer base.

This creates a flywheel impact, as new prospects will naturally discover the most important on-line marketplaces first – given the broader number of objects (extra more likely to discover what they’re in search of), and higher model popularity / belief (new prospects probably know pals & household who’ve used the platform efficiently).

If the inflow of latest prospects acquired over the past two years of Covid are certainly sticky, this considerably de-risks the enterprise mannequin for rising ecommerce companies. If these new prospects can carry them previous their “tipping level”, then the flywheel nature of those community impact kick in, the companies have a far greater likelihood of self-sustainability, and turning into the chief in a “winner-take-most” market like ecommerce[7].

We’ve seen situation play out with Shopee already. Whereas Shopee and its competitor Lazada (owned by Alibaba) have been of comparable measurement a couple of years in the past, Shopee was already beginning to achieve the lead by 2019. And through Covid, this lead widened even additional, with Lazada reporting GMV that was solely ~1/3rd that of Shopee by 2021[8]).

Even prior to now 12 months as lockdowns subsided additional, these positive aspects remained. Throughout This autumn 2021, Shopee reported near +100% y/y order progress, whereas Lazada did +54% y/y. By Q1 2022, this hole accelerated even additional to +72% y/y for Shopee vs. simply +54% y/y for Lazada. This quarter, Lazada reported a paltry +10% y/y order progress, whereas Shopee is reported +41% y/y order progress, regardless of already having ~55% market share.

So whereas nascent ecommerce companies like Shopee actually didn’t plan for Covid, they nonetheless used the chance introduced to structurally strengthen their enterprise fashions and get them previous their market “tipping level” (as evidenced by the rising lead vs. opponents), to win in a historically “winner-take-most” market.

Now that clear management is established, with ~55% market share in SE Asia and ecommerce penetration quickly approaching double-digits, the land-grab part for brand spanking new ecommerce consumers is over. Now it’s time for Shopee to begin monetizing this addicted person base, and swiftly enhance its take-rates[9]. Adj. EBITDA margins have improved by +61% since 2019, and are quickly enhancing / on observe to point out profitability throughout the subsequent 12 – 18 months.

Thus because the economic system normalizes in a post-Covid world, ecommerce firms will endure a “Covid hangover” from this slowing progress. Nevertheless inside this, it’s additionally turning into increasingly obvious that there’s a divergence occurring throughout the sector.

For some firms, like these in mature markets with most shoppers already acquainted with their choices however hadn’t beforehand signed on for one motive or one other (thus indicating a damaged or already saturated mousetrap), the final two years will show to be a short lived sugar excessive.

Different firms that have been in a position to make use of this era to speed up adoption and expedite their timeline to sustainable scale & profitability, have completely strengthened the worth of their companies. These are the nascent enterprise fashions that had already constructed a sticky “mousetrap”, and the first bottleneck was simply getting sufficient new customers to find it (which Covid solved).

Since inventory costs comply with the enterprise worth creation over time, we should always count on some shares to return to their earlier “pre-Covid” trajectory, whereas others will likely be completely based mostly greater. It appears that evidently traders are nonetheless attempting to differentiate between the 2, as they work by the messy outcomes / knowledge of the subsequent few quarters. However over the subsequent few years, we count on the structural winners who took benefit of this era to create final change, to change into extra apparent to most traders. Over time, it will mirror of their valuations.

On a aspect notice, additionally I discovered it fascinating that sell-side analysts additionally appear to be modeling these decrease ecommerce progress charges into perpetuity, even after the present financial slowdown / “Covid hangover” is predicted to finish. But when we comply with the prior recession in 2008-09 as a case research, income progress slowed for each Amazon and Mercado Libre through the 2008-09 interval, after which rapidly reaccelerated from the mid-20%’s y/y progress to the high30%’s y/y progress by 2011. Retail gross sales is intently correlated with GDP progress in any case…

If we’re appropriate concerning the underlying explanation for Shopee’s progress deceleration, we should always see an analogous bump up within the subsequent two years. Nevertheless sell-side estimates aren’t modeling on this acceleration in any respect, with estimates hovering within the mid-20% y/y vary and slowly declining within the medium-term. This feels to us, as yet one more instance of markets having bother modeling non-linear change when valuing these firms.

PORTFOLIO REVIEW

Coinbase (COIN): The crypto ecosystem strikes extraordinarily rapidly, and there’s been many new developments since we first invested in Coinbase, a 12 months in the past.

Most notably, crypto market cap has declined from a peak of ~$3 Trillion final fall, to ~$1.1 Trillion at present (a -63% decline, and -72% peak-to-trough). Crypto is a risky asset class, and has skilled many draw-downs of comparable magnitude prior to now. For instance, Bitcoin was down -93% throughout 2011, -85% from 2013-15, and -84% from 2017-18. On this context, the newest draw-down is a fairly regular end result for this rising asset class.

A big motive for this volatility, is just because there aren’t any main “real-world use instances” for the asset simply but. In our letter outlining the funding final 12 months, we wrote that crypto remains to be “in the course of ‘crossing the chasm’ into mainstream adoption & use instances, which is able to end in tens of millions of mainstream customers needing to transact crypto in some kind”

This adoption is progressing, and there are a selection of functions which have proven actual utility over the previous 12 months. Nevertheless, because it’s nonetheless early days, the majority of crypto buying and selling remains to be carried out for hypothesis, as a substitute of utility. It will undoubtedly shift over time, because the crypto ecosystem continues to develop extra utility over the approaching years.

However within the meantime, which means that when bear-markets hit, retail curiosity in buying and selling crypto dies down, since there’s no day by day use case for crypto simply but. The one supply of demand for crypto (i.e. hypothesis) dries up, resulting in costs falling in consequence.

Till crypto “crosses the chasm” into mainstream adoption and day by day utility, Coinbase’s enterprise mannequin will stay risky – and much more so than its opponents.

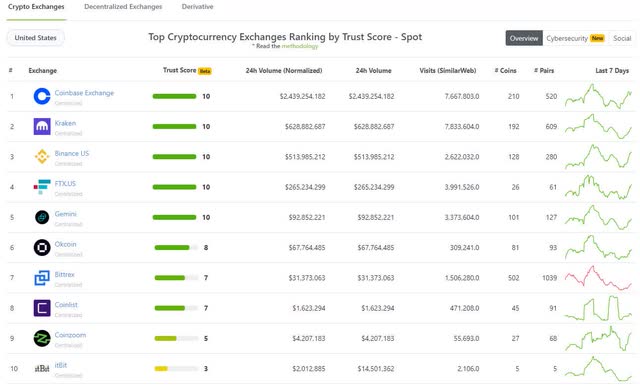

Recently, there have been headlines speculating on Coinbase’s demise, most of which cite Coinbase’s declining market share relative to different exchanges. Nevertheless that is a particularly inaccurate comparability, since we’d argue that Coinbase is in a really totally different finish market, than international exchanges which cater predominantly to establishments, and likewise lie outdoors of US laws (or any nation’s laws, for that matter).

Rivals equivalent to FTX or Binance derive the majority of their enterprise from establishments / cryptonative “whales”, whereas Coinbase derives ~77% of its revenues from retail customers that solely commerce a couple of hundred {dollars} at a time.[10] These establishments are within the enterprise of buying and selling crypto, so they are going to proceed to commerce whatever the market surroundings. In the meantime, retail customers are much more finicky, and can commerce / speculate when costs are rising, and lose curiosity when costs are declining.

“We’ve about 4 instances [Coinbase’s] day by day buying and selling quantity [on a global level] and about 3% of their person base.

So it’s an element of 100 distinction in quantity per person. They [Coinbase] have completed spectacularly on the lengthy tail retail shopper, and we have now completed significantly better on the extra subtle, extra extremely engaged customers who commerce bigger quantity every.” – Sam Bankman-Fried, Founding father of FTX

These establishments and whales are inclined to commerce on offshore exchanges, away from US laws, since they’ll entry a greater variety of merchandise and leverage. Thus as a benchmark of Coinbase’s aggressive place, it’s a a lot fairer comparability to evaluate it versus different US-based exchanges, equivalent to Kraken, FTX US, Binance US, or Gemini[11]. For additional data on this misperception, we mentioned this dynamic in our unique Coinbase memo final 12 months[12].

On this metric, we are able to see that Coinbase remains to be by far the main alternate. For instance, in keeping with CoinGecko, Coinbase is at present doing ~$2.4BN in day by day quantity, versus Kraken at simply ~$600M, Binance US at ~$500M, and FTX US at ~$260M.

US Crypto Alternate Market Share (Supply: CoinGecko (LINK); Screenshot as of August 15, 2022)

We additionally confirmed an analogous snapshot final 12 months. Should you evaluate that September 20, 2021 snapshot to the one above (see pg. 29), you’ll see that Coinbase has truly completed a fantastic job of sustaining its market share throughout this bear market.

It’s nonetheless ~4x bigger than the subsequent largest competitor, and likewise ~1.6x bigger than the subsequent 4 opponents mixed. Thus although the entire “pie” (i.e. crypto buying and selling volumes) has shrunk, Coinbase has truly maintained its relative measurement of that pie. It’s actually not dropping its aggressive place, as media headlines would have you ever imagine.

Within the meantime, Coinbase has been utilizing this time to enhance its merchandise and simplify the person expertise, in preparation for the subsequent part of mainstream adoption. For instance, Coinbase Pockets was simply redesigned this quarter, and now helps seven totally different blockchains, so extra crypto belongings could be held all inside one account. Evaluate this to its main competitor – Metamask – which nonetheless doesn’t assist Solana, and customers nonetheless must have a separate pockets for these belongings.

We’ve invested in Coinbase, based mostly upon the thesis that finally crypto will likely be used for day by day transactions – and it’s laborious for us to think about a world, the place on a regular basis shoppers will wish to change backwards and forwards between a number of wallets, once they can use Coinbase as a one-stop-shop.

Contemplating historic know-how adoption has proven that mainstream customers care most about simplicity and ease-of-use, this improvement places Coinbase on observe to finally change into the de facto crypto pockets used for day by day transactions.

On high of this, we have been inspired to see that Coinbase managed to keep away from your complete debacle across the Three Arrows Capital blowup. Three Arrows (or “3AC”, because it’s recognized) was one of many largest hedge funds within the crypto area.

In June, the agency began dealing with liquidity points, as crypto costs fell and it discovered itself over prolonged on leverage. With over $10BN in belongings at its peak, the agency’s collapse managed to take down a number of notable brokers and lenders who supplied 3AC with loans, together with the chapter of Voyager Digital and Celsius, leading to a “mini-Lehman Brothers” sort occasion for the area. Coinbase in the meantime prevented this debacle, which we imagine is one other indication of its conservative tradition (whether or not in launching new merchandise, lending, coping with regulators, and so on.).

We imagine that over the long-run, this kind of conduct will solely construct belief with prospects and stakeholders alike, which is vitally essential for a agency that seeks to safe-keep the belongings of a whole lot of tens of millions of people and establishments.

Whereas all this was occurring, Coinbase’s share value reached an astonishing ~$8BN valuation ($11BN market cap – $3BN of web money). The corporate earned $3.6BN in web revenue final 12 months, so shares have been priced at simply ~2.2x P/E (2021), for an organization that’s simply getting began on this rising area[13].

Clearly, the monetary outcomes of Coinbase will likely be risky, whereas transactions are nonetheless primarily used for hypothesis. We see the corporate as basically a tax on the crypto ecosystem, based mostly upon its dominant market place as a fiat-on ramp & US alternate. The scale of that ecosystem will ebb & movement, and is essentially out of Coinbase’s management. In good years the corporate will make a number of billion in income, and in bear markets (like at present) the corporate is guiding to a -$500M loss.

Early within the quarter, it grew to become clear that the crypto market would quickly comply with the broader fairness markets right into a bear market. And given the reflexivity in Coinbase’s enterprise mannequin, we felt it was prudent to chop a good portion of the place. We bought these shares ~$150. Through the subsequent draw-down, we began to construct this place again up because the aforementioned valuation grew to become too low cost to go up. Whereas we missed absolutely the lows, we did handle to re-build the place at a >50% low cost to the place we beforehand bought it.

It’s nonetheless a comparatively small place in our portfolio, given the nascent stage & inherent danger of the trade. Nevertheless, we’re excited to observe this enterprise develop over the subsequent decade. If we’re appropriate within the trajectory of the crypto trade and Coinbase’s place inside it, they might very effectively find yourself being one of the vital essential firms of the subsequent decade.

CONCLUSION

The following few quarters are undoubtedly going to be uneven, given the basic undercurrents within the international economic system, mixed with a destructive backdrop for progress equities.

For instance, one query traders are grappling with, is whether or not the decrease progress charges talked about beforehand merely a perform of a Covid-hangover and set to re-accelerate in a greater financial surroundings? Or are these new structural tendencies, and we should always count on decrease progress for a few years to return? Whereas our evaluation signifies the previous, others available in the market who lack this conviction could wait to speculate till the coast is obvious – thus inflicting inventory costs to lack course within the near-term.

Nevertheless, we’re assured that this too shall go. Over time, the one issues that matter for our portfolio are 1) are our firms have a powerful sufficient worth proposition and stability sheet to resist financial hurricanes? 2) Will they generate sufficient money over time, to supply a sexy return to their traders? And maybe most significantly, 3) Can we as shareholders have the abdomen and can energy to remain the course, till we are able to reap the rewards?

I firmly imagine the reply is sure to all the above. However getting there’s going to require persistence, and the bravery to see a world past the instant uneven waters we’re navigating by.

This semester, we additionally welcome Bohan Xue, who’s becoming a member of us as a analysis intern. Bohan is at present finishing his second 12 months at Columbia Enterprise College, and simply was accepted into its prestigious worth investing program. Earlier than Columbia, Bohan was the founding father of a social media advertising company, based mostly out of Shanghai. We welcome him to the crew.

Sincerely,

Fred Liu, CFA | Managing Accomplice | [email protected]

Footnotes

|

[1] Word, these figures will differ relying on the info supply, and the way “retail gross sales” is outlined. Nevertheless, the big step-up in penetration is true, whatever the supply. [2] Once more, actual percentages will differ by methodology and knowledge supply. [3] See pg. 7 of Alibaba’s June quarter earnings report (LINK). [4] Income progress is greater than GMV progress, as a result of additional advantage of accelerating take-rates. [5] New consumers drag down the general common buy frequency, since new customers take time to construct belief with the platform and ingrain this new approach of procuring into their habits. The corporate now not discloses energetic purchaser counts. However in keeping with various knowledge, the corporate was nonetheless rising new consumers ~20 – 30% y/y throughout this era. As such, the upkeep of 6x buy frequency is spectacular. [6] Evaluate this to Amazon Prime’s far decrease 2.5x orders a month, regardless of Amazon additionally locking of their prospects through a paid membership plan. [7] I first mentioned the idea of this “tipping level” for market companies, in our Q1 2019 letter (LINK). [8] Lazada reported $21BN in GMV in fall 2021, vs. Shopee at $56BN for a similar time interval (LINK). [9] Take-rates ought to enhance by ~2% this 12 months (from ~7.3% to ~9.1%), and predominately from high-margin fee and promoting revenues. [10] “Whales” seek advice from rich particular person merchants, who commerce in massive sums. [11] FTX US and Binance US are subsidiaries of FTX and Binance, respectively. Since these entities function beneath US laws, they aren’t in a position to provide the identical number of crypto belongings or merchandise as their mum or dad firms. [12] Please see web page 27, beneath the “Exploring Coinbase’s Market Share (And Why We Differ From The Avenue)” part. [13] Though admittedly, final 12 months was an excellent 12 months for the crypto markets, so traders shouldn’t count on these earnings on a standard foundation.

|

Authentic Publish

Editor’s Word: The abstract bullets for this text have been chosen by Searching for Alpha editors.